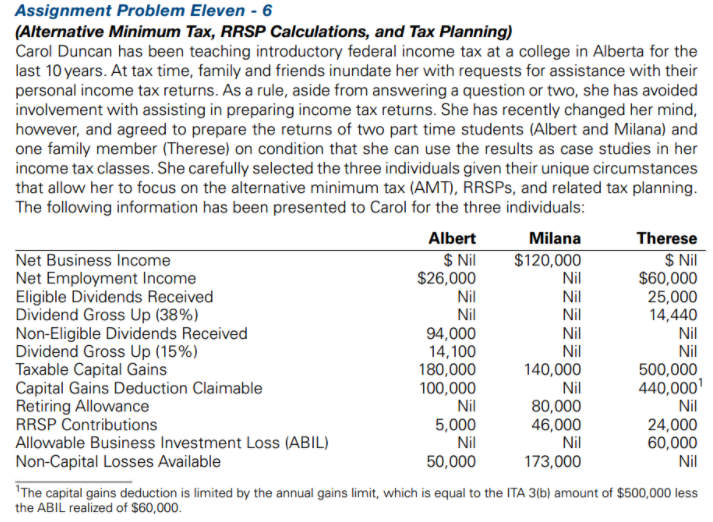

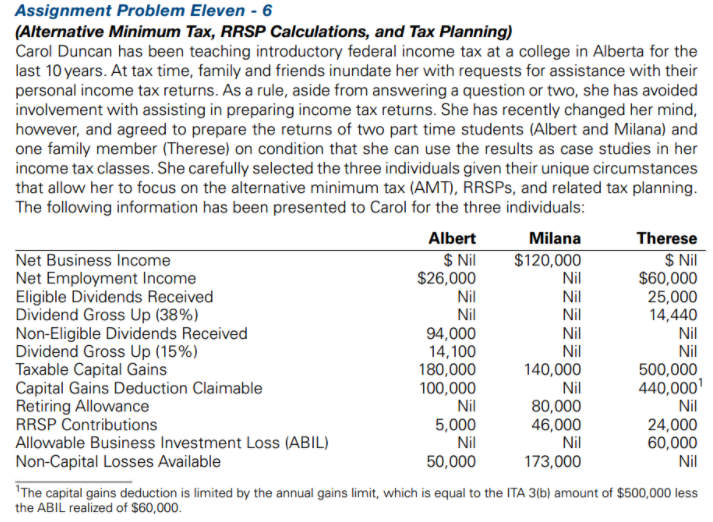

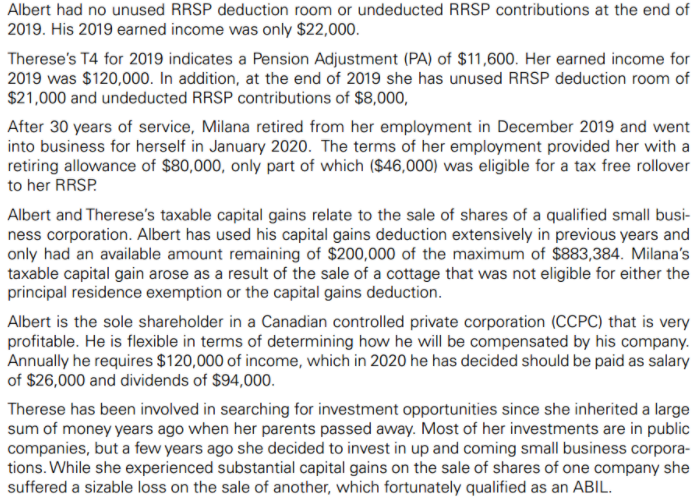

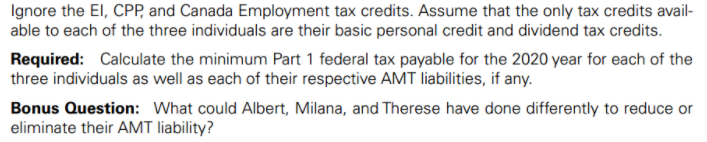

Assignment Problem Eleven - 6 (Alternative Minimum Tax, RRSP Calculations, and Tax Planning) Carol Duncan has been teaching introductory federal income tax at a college in Alberta for the last 10 years. At tax time, family and friends inundate her with requests for assistance with their personal income tax returns. As a rule, aside from answering a question or two, she has avoided involvement with assisting in preparing income tax returns. She has recently changed her mind, however, and agreed to prepare the returns of two part time students (Albert and Milana) and one family member (Therese) on condition that she can use the results as case studies in her income tax classes. She carefully selected the three individuals given their unique circumstances that allow her to focus on the alternative minimum tax (AMT), RRSPs, and related tax planning. The following information has been presented to Carol for the three individuals: Albert Milana Therese Net Business Income $ Nil $120,000 $ Nil Net Employment Income $26,000 Nil $60,000 Eligible Dividends Received Nil Nil 25,000 Dividend Gross Up (38%) Nil Nil 14,440 Non-Eligible Dividends Received 94,000 Nil Nil Dividend Gross Up (15%) 14,100 Nil Nil Taxable Capital Gains 180,000 140,000 500,000 Capital Gains Deduction Claimable 100,000 Nil 440,000 Retiring Allowance Nil 80,000 Nil RRSP Contributions 5,000 46,000 24,000 Allowable Business Investment Loss (ABIL) Nil Nil 60,000 Non-Capital Losses Available 50,000 173,000 Nil The capital gains deduction is limited by the annual gains limit, which is equal to the ITA 3(b) amount of $500,000 less the ABIL realized of $60,000. Albert had no unused RRSP deduction room or undeducted RRSP contributions at the end of 2019. His 2019 earned income was only $22,000. Therese's T4 for 2019 indicates a Pension Adjustment (PA) of $11,600. Her earned income for 2019 was $120,000. In addition, at the end of 2019 she has unused RRSP deduction room of $21,000 and undeducted RRSP contributions of $8,000, After 30 years of service, Milana retired from her employment in December 2019 and went into business for herself in January 2020. The terms of her employment provided her with a retiring allowance of $80,000, only part of which ($46,000) was eligible for a tax free rollover to her RRSP Albert and Therese's taxable capital gains relate to the sale of shares of a qualified small busi- ness corporation. Albert has used his capital gains deduction extensively in previous years and only had an available amount remaining of $200,000 of the maximum of $883,384. Milana's taxable capital gain arose as a result of the sale of a cottage that was not eligible for either the principal residence exemption or the capital gains deduction. Albert is the sole shareholder in a Canadian controlled private corporation (CCPC) that is very profitable. He is flexible in terms of determining how he will be compensated by his company. Annually he requires $120,000 of income, which in 2020 he has decided should be paid as salary of $26,000 and dividends of $94,000. Therese has been involved in searching for investment opportunities since she inherited a large sum of money years ago when her parents passed away. Most of her investments are in public companies, but a few years ago she decided to invest in up and coming small business corpora- tions. While she experienced substantial capital gains on the sale of shares of one company she suffered a sizable loss on the sale of another, which fortunately qualified as an ABIL. Ignore the EI, CPP, and Canada Employment tax credits. Assume that the only tax credits avail- able to each of the three individuals are their basic personal credit and dividend tax credits. Required: Calculate the minimum Part 1 federal tax payable for the 2020 year for each of the three individuals as well as each of their respective AMT liabilities, if any. Bonus Question: What could Albert, Milana, and Therese have done differently to reduce or eliminate their AMT liability? Assignment Problem Eleven - 6 (Alternative Minimum Tax, RRSP Calculations, and Tax Planning) Carol Duncan has been teaching introductory federal income tax at a college in Alberta for the last 10 years. At tax time, family and friends inundate her with requests for assistance with their personal income tax returns. As a rule, aside from answering a question or two, she has avoided involvement with assisting in preparing income tax returns. She has recently changed her mind, however, and agreed to prepare the returns of two part time students (Albert and Milana) and one family member (Therese) on condition that she can use the results as case studies in her income tax classes. She carefully selected the three individuals given their unique circumstances that allow her to focus on the alternative minimum tax (AMT), RRSPs, and related tax planning. The following information has been presented to Carol for the three individuals: Albert Milana Therese Net Business Income $ Nil $120,000 $ Nil Net Employment Income $26,000 Nil $60,000 Eligible Dividends Received Nil Nil 25,000 Dividend Gross Up (38%) Nil Nil 14,440 Non-Eligible Dividends Received 94,000 Nil Nil Dividend Gross Up (15%) 14,100 Nil Nil Taxable Capital Gains 180,000 140,000 500,000 Capital Gains Deduction Claimable 100,000 Nil 440,000 Retiring Allowance Nil 80,000 Nil RRSP Contributions 5,000 46,000 24,000 Allowable Business Investment Loss (ABIL) Nil Nil 60,000 Non-Capital Losses Available 50,000 173,000 Nil The capital gains deduction is limited by the annual gains limit, which is equal to the ITA 3(b) amount of $500,000 less the ABIL realized of $60,000. Albert had no unused RRSP deduction room or undeducted RRSP contributions at the end of 2019. His 2019 earned income was only $22,000. Therese's T4 for 2019 indicates a Pension Adjustment (PA) of $11,600. Her earned income for 2019 was $120,000. In addition, at the end of 2019 she has unused RRSP deduction room of $21,000 and undeducted RRSP contributions of $8,000, After 30 years of service, Milana retired from her employment in December 2019 and went into business for herself in January 2020. The terms of her employment provided her with a retiring allowance of $80,000, only part of which ($46,000) was eligible for a tax free rollover to her RRSP Albert and Therese's taxable capital gains relate to the sale of shares of a qualified small busi- ness corporation. Albert has used his capital gains deduction extensively in previous years and only had an available amount remaining of $200,000 of the maximum of $883,384. Milana's taxable capital gain arose as a result of the sale of a cottage that was not eligible for either the principal residence exemption or the capital gains deduction. Albert is the sole shareholder in a Canadian controlled private corporation (CCPC) that is very profitable. He is flexible in terms of determining how he will be compensated by his company. Annually he requires $120,000 of income, which in 2020 he has decided should be paid as salary of $26,000 and dividends of $94,000. Therese has been involved in searching for investment opportunities since she inherited a large sum of money years ago when her parents passed away. Most of her investments are in public companies, but a few years ago she decided to invest in up and coming small business corpora- tions. While she experienced substantial capital gains on the sale of shares of one company she suffered a sizable loss on the sale of another, which fortunately qualified as an ABIL. Ignore the EI, CPP, and Canada Employment tax credits. Assume that the only tax credits avail- able to each of the three individuals are their basic personal credit and dividend tax credits. Required: Calculate the minimum Part 1 federal tax payable for the 2020 year for each of the three individuals as well as each of their respective AMT liabilities, if any. Bonus Question: What could Albert, Milana, and Therese have done differently to reduce or eliminate their AMT liability