Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assignment: Chapter 02 Using Financial Statements and Budgets Steve and Jane Ibarra have been married for over two years. They have been trying to

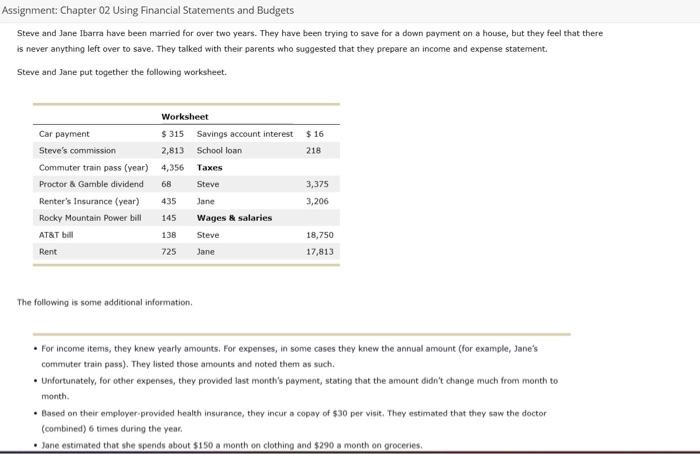

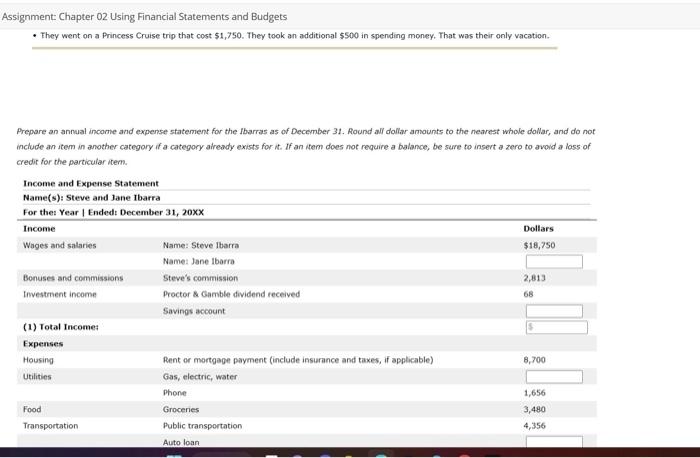

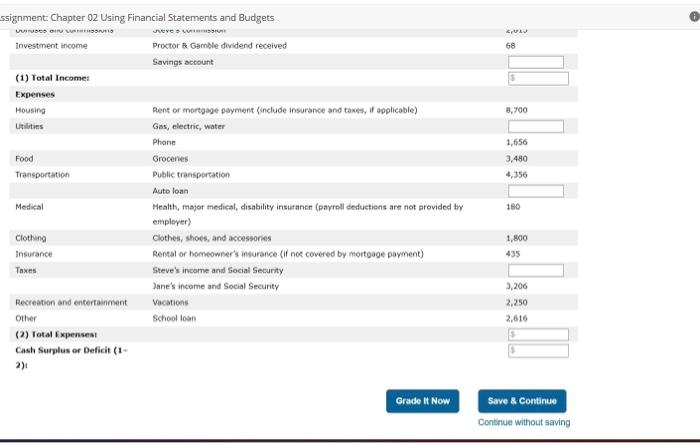

Assignment: Chapter 02 Using Financial Statements and Budgets Steve and Jane Ibarra have been married for over two years. They have been trying to save for a down payment on a house, but they feel that there is never anything left over to save. They talked with their parents who suggested that they prepare an income and expense statement. Steve and Jane put together the following worksheet. Worksheet Car payment Steve's commission $ 315 Savings account interest 2,813 School loan $16 218 Commuter train pass (year) 4,356 Taxes Proctor & Gamble dividend 68 Steve 3,375 Renter's Insurance (year) 435 Jane 3,206 Rocky Mountain Power bill 145 Wages & salaries AT&T bill 138 Steve 18,750 Rent 725 Jane 17,813 The following is some additional information. For income items, they knew yearly amounts. For expenses, in some cases they knew the annual amount (for example, Jane's commuter train pass). They listed those amounts and noted them as such. Unfortunately, for other expenses, they provided last month's payment, stating that the amount didn't change much from month to month. Based on their employer-provided health insurance, they incur a copay of $30 per visit. They estimated that they saw the doctor (combined) 6 times during the year. . Jane estimated that she spends about $150 a month on clothing and $290 a month on groceries. Assignment: Chapter 02 Using Financial Statements and Budgets They went on a Princess Cruise trip that cost $1,750. They took an additional $500 in spending money. That was their only vacation. Prepare an annual income and expense statement for the Ibarras as of December 31. Round all dollar amounts to the nearest whole dollar, and do not include an item in another category if a category already exists for it. If an item does not require a balance, be sure to insert a zero to avoid a loss of credit for the particular item. Income and Expense Statement Name(s): Steve and Jane Ibarra For the: Year | Ended: December 31, 20XX Income Wages and salaries Bonuses and commissions Investment income (1) Total Income: Expenses Housing Name: Steve Ibarra Name: Jane Ibarra Steve's commission Proctor & Gamble dividend received Savings account Dollars $18,750 2,813 68 Utilities Food Transportation Rent or mortgage payment (include insurance and taxes, if applicable) Gas, electric, water 8,700 Phone Groceries Public transportation Auto loan 1,656 3,480 4,356 ssignment: Chapter 02 Using Financial Statements and Budgets Uses B Investment income (1) Total Income: Expenses Housing Utilities Proctor & Gamble dividend received Savings account 68 D Rent or mortgage payment (include insurance and taxes, if applicable) 8,700 Gas, electric, water Phone Food Transportation Groceries Auto loan Medical Clothing Insurance Taxes 1,656 3,480 4,356 Public transportation Health, major medical, disability insurance (payroll deductions are not provided by employer) 180 Clothes, shoes, and accessories Rental or homeowner's insurance (if not covered by mortgage payment) Steve's income and Social Security Recreation and entertainment Other (2) Total Expenses Cash Surplus or Deficit (1- 2)1 Jane's income and Social Security Vacations School loan 1,800 435 3,206 2,250 2,616 Grade It Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started