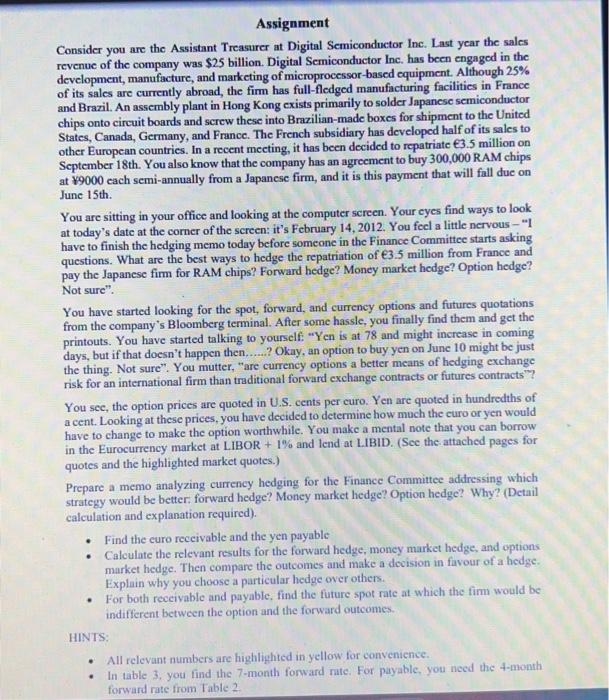

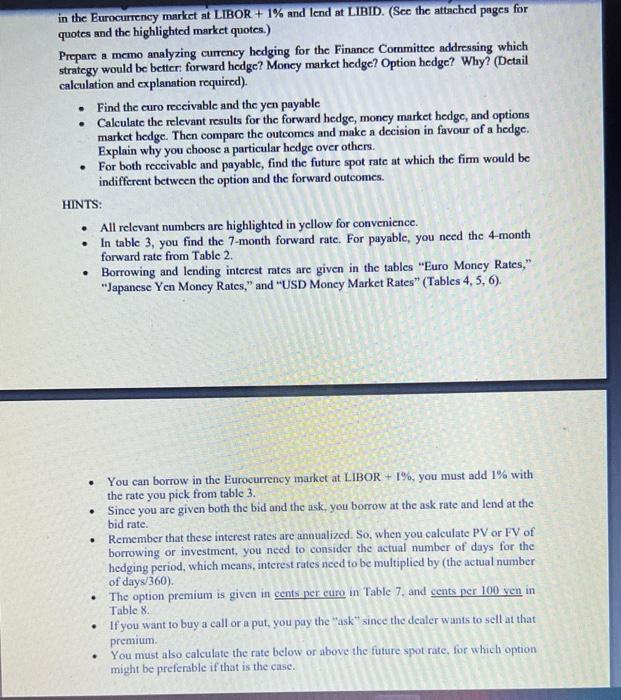

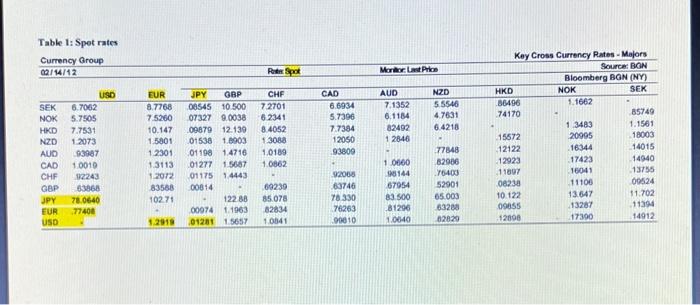

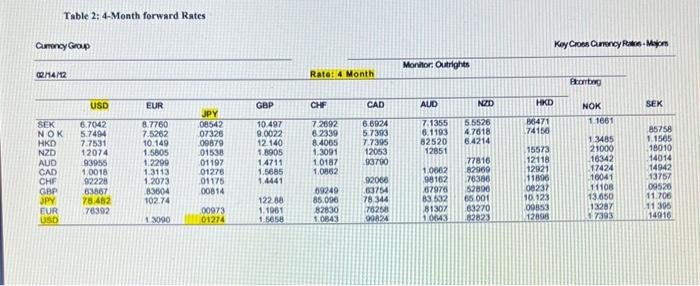

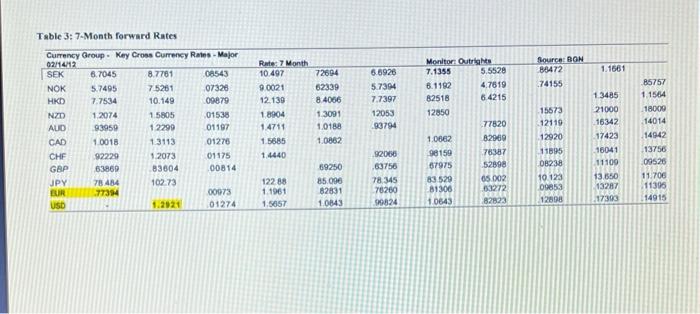

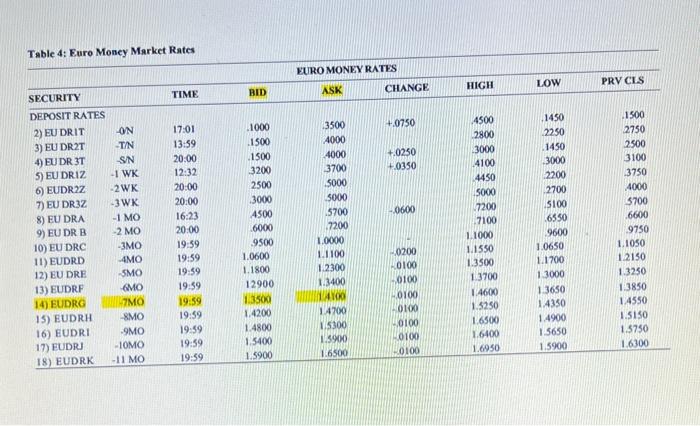

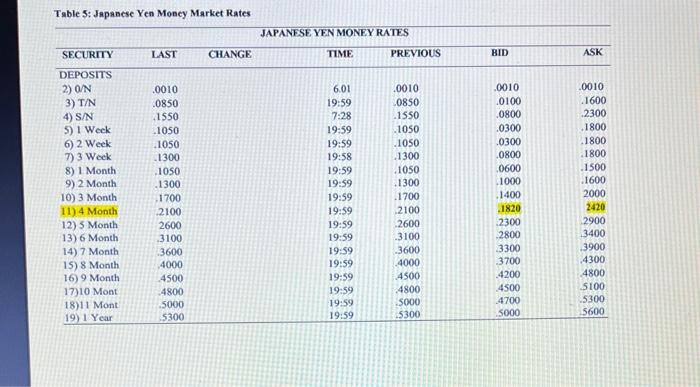

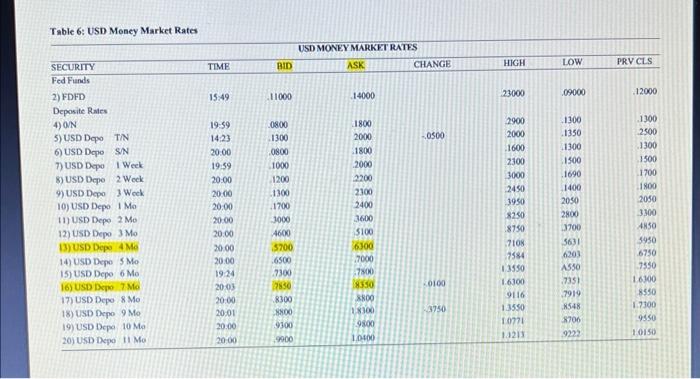

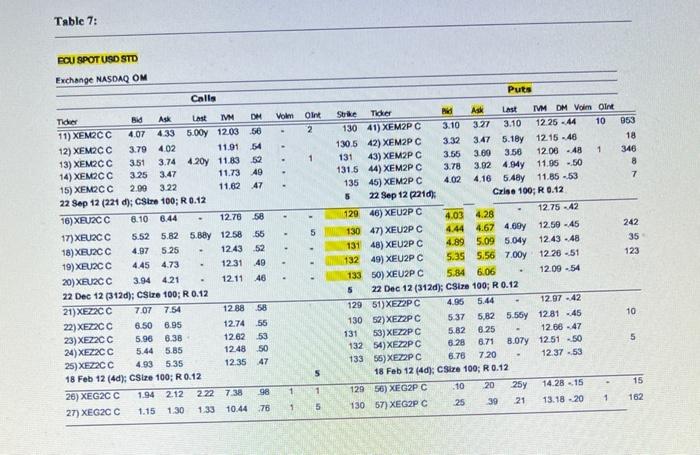

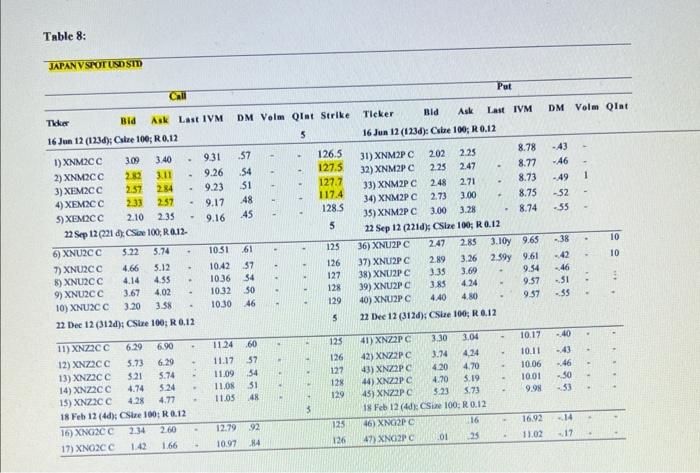

Assignment Consider you are the Assistant Treasurer at Digital Semiconductor Ine. Last year the sales revenue of the company was $25 billion. Digital Semiconductor Inc. has been engaged in the development, manufacture, and marketing of microprocessor-based equipment. Although 25% of its sales are currently abroad, the firm has full-fledged manufacturing facilities in France and Brazil. An assembly plant in Hong Kong exists primarily to solder Japanese semiconductor chips onto circuit boards and screw these into Brazilian-made boxes for shipment to the United States, Canada, Germany, and France. The French subsidiary has developed half of its sales to other European countries. In a recent meeting, it has been decided to repatriate 3.5 million on September 18th. You also know that the company has an agreement to buy 300,000 RAM chips at $9000 cach semi-annually from a Japanese firm, and it is this payment that will fall due on June 15th. You are sitting in your office and looking at the computer screen. Your cyes find ways to look at today's date at the corner of the screen: it's February 14, 2012. You feel a little nervous - "I have to finish the hedging memo today before someone in the Finance Committee starts asking questions. What are the best ways to hedge the repatriation of 3.5 million from France and pay the Japanese firm for RAM chips? Forward hedge? Money market hedge? Option hedge? Not sure". You have started looking for the spot, forward, and currency options and futures quotations from the company's Bloomberg terminal. After some hassle, you finally find them and get the printouts. You have started talking to yourself: "Yen is at 78 and might increase in coming days, but if that doesn't happen then,....? Okay, an option to buy yen on June 10 might be just the thing. Not sure". You mutter, "are currency options a better means of hedging exchangc risk for an international firm than traditional forward exchange contracts or futures contracts"? You see, the option prices are quoted in U.S. cents per curo. Yen are quoted in hundredths of a cent. Looking at these prices, you have decided to determine how much the euro or yen would have to change to make the option worthwhile. You make a mental note that you can borrow in the Eurocurrency market at L.IBOR + 1\% and lend at L.IBID. (See the attached pages for quotes and the highlighted market quotes.) Prepare a memo analyzing currency hedging for the Finance Committee addressing which strategy would be better, forward hedge? Money market hedge? Option hedge? Why? (Detail calculation and explanation required). - Find the euro receivable and the yen payable - Calculate the relevant results for the forward hedge, money market hedge, and options market hedge. Then compare the outcomes and make a decision in favour of a hedge. Explain why you choose a particular hedge over others. - For both receivable and payable, find the future spot rate at which the firm would be indifferent between the option and the forward outcomes. HINTS: - All relevant numbers are highlighted in yellow for convenience. - In table 3, you find the 7-month forward rate. For payable, you need the 4 -month forward rate from Table 2 . in the Eurocurrency market at LIBOR +1% and lend at LIBID. (See the attached pages for quotes and the highlighted market quotes.) Prepare a memo analyzing currency hedging for the Finance Committee addressing which strategy would be better forward hedge? Moncy market hedge? Option hedge? Why? (Detail calculation and explanation required). - Find the curo reccivable and the yen payable - Calculate the relevant results for the forward hedgc, moncy market hedgc, and options market hedge. Then compare the outcomes and make a decision in favour of a hedge. Explain why you choose a particular hedge over others. - For both reccivable and payable, find the future spot rate at which the firm would be indifferent between the option and the forward outcomes. HINTS: - All relevant numbers are highlighted in yellow for convenience. - In table 3, you find the 7-month forward rate. For payable, you need the 4-month forward rate from Table 2 . - Borrowing and lending interest rates are given in the tables "Euro Money Rates," "Japanese Yen Moncy Rates," and "USD Moncy Market Rates" (Tables 4, 5, 6). - You can borrow in the Eurocurrency market at LIBOR + 1\%, you must add 1% with the rate you pick from table 3 . - Since you are given both the bid and the usk, you borrow at the ask rate and lend at the bid rate. - Remember that these interest rates are annualized. So, when you calculate PV or FV of borrowing or investment, you need to consider the actual number of days for the hedging period, which means, interest rates need to be multiplied by (the actual number of days 1360 ). - The option premium is given in cents per curo in Table 7, and cents per 100 yen in Table 8 . - If you want to buy a call or a pat, you pay the "ask" since the dealer wants to sell at that premium. - You must also calculate the rate below or above the future spot rate, for which option might be preferable if that is the case. Table 1: Spet rates Table 2: 4-Month forward Rates GminnGenin KeyCroes Cunency Pition -Myon Table 3: 7.Month forward Rates Table 4: Euro Money Market Rates Table 5: Japanese Yen Mosey Market Rates Table 6: USD Meney Market Rates Table 7: FCU BPOTUSD STD Exchange NASDMQ OM Table 8: JAPANVSTOTLDSTB Assignment Consider you are the Assistant Treasurer at Digital Semiconductor Ine. Last year the sales revenue of the company was $25 billion. Digital Semiconductor Inc. has been engaged in the development, manufacture, and marketing of microprocessor-based equipment. Although 25% of its sales are currently abroad, the firm has full-fledged manufacturing facilities in France and Brazil. An assembly plant in Hong Kong exists primarily to solder Japanese semiconductor chips onto circuit boards and screw these into Brazilian-made boxes for shipment to the United States, Canada, Germany, and France. The French subsidiary has developed half of its sales to other European countries. In a recent meeting, it has been decided to repatriate 3.5 million on September 18th. You also know that the company has an agreement to buy 300,000 RAM chips at $9000 cach semi-annually from a Japanese firm, and it is this payment that will fall due on June 15th. You are sitting in your office and looking at the computer screen. Your cyes find ways to look at today's date at the corner of the screen: it's February 14, 2012. You feel a little nervous - "I have to finish the hedging memo today before someone in the Finance Committee starts asking questions. What are the best ways to hedge the repatriation of 3.5 million from France and pay the Japanese firm for RAM chips? Forward hedge? Money market hedge? Option hedge? Not sure". You have started looking for the spot, forward, and currency options and futures quotations from the company's Bloomberg terminal. After some hassle, you finally find them and get the printouts. You have started talking to yourself: "Yen is at 78 and might increase in coming days, but if that doesn't happen then,....? Okay, an option to buy yen on June 10 might be just the thing. Not sure". You mutter, "are currency options a better means of hedging exchangc risk for an international firm than traditional forward exchange contracts or futures contracts"? You see, the option prices are quoted in U.S. cents per curo. Yen are quoted in hundredths of a cent. Looking at these prices, you have decided to determine how much the euro or yen would have to change to make the option worthwhile. You make a mental note that you can borrow in the Eurocurrency market at L.IBOR + 1\% and lend at L.IBID. (See the attached pages for quotes and the highlighted market quotes.) Prepare a memo analyzing currency hedging for the Finance Committee addressing which strategy would be better, forward hedge? Money market hedge? Option hedge? Why? (Detail calculation and explanation required). - Find the euro receivable and the yen payable - Calculate the relevant results for the forward hedge, money market hedge, and options market hedge. Then compare the outcomes and make a decision in favour of a hedge. Explain why you choose a particular hedge over others. - For both receivable and payable, find the future spot rate at which the firm would be indifferent between the option and the forward outcomes. HINTS: - All relevant numbers are highlighted in yellow for convenience. - In table 3, you find the 7-month forward rate. For payable, you need the 4 -month forward rate from Table 2 . in the Eurocurrency market at LIBOR +1% and lend at LIBID. (See the attached pages for quotes and the highlighted market quotes.) Prepare a memo analyzing currency hedging for the Finance Committee addressing which strategy would be better forward hedge? Moncy market hedge? Option hedge? Why? (Detail calculation and explanation required). - Find the curo reccivable and the yen payable - Calculate the relevant results for the forward hedgc, moncy market hedgc, and options market hedge. Then compare the outcomes and make a decision in favour of a hedge. Explain why you choose a particular hedge over others. - For both reccivable and payable, find the future spot rate at which the firm would be indifferent between the option and the forward outcomes. HINTS: - All relevant numbers are highlighted in yellow for convenience. - In table 3, you find the 7-month forward rate. For payable, you need the 4-month forward rate from Table 2 . - Borrowing and lending interest rates are given in the tables "Euro Money Rates," "Japanese Yen Moncy Rates," and "USD Moncy Market Rates" (Tables 4, 5, 6). - You can borrow in the Eurocurrency market at LIBOR + 1\%, you must add 1% with the rate you pick from table 3 . - Since you are given both the bid and the usk, you borrow at the ask rate and lend at the bid rate. - Remember that these interest rates are annualized. So, when you calculate PV or FV of borrowing or investment, you need to consider the actual number of days for the hedging period, which means, interest rates need to be multiplied by (the actual number of days 1360 ). - The option premium is given in cents per curo in Table 7, and cents per 100 yen in Table 8 . - If you want to buy a call or a pat, you pay the "ask" since the dealer wants to sell at that premium. - You must also calculate the rate below or above the future spot rate, for which option might be preferable if that is the case. Table 1: Spet rates Table 2: 4-Month forward Rates GminnGenin KeyCroes Cunency Pition -Myon Table 3: 7.Month forward Rates Table 4: Euro Money Market Rates Table 5: Japanese Yen Mosey Market Rates Table 6: USD Meney Market Rates Table 7: FCU BPOTUSD STD Exchange NASDMQ OM Table 8: JAPANVSTOTLDSTB