Answered step by step

Verified Expert Solution

Question

1 Approved Answer

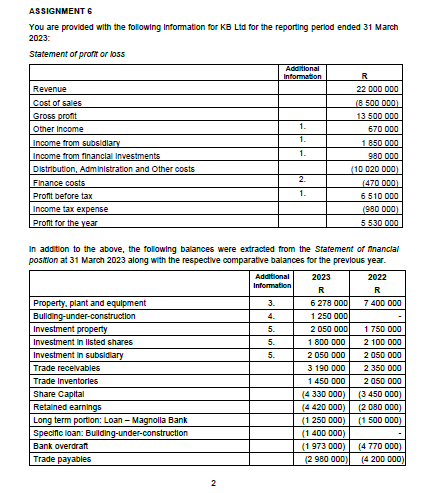

ASSIGNMENT 6 You are provided with the following Information for KB Ltd for the reporting period ended 31 March 2023: Statement of profit or loss

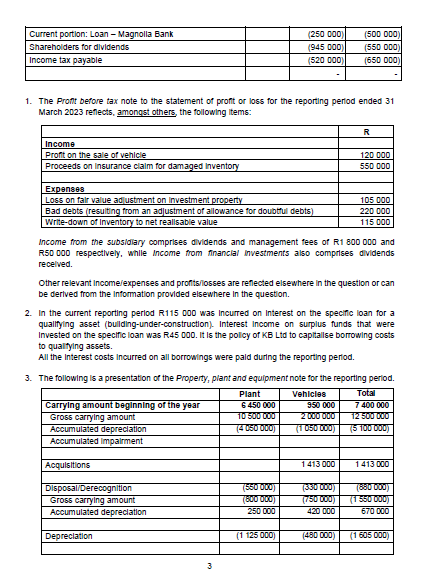

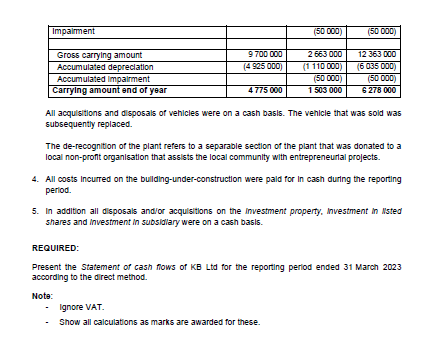

ASSIGNMENT 6 You are provided with the following Information for KB Ltd for the reporting period ended 31 March 2023: Statement of profit or loss In addition to the above, the following balances were extracted from the Statement of nnanclal position at 31 March 2023 along with the respective comparative balances for the previous year. 2 All acqulsitions and disposals of vehicles were on a cash basis. The vehicle that was sold was subsequently replaced. The de-recognition of the plant refers to a separable section of the plant that was donated to a local non-profit organlsation that assists the local community with entrepreneurial projects. 4. All costs Incurred on the bullding-under-construction were paid for in cash during the reporting period. 5. In addition all diposals andior acqulsitions on the investment property, investment in Isted shares and investment in subsidiary were on a cash basis. REQUIRED: Present the Statement of cash flows of KB Ltd for the reporting period ended 31 March 2023 according to the drect method. Note: - Ignore VAT. - Show all calculations as marks are awarded for these. 1. The Pront before tax note to the statement of proft or loss for the reporting period ended 31 March 2023 reflects, amongst others, the following items: \begin{tabular}{|l|r|} \hline & \multicolumn{1}{|c|}{R} \\ \hline Incom & \\ \hline Proft on the sale of vehicle & 120000 \\ \hline Proceeds on Insurance claim for damaged Inventory & 550000 \\ \hline & \\ \hline Expenses & 105000 \\ \hline Loss on fair value adlustment on Investment property & 220000 \\ \hline Bad debts (resuiting from an adjustment of allowance for doubtiul debts) & 115000 \\ \hline Write-down of Inventory to net reallsable value & \\ \hline \end{tabular} Income from the subsldary comprises dividends and management fees of R1 800000 and R5D 000 respectively, whlle Income from financlal investments also comprises dividends recelved. Other relevant income/expenses and pronts/losses are reflected elsewhere in the question or can be derlved from the information provided elsewhere in the question. 2. In the current reporting period R115 000 was incurted on Interest on the specific loan for a qualifying asset (bullding-under-construction). Interest income on surplus funds that were Invested on the specific loan was R45 000. It is the policy of KB Lid to caplialse borrowing costs to qualifying assets. All the Interest costs incurred on all borrowings were pald during the reporting period. 3. The following is a presentation of the Property, piant and equipment note for the reporting period. 3

ASSIGNMENT 6 You are provided with the following Information for KB Ltd for the reporting period ended 31 March 2023: Statement of profit or loss In addition to the above, the following balances were extracted from the Statement of nnanclal position at 31 March 2023 along with the respective comparative balances for the previous year. 2 All acqulsitions and disposals of vehicles were on a cash basis. The vehicle that was sold was subsequently replaced. The de-recognition of the plant refers to a separable section of the plant that was donated to a local non-profit organlsation that assists the local community with entrepreneurial projects. 4. All costs Incurred on the bullding-under-construction were paid for in cash during the reporting period. 5. In addition all diposals andior acqulsitions on the investment property, investment in Isted shares and investment in subsidiary were on a cash basis. REQUIRED: Present the Statement of cash flows of KB Ltd for the reporting period ended 31 March 2023 according to the drect method. Note: - Ignore VAT. - Show all calculations as marks are awarded for these. 1. The Pront before tax note to the statement of proft or loss for the reporting period ended 31 March 2023 reflects, amongst others, the following items: \begin{tabular}{|l|r|} \hline & \multicolumn{1}{|c|}{R} \\ \hline Incom & \\ \hline Proft on the sale of vehicle & 120000 \\ \hline Proceeds on Insurance claim for damaged Inventory & 550000 \\ \hline & \\ \hline Expenses & 105000 \\ \hline Loss on fair value adlustment on Investment property & 220000 \\ \hline Bad debts (resuiting from an adjustment of allowance for doubtiul debts) & 115000 \\ \hline Write-down of Inventory to net reallsable value & \\ \hline \end{tabular} Income from the subsldary comprises dividends and management fees of R1 800000 and R5D 000 respectively, whlle Income from financlal investments also comprises dividends recelved. Other relevant income/expenses and pronts/losses are reflected elsewhere in the question or can be derlved from the information provided elsewhere in the question. 2. In the current reporting period R115 000 was incurted on Interest on the specific loan for a qualifying asset (bullding-under-construction). Interest income on surplus funds that were Invested on the specific loan was R45 000. It is the policy of KB Lid to caplialse borrowing costs to qualifying assets. All the Interest costs incurred on all borrowings were pald during the reporting period. 3. The following is a presentation of the Property, piant and equipment note for the reporting period. 3 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started