Answered step by step

Verified Expert Solution

Question

1 Approved Answer

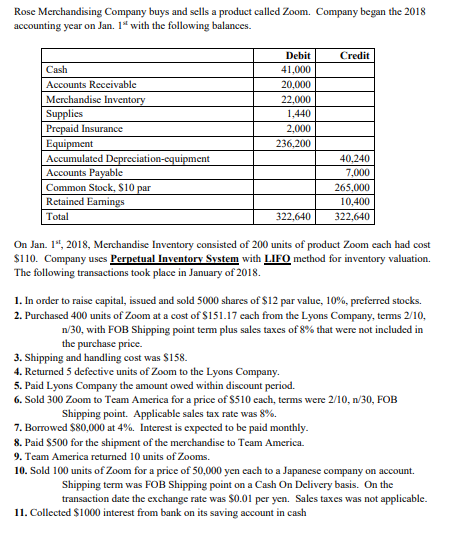

Assignment= Prepare an Adjusted Trial Balance Rose Merchandising Company buys and sells a product called Zoom. Company began the 2018 accounting year on Jan. 1

Assignment= Prepare an Adjusted Trial Balance

Rose Merchandising Company buys and sells a product called Zoom. Company began the 2018 accounting year on Jan. 1 with the following balances. Credit Cash 41,000 20,000 22,000 1.440 2,000 236,200 Prepaid Insurance Accumulated Accounts Payable Common Stock, $10 40,240 7,000 265,000 10,400 22,640322,640 Total On Jan. 1, 2018, Merchandise Inventory consisted of 200 units of product Zoom each had cost $110. Company uses Perpetual Inventory System with LIFO method for inventory valuation. took place in January of 2018. l. In order to raise capital, issued and sold 5000 shares of $12 par value, 10%, preferred stocks. 2. Purchased 400 units of Zoom at a cost of $151.17 each from the Lyons Company, terms 2/10, n/30, with FOB Shipping point term plus sales taxes of 8% that were not included in the purchase price. 3. Shipping and handling cost was $158 4. Returned 5 defective units of Zoom to the Lyons Company. 5. Paid Lyons Company the amount owed within discount period. 6. Sold 300 Zoom to Team America for a price of $510 each, terms were 2/10, n/30, FOB Shipping point. Applicable sales tax rate was 8%. 7. Borrowed $80,000 at 4%. Interest is expected to be paid monthly. 8. Paid S500 for the shipment of the merchandise to Team America. 9. Team America returned 10 units of Zooms. 10. Sold 100 units of Zoom for a price of 50,000 yen each to a Japanese company on account. Shipping term was FOB Shipping point on a Cash On Delivery basis. transaction date the On the exchange rate was $0.01 per yen. 11. Collected $1000 interest from bank on its saving account in cashStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started