Answered step by step

Verified Expert Solution

Question

1 Approved Answer

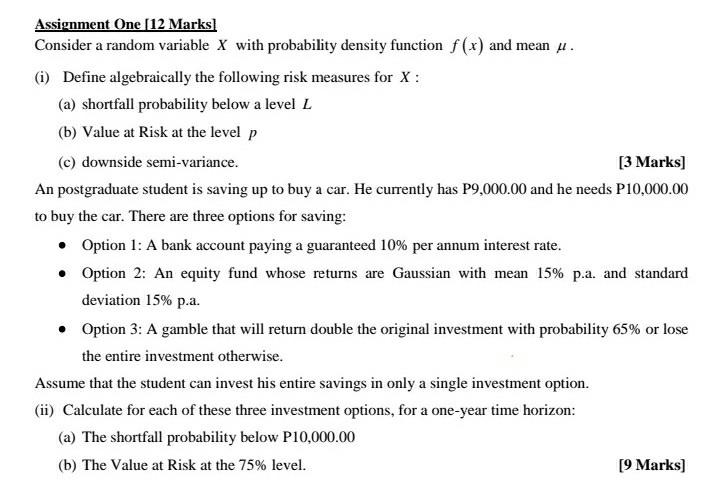

Assignment One [12 Marks] Consider a random variable X with probability density function f(x) and mean . (i) Define algebraically the following risk measures for

Assignment One [12 Marks] Consider a random variable X with probability density function f(x) and mean . (i) Define algebraically the following risk measures for X: (a) shortfall probability below a level L (b) Value at Risk at the level p (e) downside semi-variance. [3 Marks) An postgraduate student is saving up to buy a car. He currently has P9,000.00 and he needs P10,000.00 to buy the car. There are three options for saving: Option 1: A bank account paying a guaranteed 10% per annum interest rate. Option 2: An equity fund whose returns are Gaussian with mean 15% p.a. and standard deviation 15% p.a. Option 3: A gamble that will return double the original investment with probability 65% or lose the entire investment otherwise. Assume that the student can invest his entire savings in only a single investment option. (ii) Calculate for each of these three investment options, for a one-year time horizon: (a) The shortfall probability below P10,000.00 (b) The Value at Risk at the 75% level. [9 Marks] Assignment One [12 Marks] Consider a random variable X with probability density function f(x) and mean . (i) Define algebraically the following risk measures for X: (a) shortfall probability below a level L (b) Value at Risk at the level p (e) downside semi-variance. [3 Marks) An postgraduate student is saving up to buy a car. He currently has P9,000.00 and he needs P10,000.00 to buy the car. There are three options for saving: Option 1: A bank account paying a guaranteed 10% per annum interest rate. Option 2: An equity fund whose returns are Gaussian with mean 15% p.a. and standard deviation 15% p.a. Option 3: A gamble that will return double the original investment with probability 65% or lose the entire investment otherwise. Assume that the student can invest his entire savings in only a single investment option. (ii) Calculate for each of these three investment options, for a one-year time horizon: (a) The shortfall probability below P10,000.00 (b) The Value at Risk at the 75% level. [9 Marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started