Answered step by step

Verified Expert Solution

Question

1 Approved Answer

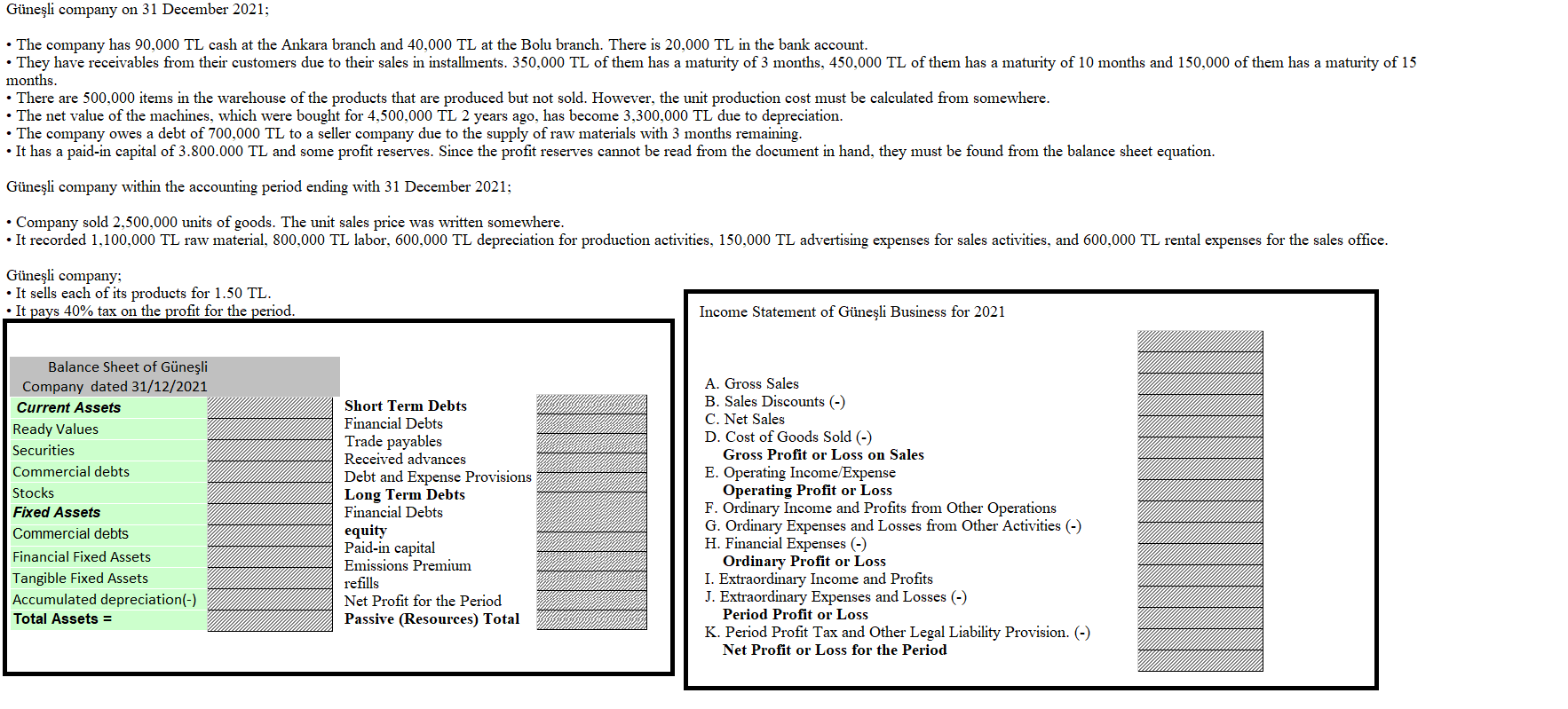

Assignment: Fill in the cells in the balance sheet and income statement according to the data in the description. Excel or similar calculation tools can

Assignment: Fill in the cells in the balance sheet and income statement according to the data in the description. Excel or similar calculation tools can be used

Gneli company on 31 December 2021; The company has 90,000 TL cash at the Ankara branch and 40,000 TL at the Bolu branch. There is 20,000 TL in the bank account. They have receivables from their customers due to their sales in installments. 350,000 TL of them has a maturity of 3 months, 450,000 TL of them has a maturity of 10 months and 150,000 of them has a maturity of 15 months. There are 500,000 items in the warehouse of the products that are produced but not sold. However, the unit production cost must be calculated from somewhere. The net value of the machines, which were bought for 4,500,000 TL 2 years ago, has become 3,300,000 TL due to depreciation. The company owes a debt of 700,000 TL to a seller company due to the supply of raw materials with 3 months remaining. It has a paid-in capital of 3.800.000 TL and some profit reserves. Since the profit reserves cannot be read from the document in hand, they must be found from the balance sheet equation. Gneli company within the accounting period ending with 31 December 2021; Company sold 2,500,000 units of goods. The unit sales price was written somewhere. It recorded 1,100,000 TL raw material, 800,000 TL labor, 600,000 TL depreciation for production activities, 150,000 TL advertising expenses for sales activities, and 600,000 TL rental expenses for the sales office. Gneli company; It sells each of its products for 1.50 TL. It pays 40% tax on the profit for the period. Income Statement of Gneli Business for 2021 Balance Sheet of Gneli Company dated 31/12/2021 Current Assets Ready Values Securities Commercial debts Stocks Fixed Assets Commercial debts Financial Fixed Assets Tangible Fixed Assets Accumulated depreciation(-) Total Assets = WWW Short Term Debts Financial Debts Trade payables Received advances Debt and Expense Provisions Long Term Debts Financial Debts equity Paid-in capital Emissions Premium refills Net Profit for the Period Passive (Resources) Total A. Gross Sales B. Sales Discounts (-) C. Net Sales D. Cost of Goods Sold (-) Gross Profit or Loss on Sales E. Operating Income Expense Operating Profit or Loss F. Ordinary Income and Profits from Other Operations G. Ordinary Expenses and Losses from Other Activities (-) H. Financial Expenses (-) Ordinary Profit or Loss I. Extraordinary Income and Profits J. Extraordinary Expenses and Losses (-) Period Profit or Loss K. Period Profit Tax and Other Legal Liability Provision. (-) Net Profit or Loss for the PeriodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started