Answered step by step

Verified Expert Solution

Question

1 Approved Answer

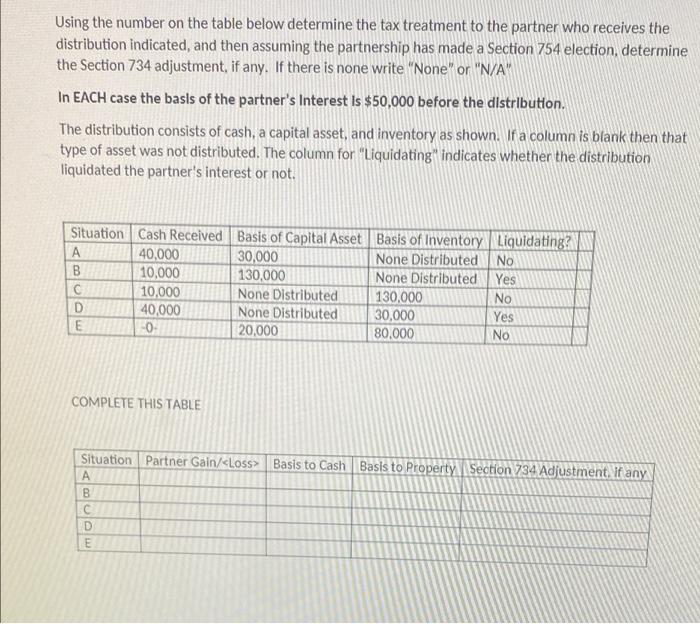

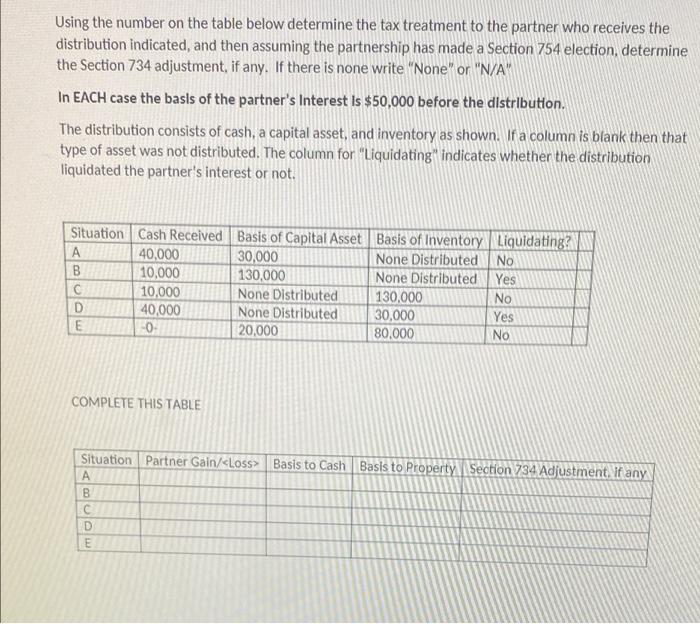

assignment 9 Using the number on the table below determine the tax treatment to the partner who receives the distribution indicated, and then assuming the

assignment 9

Using the number on the table below determine the tax treatment to the partner who receives the distribution indicated, and then assuming the partnership has made a Section 754 election, determine the Section 734 adjustment, if any. If there is none write "None" or "N/A" In EACH case the basis of the partner's Interest Is $50,000 before the distribution. The distribution consists of cash, a capital asset, and inventory as shown. If a column is blank then that type of asset was not distributed. The column for "Liquidating" indicates whether the distribution liquidated the partner's interest or not. Situation Cash Received Basis of Capital Asset Basis of Inventory Liquidating? 40,000 30,000 None Distributed No B 10,000 130,000 None Distributed Yes 10,000 None Distributed 130,000 No D 40,000 None Distributed 30,000 Yes E 0 20,000 80.000 No COMPLETE THIS TABLE Situation Partner Gain/

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started