Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assignment 7 1. Evaluate this statement: For the owner of a 20-year 5% BBB-rated bond, an increase in yield to-maturity just shortly after the

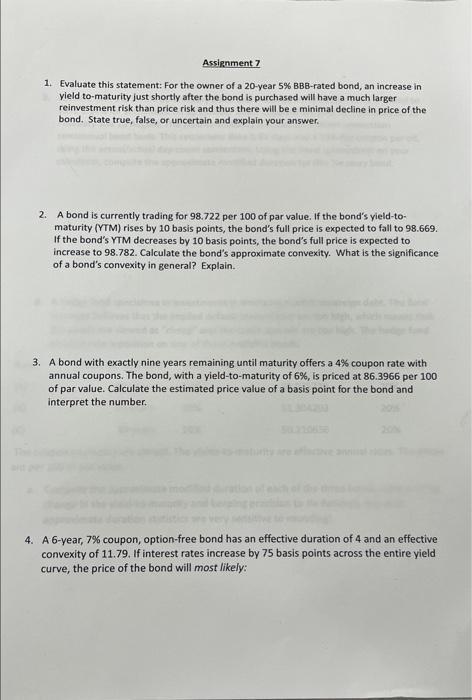

Assignment 7 1. Evaluate this statement: For the owner of a 20-year 5% BBB-rated bond, an increase in yield to-maturity just shortly after the bond is purchased will have a much larger reinvestment risk than price risk and thus there will be e minimal decline in price of the bond. State true, false, or uncertain and explain your answer. 2. A bond is currently trading for 98.722 per 100 of par value. If the bond's yield-to- maturity (YTM) rises by 10 basis points, the bond's full price is expected to fall to 98.669. If the bond's YTM decreases by 10 basis points, the bond's full price is expected to increase to 98.782. Calculate the bond's approximate convexity. What is the significance of a bond's convexity in general? Explain. 3. A bond with exactly nine years remaining until maturity offers a 4% coupon rate with annual coupons. The bond, with a yield-to-maturity of 6%, is priced at 86.3966 per 100 of par value. Calculate the estimated price value of a basis point for the bond and interpret the number. 4. A 6-year, 7% coupon, option-free bond has an effective duration of 4 and an effective convexity of 11.79. If interest rates increase by 75 basis points across the entire yield curve, the price of the bond will most likely:

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Ass ignment 7 1 1 ANS WER False Increases in yield to maturity will lead to a decrease in the price of the bond regardless of the bond s rating EX PL ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started