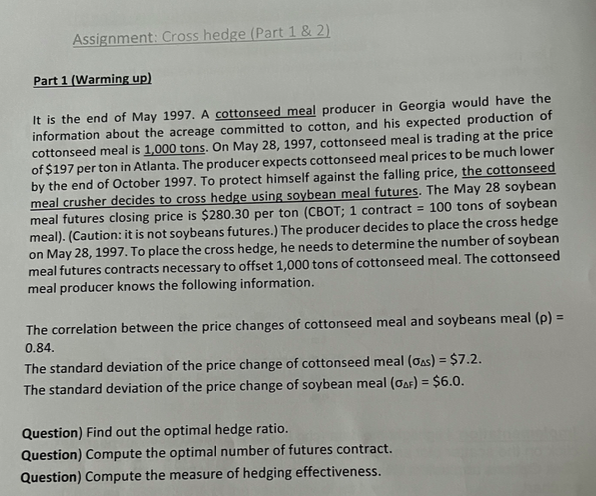

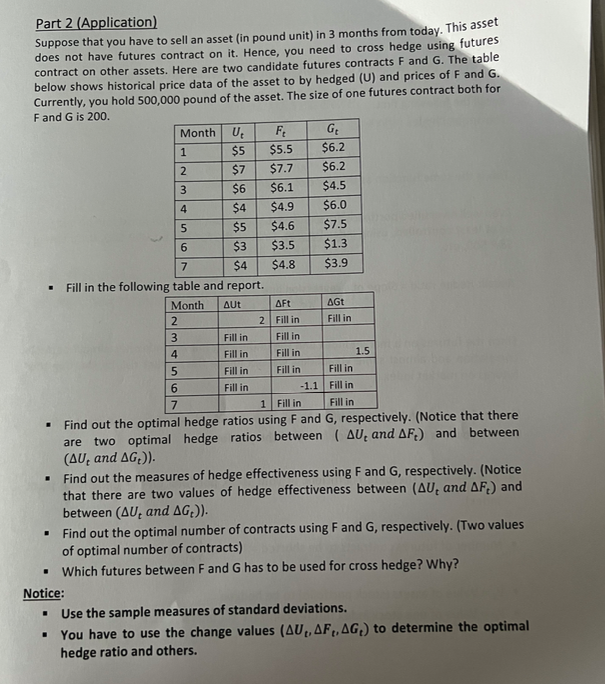

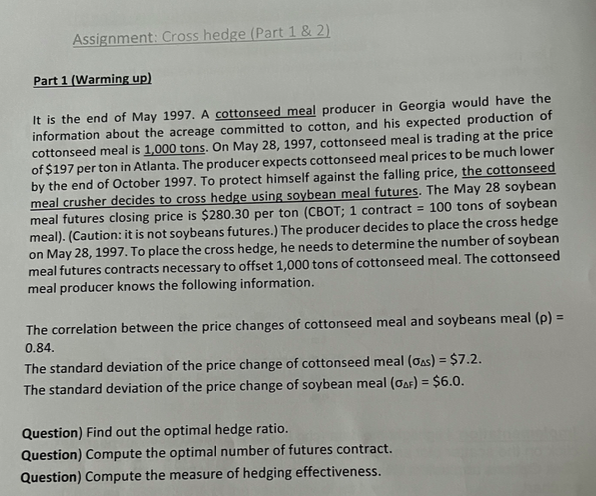

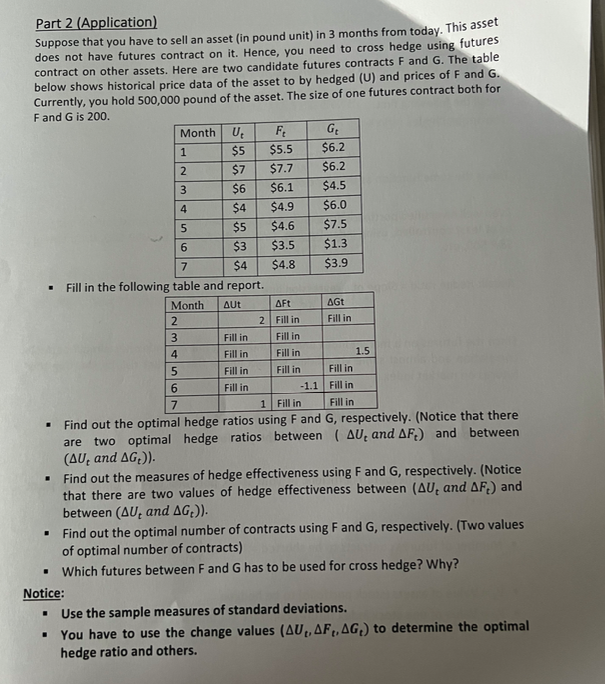

Assignment: Cross hedge (Part 1 & 2) Part 1 (Warming up) It is the end of May 1997. A cottonseed meal producer in Georgia would have the information about the acreage committed to cotton, and his expected production of cottonseed meal is 1,000 tons. On May 28, 1997, cottonseed meal is trading at the price of $197 per ton in Atlanta. The producer expects cottonseed meal prices to be much lower by the end of October 1997. To protect himself against the falling price, the cottonseed meal crusher decides to cross hedge using soybean meal futures. The May 28 soybean meal futures closing price is $280.30 per ton (CBOT; 1 contract = 100 tons of soybean meal). (Caution: it is not soybeans futures.) The producer decides to place the cross hedge on May 28, 1997. To place the cross hedge, he needs to determine the number of soybean meal futures contracts necessary to offset 1,000 tons of cottonseed meal. The cottonseed meal producer knows the following information. The correlation between the price changes of cottonseed meal and soybeans meal (p) = 0.84. The standard deviation of the price change of cottonseed meal (OAS) = $7.2. The standard deviation of the price change of soybean meal (OAF) = $6.0. Question) Find out the optimal hedge ratio. Question) Compute the optimal number of futures contract. Question) Compute the measure of hedging effectiveness. Part 2 (Application) Suppose that you have to sell an asset (in pound unit) in 3 months from today. This asset does not have futures contract on it. Hence, you need to cross hedge using futures contract on other assets. Here are two candidate futures contracts F and G. The table below shows historical price data of the asset to by hedged (U) and prices of F and G. Currently, you hold 500,000 pound of the asset. The size of one futures contract both for F and G is 200. Month U F Gr 1 $5 $5.5 $6.2 2 $7 $7.7 $6.2 3 $6 $6.1 $4.5 4 $4 $4.9 $6.0 5 $5 $4.6 $7.5 6 $3 $3.5 $1.3 7 $4 $4.8 $3.9 Fill in the following table and report. Month AUT AFt AGt 2 2 Fill in Fill in 3 Fill in Fill in 4 Fill in Fill in 5 Fill in Fill in Fill in 6 Fill in -1.1 Fill in 7 1 Fill in Fill in Find out the optimal hedge ratios using F and G, respectively. (Notice that there are two optimal hedge ratios between (AU, and AF) and between (AU, and AG.)). Find out the measures of hedge effectiveness using F and G, respectively. (Notice that there are two values of hedge effectiveness between (AU, and AF,) and between (AU, and AG,)). Find out the optimal number of contracts using F and G, respectively. (Two values of optimal number of contracts) . Which futures between F and G has to be used for cross hedge? Why? Notice: . Use the sample measures of standard deviations. . You have to use the change values (AU, AF, AG,) to determine the optimal hedge ratio and others. . 1.5