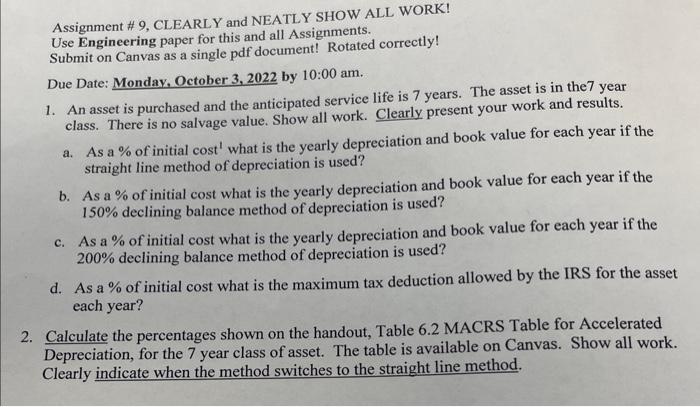

Assignment # 9, CLEARLY and NEATLY SHOW ALL WORK! Use Engineering paper for this and all Assignments. Submit on Canvas as a single pdf document! Rotated correctly! Due Date: Monday, October 3,2022 by 10:00 am. 1. An asset is purchased and the anticipated service life is 7 years. The asset is in the 7 year class. There is no salvage value. Show all work. Clearly present your work and results. a. As a \% of initial cost 1 what is the yearly depreciation and book value for each year if the straight line method of depreciation is used? b. As a \% of initial cost what is the yearly depreciation and book value for each year if the 150% declining balance method of depreciation is used? c. As a \% of initial cost what is the yearly depreciation and book value for each year if the 200% declining balance method of depreciation is used? d. As a \% of initial cost what is the maximum tax deduction allowed by the IRS for the asset each year? 2. Calculate the percentages shown on the handout, Table 6.2 MACRS Table for Accelerated Depreciation, for the 7 year class of asset. The table is available on Canvas. Show all work. Clearly indicate when the method switches to the straight line method. Assignment # 9, CLEARLY and NEATLY SHOW ALL WORK! Use Engineering paper for this and all Assignments. Submit on Canvas as a single pdf document! Rotated correctly! Due Date: Monday, October 3,2022 by 10:00 am. 1. An asset is purchased and the anticipated service life is 7 years. The asset is in the 7 year class. There is no salvage value. Show all work. Clearly present your work and results. a. As a \% of initial cost 1 what is the yearly depreciation and book value for each year if the straight line method of depreciation is used? b. As a \% of initial cost what is the yearly depreciation and book value for each year if the 150% declining balance method of depreciation is used? c. As a \% of initial cost what is the yearly depreciation and book value for each year if the 200% declining balance method of depreciation is used? d. As a \% of initial cost what is the maximum tax deduction allowed by the IRS for the asset each year? 2. Calculate the percentages shown on the handout, Table 6.2 MACRS Table for Accelerated Depreciation, for the 7 year class of asset. The table is available on Canvas. Show all work. Clearly indicate when the method switches to the straight line method