Question

Assignment 5 USE GAAP CODIFICATIONS At December 31, 2017, Acme Inc. had the following deferred tax balances: Deferred tax liability $ 62,500 Deferred tax asset

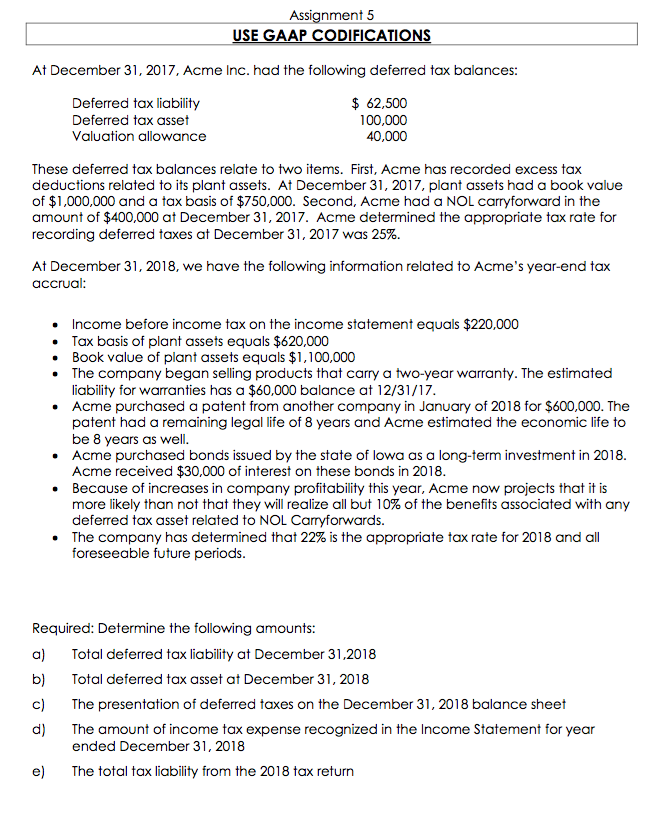

Assignment 5

USE GAAP CODIFICATIONS

At December 31, 2017, Acme Inc. had the following deferred tax balances:

Deferred tax liability $ 62,500

Deferred tax asset 100,000

Valuation allowance 40,000

These deferred tax balances relate to two items. First, Acme has recorded excess tax deductions related to its plant assets. At December 31, 2017, plant assets had a book value of $1,000,000 and a tax basis of $750,000. Second, Acme had a NOL carryforward in the amount of $400,000 at December 31, 2017. Acme determined the appropriate tax rate for recording deferred taxes at December 31, 2017 was 25%.

At December 31, 2018, we have the following information related to Acmes year-end tax accrual:

- Income before income tax on the income statement equals $220,000

- Tax basis of plant assets equals $620,000

- Book value of plant assets equals $1,100,000

- The company began selling products that carry a two-year warranty. The estimated liability for warranties has a $60,000 balance at 12/31/17.

- Acme purchased a patent from another company in January of 2018 for $600,000. The patent had a remaining legal life of 8 years and Acme estimated the economic life to be 8 years as well.

- Acme purchased bonds issued by the state of Iowa as a long-term investment in 2018. Acme received $30,000 of interest on these bonds in 2018.

- Because of increases in company profitability this year, Acme now projects that it is more likely than not that they will realize all but 10% of the benefits associated with any deferred tax asset related to NOL Carryforwards.

- The company has determined that 22% is the appropriate tax rate for 2018 and all foreseeable future periods.

Required: Determine the following amounts:

a) Total deferred tax liability at December 31,2018

b) Total deferred tax asset at December 31, 2018

c) The presentation of deferred taxes on the December 31, 2018 balance sheet

d) The amount of income tax expense recognized in the Income Statement for year ended December 31, 2018

e) The total tax liability from the 2018 tax return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started