Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assignment Description In this final assignment, you are asked to answer several questions regarding a potential business idea ( described below ) . Apply all

Assignment Description

In this final assignment, you are asked to answer several questions regarding a potential business idea described below Apply all that you have learnt throughout the course to answer the questions and good luck!

A small bookstore on Gran Via, one of the main arteries through Madrid and a famous shopping street, has come up with the idea of delivering books to visitors to Madrid who stay in local hotels. Given the central location of the bookstore, the books would be delivered to tourists staying in nearby hotels within less than minutes.

The idea for the delivery service originally came from five MBA students at IE Business School who conducted a market study into the potential need for such a service. From person experience, the students knew that it is easy to forget ones current book at home while travelling. The five MBA students spent last summer interviewing local tourists about the desirability of such a service. Manuel Munoz, the bookstore owner, sponsored this market study with The market study also revealed that Amazon were planning to set up a similar delivery service in central Madrid. Due to various administrative delays, Amazon would only be able to start its delivery service in exactly years from now. It would then immediately price Manuels bookstore out of the market.

The bookstore would need to buy two electrical bicycles for the delivery guys at a price of each. The two bicycles would be fully depreciated in a straight line over the three years. They could be sold for each at the end of the project. The bookstore would also need to use an empty room at the back of the store as a storeroom. If the bookstore were not to go ahead with the delivery service, the empty room could be rented out at an annual rent of The storage room would require heavyduty metal shelves at a total cost of These metal shelves would have to be fixed to the walls and would therefore be difficult to remove once fixed. Hence, Manuel assumes that the shelves will not have a resale value. He also assumes that they will not be depreciated.

If going ahead, Manuel wants to advertise the new delivery service by distributing leaflets to nearby hotels. He has been quoted a fee of for the design of various promotional items and another for the printing of sufficiently enough leaflets and other promotional items such as free keyholders to last for the next three years.

The two delivery guys needed for the delivery service would be paid pa However, Manuel expects to relocate an existing employee who already works for the bookstore to the delivery service. This employee currently earns pa

The new delivery service would generate sales of books, books and books each month during the first year, the second year and the third year, respectively. The average sales price of the books would be The cost of the books sold is of their sales price to the customers. Manuel expects that the number of books sold instore would drop by of the number of books sold via the delivery service. The average sales price per book for the eroded sales is and the cost of the books sold is The bookstore pays of tax on its profits.

Manuel is somewhat confused about his cost of capital. He knows that he should not rely on the bookstores historic cost of debt. He therefore phoned up his bank manager who quoted him an interest rate of if he were to take out a loan today. Following some extensive research on the internet, he is pretty sure that the equity beta of his bookstore is roughly He asked one of his regular customers, a finance professor at IE what risk premium he should use for the market premium. The professor suggested to use a market risk premium of pa

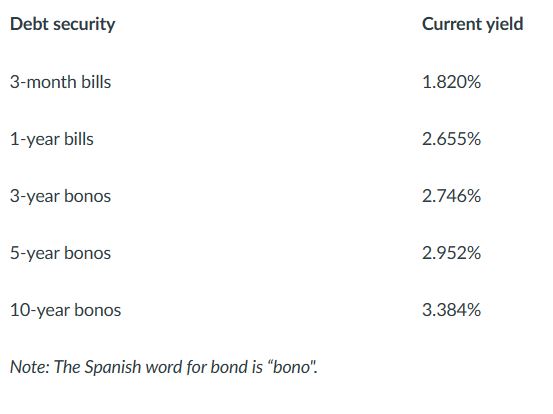

However, Manuel does not know what rate to use for the riskfree rate. He looked up the yields on various debt securities issued by the Spanish government and he found the following:

Note: The Spanish word for bond is "bono".

The bookstore is currently financed by of debt and of equity. The new project is expected to require the same capital structure or mix of debt and equity as the entire bookstore.

Net working capital of of the annual sales revenue would need to be in place at the start of each year. The net working capital would be fully recovered at the end of the project.

Manuel does not feel very confident about estimating his cost of capital. Would you be able to help him? What value would you suggest for the cost of capital? Please answer each of the following questions:

Determine the incremental cash flows for this project. Clearly explain why a given cash flow is incremental or not.

Compute the NPV IRR and payback period for the project. Should Manuel go ahead with this project?

Manuel does not feel very confident about his estimated cost of capital. Would you be able to reassure him? If yes,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started