Question: BOB'S BACK HOES STUDENT EXERCISE Overview In this case-study, you, the student, will set up a new service company file using the Easy Step

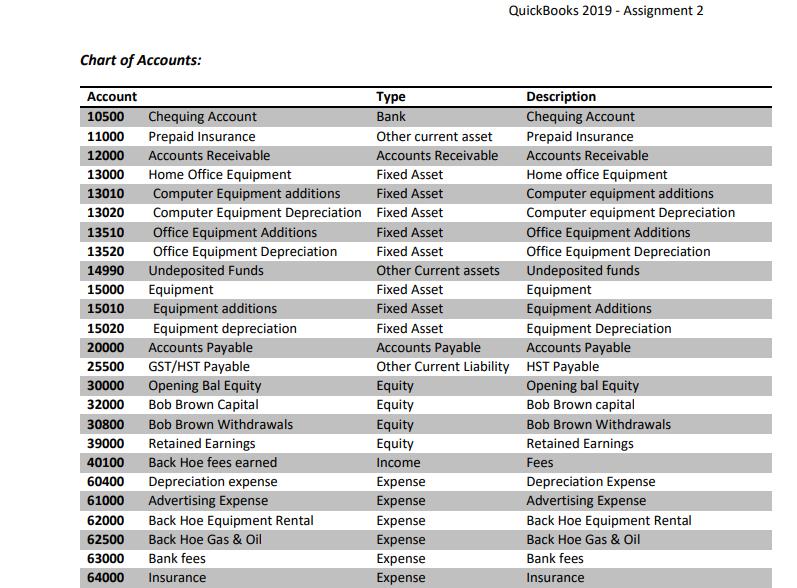

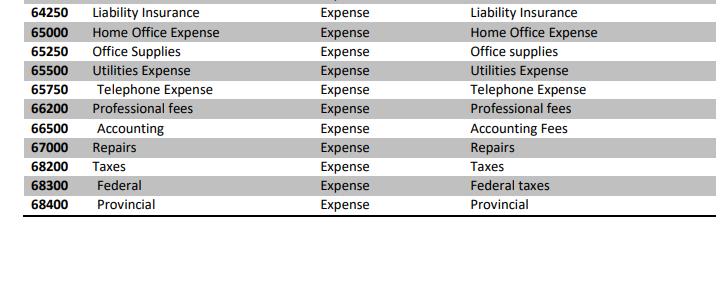

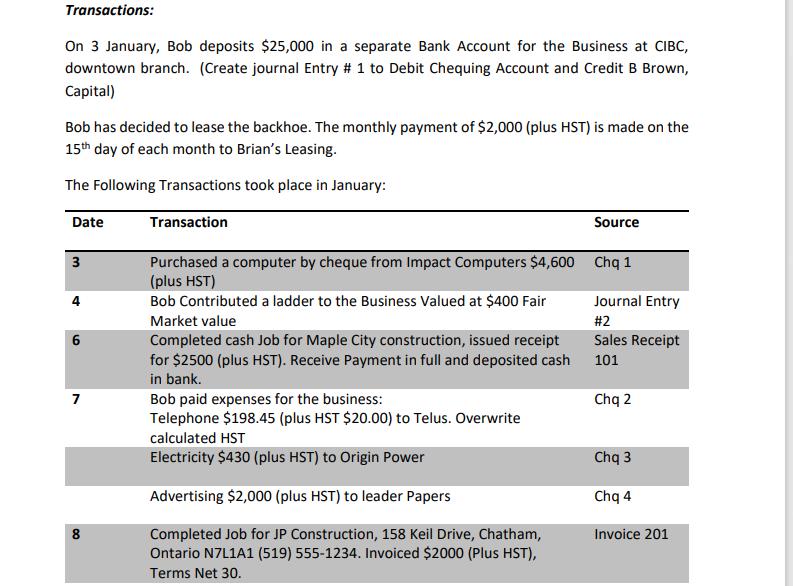

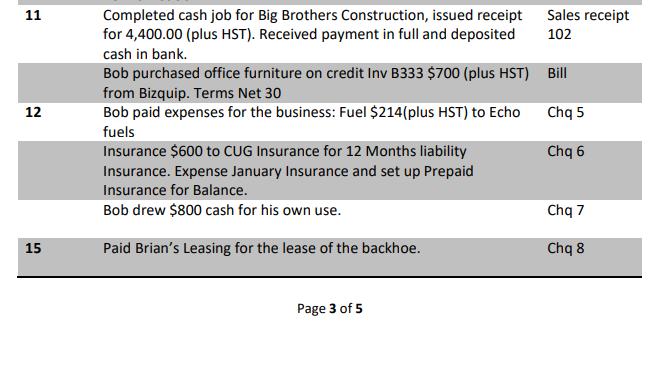

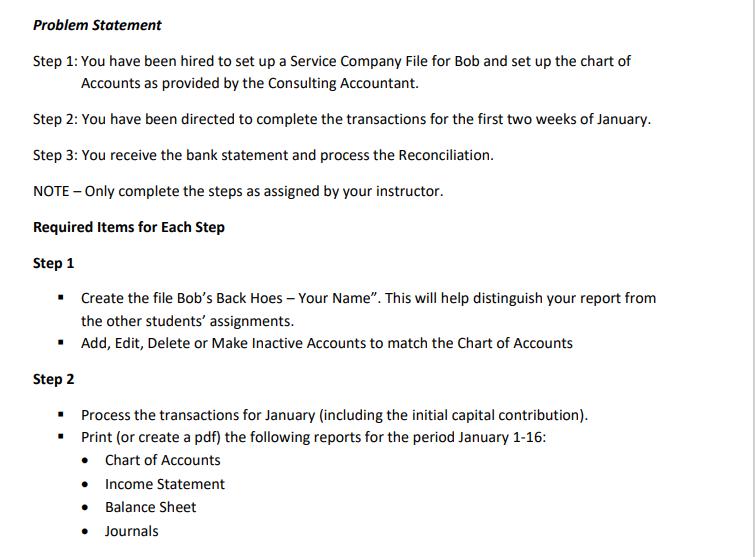

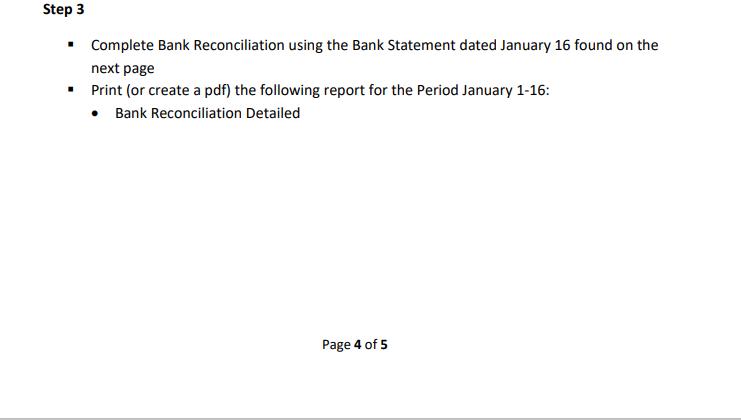

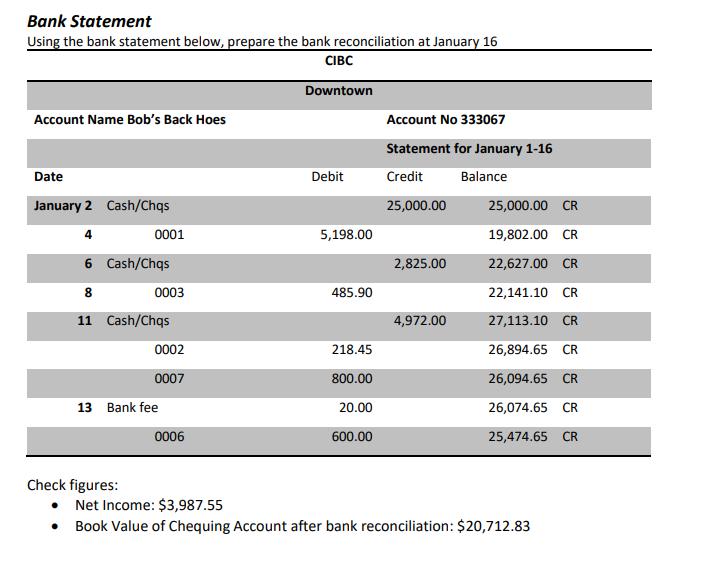

BOB'S BACK HOES STUDENT EXERCISE Overview In this case-study, you, the student, will set up a new service company file using the Easy Step Interview found by clicking on Detailed Start after clicking to create a new company. As you navigate through the Easy Step Interview, you will decide the best answers to the interview based on the information presented here. You will also have the opportunity to practice setting up a Chart of Accounts, and completing Journal entries, sales, Bills, and Cheques. As an extended activity, you may be required to complete the Bank Reconciliation. Accounting Information Bob Brown has decided to start a business of his own, doing backhoe work for clients beginning January 1. He will run the business from his home at 123 Any Street, Chatham, Ontario N7M 1A1. He has obtained his Business Number and registered for Goods and Services tax. Tax rates are GST 5%, and HST 13% Bob will use the calendar year as his fiscal year. His first HST quarterly report period will end March 31. Bob will only do business in Southwest Ontario. This is a Service Based Business with no inventory. To assist with setting up the Chart of Accounts, choose 'General Service-Based Business' as the industry in the Easy Step Interview process. Set up a Service Item called Back Hoe Fees, Description Back Hoe Services, Default Tax will be HST Only. Bob Expects to invoice some Customers and collect Payment later. Bob will sometimes buy products and services on credit and pay his vendors later. Attached is a Chart of Accounts Bob has been given to use with his business. QuickBooks 2019 - Assignment 2 Chart of Accounts: Bank Description Chequing Account Account 10500 Chequing Account 11000 Prepaid Insurance Other current asset Prepaid Insurance Accounts Receivable Fixed Asset 12000 Accounts Receivable Accounts Receivable 13000 Home Office Equipment Home office Equipment Computer Equipment additions Computer Equipment Depreciation Fixed Asset Computer equipment additions Computer equipment Depreciation 13010 Fixed Asset 13020 Office Equipment Additions Office Equipment Depreciation Undeposited Funds 13510 Fixed Asset Office Equipment Additions Office Equipment Depreciation Undeposited funds 13520 Fixed Asset 14990 Other Current assets 15000 Equipment Fixed Asset Equipment 15010 Equipment additions Fixed Asset Equipment Additions Equipment depreciation Accounts Payable GST/HST Payable Opening Bal Equity Bob Brown Capital 15020 Fixed Asset Equipment Depreciation Accounts Payable 20000 Accounts Payable Other Current Liability HST Payable Equity Equity 25500 30000 Opening bal Equity Bob Brown capital 32000 30800 Bob Brown Withdrawals Equity Bob Brown Withdrawals 39000 Retained Earnings Equity Retained Earnings 40100 Back Hoe fees earned Income Fees 60400 Depreciation expense Expense Depreciation Expense 61000 Advertising Expense Expense Advertising Expense 62000 Back Hoe Equipment Rental Expense Back Hoe Equipment Rental 62500 Back Hoe Gas & Oil Expense Back Hoe Gas & Oil 63000 Bank fees Expense Bank fees 64000 Insurance Expense Insurance 64250 Liability Insurance Expense Liability Insurance 65000 Home Office Expense Office Supplies Utilities Expense Telephone Expense Expense Home Office Expense Office supplies 65250 Expense 65500 Expense Utilities Expense 65750 Expense Telephone Expense 66200 Professional fees Expense Professional fees 66500 Accounting Expense Expense Accounting Fees 67000 Repairs Repairs 68200 Taxes Expense es 68300 Federal Expense Federal taxes 68400 Provincial Expense Provincial Transactions: On 3 January, Bob deposits $25,000 in a separate Bank Account for the Business at CIBC, downtown branch. (Create journal Entry # 1 to Debit Chequing Account and Credit B Brown, Capital) Bob has decided to lease the backhoe. The monthly payment of $2,000 (plus HST) is made on the 15th day of each month to Brian's Leasing. The Following Transactions took place in January: Date Transaction Source Purchased a computer by cheque from Impact Computers $4,600 Chq 1 (plus HST) Bob Contributed a ladder to the Business Valued at $400 Fair Market value 3 4 Journal Entry #2 Completed cash Job for Maple City construction, issued receipt for $2500 (plus HST). Receive Payment in full and deposited cash 101 in bank. Bob paid expenses for the business: Telephone $198.45 (plus HST $20.00) to Telus. Overwrite 6 Sales Receipt Chq 2 7 calculated HST Electricity $430 (plus HST) to Origin Power Chq 3 Advertising $2,000 (plus HST) to leader Papers Chq 4 Completed Job for JP Construction, 158 Keil Drive, Chatham, Ontario N7L1A1 (519) 555-1234. Invoiced $2000 (Plus HST), Terms Net 30. 8 Invoice 201 Completed cash job for Big Brothers Construction, issued receipt Sales receipt for 4,400.00 (plus HST). Received payment in full and deposited 11 102 cash in bank. Bob purchased office furniture on credit Inv B333 $700 (plus HST) Bill from Bizquip. Terms Net 30 Bob paid expenses for the business: Fuel $214(plus HST) to Echo 12 Chq 5 fuels Insurance $600 to CUG Insurance for 12 Months liability Insurance. Expense January Insurance and set up Prepaid Chq 6 Insurance for Balance. Bob drew $800 cash for his own use. Chq 7 15 Paid Brian's Leasing for the lease of the backhoe. Chq 8 Page 3 of 5 Problem Statement Step 1: You have been hired to set up a Service Company File for Bob and set up the chart of Accounts as provided by the Consulting Accountant. Step 2: You have been directed to complete the transactions for the first two weeks of January. Step 3: You receive the bank statement and process the Reconciliation. NOTE - Only complete the steps as assigned by your instructor. Required Items for Each Step Step 1 Create the file Bob's Back Hoes Your Name". This will help distinguish your report from the other students' assignments. Add, Edit, Delete or Make Inactive Accounts to match the Chart of Accounts Step 2 Process the transactions for January (including the initial capital contribution). Print (or create a pdf) the following reports for the period January 1-16: Chart of Accounts Income Statement Balance Sheet Journals Step 3 Complete Bank Reconciliation using the Bank Statement dated January 16 found on the next page Print (or create a pdf) the following report for the Period January 1-16: Bank Reconciliation Detailed Page 4 of 5 Bank Statement Using the bank statement below, prepare the bank reconciliation at January 16 CIBC Downtown Account Name Bob's Back Hoes Account No 333067 Statement for January 1-16 Date Debit Credit Balance January 2 Cash/Chqs 25,000.00 25,000.00 CR 0001 5,198.00 19,802.00 CR 6 Cash/Chqs 2,825.00 22,627.00 CR 8 0003 485.90 22,141.10 CR 11 Cash/Chqs 4,972.00 27,113.10 CR 0002 218.45 26,894.65 CR 0007 800.00 26,094.65 CR 13 Bank fee 20.00 26,074.65 CR 0006 600.00 25,474.6 CR Check figures: Net Income: $3,987.55 Book Value of Chequing Account after bank reconciliation: $20,712.83 BOB'S BACK HOES STUDENT EXERCISE Overview In this case-study, you, the student, will set up a new service company file using the Easy Step Interview found by clicking on Detailed Start after clicking to create a new company. As you navigate through the Easy Step Interview, you will decide the best answers to the interview based on the information presented here. You will also have the opportunity to practice setting up a Chart of Accounts, and completing Journal entries, sales, Bills, and Cheques. As an extended activity, you may be required to complete the Bank Reconciliation. Accounting Information Bob Brown has decided to start a business of his own, doing backhoe work for clients beginning January 1. He will run the business from his home at 123 Any Street, Chatham, Ontario N7M 1A1. He has obtained his Business Number and registered for Goods and Services tax. Tax rates are GST 5%, and HST 13% Bob will use the calendar year as his fiscal year. His first HST quarterly report period will end March 31. Bob will only do business in Southwest Ontario. This is a Service Based Business with no inventory. To assist with setting up the Chart of Accounts, choose 'General Service-Based Business' as the industry in the Easy Step Interview process. Set up a Service Item called Back Hoe Fees, Description Back Hoe Services, Default Tax will be HST Only. Bob Expects to invoice some Customers and collect Payment later. Bob will sometimes buy products and services on credit and pay his vendors later. Attached is a Chart of Accounts Bob has been given to use with his business. QuickBooks 2019 - Assignment 2 Chart of Accounts: Bank Description Chequing Account Account 10500 Chequing Account 11000 Prepaid Insurance Other current asset Prepaid Insurance Accounts Receivable Fixed Asset 12000 Accounts Receivable Accounts Receivable 13000 Home Office Equipment Home office Equipment Computer Equipment additions Computer Equipment Depreciation Fixed Asset Computer equipment additions Computer equipment Depreciation 13010 Fixed Asset 13020 Office Equipment Additions Office Equipment Depreciation Undeposited Funds 13510 Fixed Asset Office Equipment Additions Office Equipment Depreciation Undeposited funds 13520 Fixed Asset 14990 Other Current assets 15000 Equipment Fixed Asset Equipment 15010 Equipment additions Fixed Asset Equipment Additions Equipment depreciation Accounts Payable GST/HST Payable Opening Bal Equity Bob Brown Capital 15020 Fixed Asset Equipment Depreciation Accounts Payable 20000 Accounts Payable Other Current Liability HST Payable Equity Equity 25500 30000 Opening bal Equity Bob Brown capital 32000 30800 Bob Brown Withdrawals Equity Bob Brown Withdrawals 39000 Retained Earnings Equity Retained Earnings 40100 Back Hoe fees earned Income Fees 60400 Depreciation expense Expense Depreciation Expense 61000 Advertising Expense Expense Advertising Expense 62000 Back Hoe Equipment Rental Expense Back Hoe Equipment Rental 62500 Back Hoe Gas & Oil Expense Back Hoe Gas & Oil 63000 Bank fees Expense Bank fees 64000 Insurance Expense Insurance 64250 Liability Insurance Expense Liability Insurance 65000 Home Office Expense Office Supplies Utilities Expense Telephone Expense Expense Home Office Expense Office supplies 65250 Expense 65500 Expense Utilities Expense 65750 Expense Telephone Expense 66200 Professional fees Expense Professional fees 66500 Accounting Expense Expense Accounting Fees 67000 Repairs Repairs 68200 Taxes Expense es 68300 Federal Expense Federal taxes 68400 Provincial Expense Provincial Transactions: On 3 January, Bob deposits $25,000 in a separate Bank Account for the Business at CIBC, downtown branch. (Create journal Entry # 1 to Debit Chequing Account and Credit B Brown, Capital) Bob has decided to lease the backhoe. The monthly payment of $2,000 (plus HST) is made on the 15th day of each month to Brian's Leasing. The Following Transactions took place in January: Date Transaction Source Purchased a computer by cheque from Impact Computers $4,600 Chq 1 (plus HST) Bob Contributed a ladder to the Business Valued at $400 Fair Market value 3 4 Journal Entry #2 Completed cash Job for Maple City construction, issued receipt for $2500 (plus HST). Receive Payment in full and deposited cash 101 in bank. Bob paid expenses for the business: Telephone $198.45 (plus HST $20.00) to Telus. Overwrite 6 Sales Receipt Chq 2 7 calculated HST Electricity $430 (plus HST) to Origin Power Chq 3 Advertising $2,000 (plus HST) to leader Papers Chq 4 Completed Job for JP Construction, 158 Keil Drive, Chatham, Ontario N7L1A1 (519) 555-1234. Invoiced $2000 (Plus HST), Terms Net 30. 8 Invoice 201 Completed cash job for Big Brothers Construction, issued receipt Sales receipt for 4,400.00 (plus HST). Received payment in full and deposited 11 102 cash in bank. Bob purchased office furniture on credit Inv B333 $700 (plus HST) Bill from Bizquip. Terms Net 30 Bob paid expenses for the business: Fuel $214(plus HST) to Echo 12 Chq 5 fuels Insurance $600 to CUG Insurance for 12 Months liability Insurance. Expense January Insurance and set up Prepaid Chq 6 Insurance for Balance. Bob drew $800 cash for his own use. Chq 7 15 Paid Brian's Leasing for the lease of the backhoe. Chq 8 Page 3 of 5 Problem Statement Step 1: You have been hired to set up a Service Company File for Bob and set up the chart of Accounts as provided by the Consulting Accountant. Step 2: You have been directed to complete the transactions for the first two weeks of January. Step 3: You receive the bank statement and process the Reconciliation. NOTE - Only complete the steps as assigned by your instructor. Required Items for Each Step Step 1 Create the file Bob's Back Hoes Your Name". This will help distinguish your report from the other students' assignments. Add, Edit, Delete or Make Inactive Accounts to match the Chart of Accounts Step 2 Process the transactions for January (including the initial capital contribution). Print (or create a pdf) the following reports for the period January 1-16: Chart of Accounts Income Statement Balance Sheet Journals Step 3 Complete Bank Reconciliation using the Bank Statement dated January 16 found on the next page Print (or create a pdf) the following report for the Period January 1-16: Bank Reconciliation Detailed Page 4 of 5 Bank Statement Using the bank statement below, prepare the bank reconciliation at January 16 CIBC Downtown Account Name Bob's Back Hoes Account No 333067 Statement for January 1-16 Date Debit Credit Balance January 2 Cash/Chqs 25,000.00 25,000.00 CR 0001 5,198.00 19,802.00 CR 6 Cash/Chqs 2,825.00 22,627.00 CR 8 0003 485.90 22,141.10 CR 11 Cash/Chqs 4,972.00 27,113.10 CR 0002 218.45 26,894.65 CR 0007 800.00 26,094.65 CR 13 Bank fee 20.00 26,074.65 CR 0006 600.00 25,474.6 CR Check figures: Net Income: $3,987.55 Book Value of Chequing Account after bank reconciliation: $20,712.83 BOB'S BACK HOES STUDENT EXERCISE Overview In this case-study, you, the student, will set up a new service company file using the Easy Step Interview found by clicking on Detailed Start after clicking to create a new company. As you navigate through the Easy Step Interview, you will decide the best answers to the interview based on the information presented here. You will also have the opportunity to practice setting up a Chart of Accounts, and completing Journal entries, sales, Bills, and Cheques. As an extended activity, you may be required to complete the Bank Reconciliation. Accounting Information Bob Brown has decided to start a business of his own, doing backhoe work for clients beginning January 1. He will run the business from his home at 123 Any Street, Chatham, Ontario N7M 1A1. He has obtained his Business Number and registered for Goods and Services tax. Tax rates are GST 5%, and HST 13% Bob will use the calendar year as his fiscal year. His first HST quarterly report period will end March 31. Bob will only do business in Southwest Ontario. This is a Service Based Business with no inventory. To assist with setting up the Chart of Accounts, choose 'General Service-Based Business' as the industry in the Easy Step Interview process. Set up a Service Item called Back Hoe Fees, Description Back Hoe Services, Default Tax will be HST Only. Bob Expects to invoice some Customers and collect Payment later. Bob will sometimes buy products and services on credit and pay his vendors later. Attached is a Chart of Accounts Bob has been given to use with his business. QuickBooks 2019 - Assignment 2 Chart of Accounts: Bank Description Chequing Account Account 10500 Chequing Account 11000 Prepaid Insurance Other current asset Prepaid Insurance Accounts Receivable Fixed Asset 12000 Accounts Receivable Accounts Receivable 13000 Home Office Equipment Home office Equipment Computer Equipment additions Computer Equipment Depreciation Fixed Asset Computer equipment additions Computer equipment Depreciation 13010 Fixed Asset 13020 Office Equipment Additions Office Equipment Depreciation Undeposited Funds 13510 Fixed Asset Office Equipment Additions Office Equipment Depreciation Undeposited funds 13520 Fixed Asset 14990 Other Current assets 15000 Equipment Fixed Asset Equipment 15010 Equipment additions Fixed Asset Equipment Additions Equipment depreciation Accounts Payable GST/HST Payable Opening Bal Equity Bob Brown Capital 15020 Fixed Asset Equipment Depreciation Accounts Payable 20000 Accounts Payable Other Current Liability HST Payable Equity Equity 25500 30000 Opening bal Equity Bob Brown capital 32000 30800 Bob Brown Withdrawals Equity Bob Brown Withdrawals 39000 Retained Earnings Equity Retained Earnings 40100 Back Hoe fees earned Income Fees 60400 Depreciation expense Expense Depreciation Expense 61000 Advertising Expense Expense Advertising Expense 62000 Back Hoe Equipment Rental Expense Back Hoe Equipment Rental 62500 Back Hoe Gas & Oil Expense Back Hoe Gas & Oil 63000 Bank fees Expense Bank fees 64000 Insurance Expense Insurance 64250 Liability Insurance Expense Liability Insurance 65000 Home Office Expense Office Supplies Utilities Expense Telephone Expense Expense Home Office Expense Office supplies 65250 Expense 65500 Expense Utilities Expense 65750 Expense Telephone Expense 66200 Professional fees Expense Professional fees 66500 Accounting Expense Expense Accounting Fees 67000 Repairs Repairs 68200 Taxes Expense es 68300 Federal Expense Federal taxes 68400 Provincial Expense Provincial Transactions: On 3 January, Bob deposits $25,000 in a separate Bank Account for the Business at CIBC, downtown branch. (Create journal Entry # 1 to Debit Chequing Account and Credit B Brown, Capital) Bob has decided to lease the backhoe. The monthly payment of $2,000 (plus HST) is made on the 15th day of each month to Brian's Leasing. The Following Transactions took place in January: Date Transaction Source Purchased a computer by cheque from Impact Computers $4,600 Chq 1 (plus HST) Bob Contributed a ladder to the Business Valued at $400 Fair Market value 3 4 Journal Entry #2 Completed cash Job for Maple City construction, issued receipt for $2500 (plus HST). Receive Payment in full and deposited cash 101 in bank. Bob paid expenses for the business: Telephone $198.45 (plus HST $20.00) to Telus. Overwrite 6 Sales Receipt Chq 2 7 calculated HST Electricity $430 (plus HST) to Origin Power Chq 3 Advertising $2,000 (plus HST) to leader Papers Chq 4 Completed Job for JP Construction, 158 Keil Drive, Chatham, Ontario N7L1A1 (519) 555-1234. Invoiced $2000 (Plus HST), Terms Net 30. 8 Invoice 201 Completed cash job for Big Brothers Construction, issued receipt Sales receipt for 4,400.00 (plus HST). Received payment in full and deposited 11 102 cash in bank. Bob purchased office furniture on credit Inv B333 $700 (plus HST) Bill from Bizquip. Terms Net 30 Bob paid expenses for the business: Fuel $214(plus HST) to Echo 12 Chq 5 fuels Insurance $600 to CUG Insurance for 12 Months liability Insurance. Expense January Insurance and set up Prepaid Chq 6 Insurance for Balance. Bob drew $800 cash for his own use. Chq 7 15 Paid Brian's Leasing for the lease of the backhoe. Chq 8 Page 3 of 5 Problem Statement Step 1: You have been hired to set up a Service Company File for Bob and set up the chart of Accounts as provided by the Consulting Accountant. Step 2: You have been directed to complete the transactions for the first two weeks of January. Step 3: You receive the bank statement and process the Reconciliation. NOTE - Only complete the steps as assigned by your instructor. Required Items for Each Step Step 1 Create the file Bob's Back Hoes Your Name". This will help distinguish your report from the other students' assignments. Add, Edit, Delete or Make Inactive Accounts to match the Chart of Accounts Step 2 Process the transactions for January (including the initial capital contribution). Print (or create a pdf) the following reports for the period January 1-16: Chart of Accounts Income Statement Balance Sheet Journals Step 3 Complete Bank Reconciliation using the Bank Statement dated January 16 found on the next page Print (or create a pdf) the following report for the Period January 1-16: Bank Reconciliation Detailed Page 4 of 5 Bank Statement Using the bank statement below, prepare the bank reconciliation at January 16 CIBC Downtown Account Name Bob's Back Hoes Account No 333067 Statement for January 1-16 Date Debit Credit Balance January 2 Cash/Chqs 25,000.00 25,000.00 CR 0001 5,198.00 19,802.00 CR 6 Cash/Chqs 2,825.00 22,627.00 CR 8 0003 485.90 22,141.10 CR 11 Cash/Chqs 4,972.00 27,113.10 CR 0002 218.45 26,894.65 CR 0007 800.00 26,094.65 CR 13 Bank fee 20.00 26,074.65 CR 0006 600.00 25,474.6 CR Check figures: Net Income: $3,987.55 Book Value of Chequing Account after bank reconciliation: $20,712.83

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts