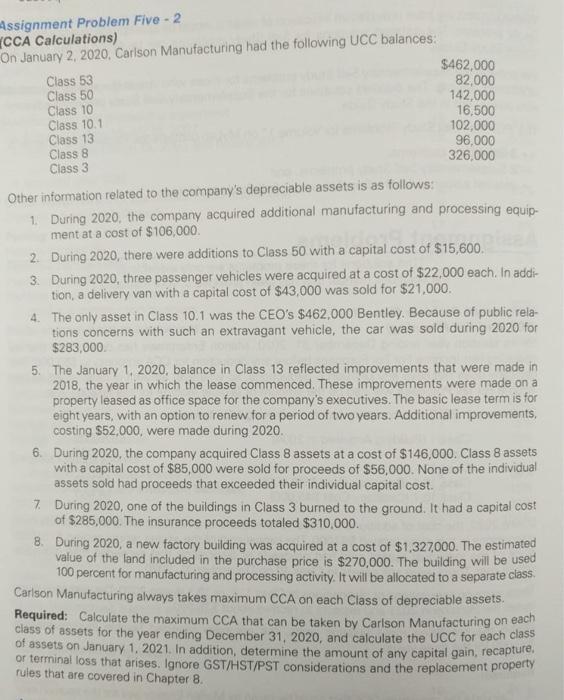

Assignment Problem Five - 2 CCA Calculations) On January 2, 2020, Carlson Manufacturing had the following UCC balances: Class 53 Class 50 Class 10 Class 10.1 Class 13 Class 8 Class 3 $462,000 82,000 142,000 16,500 102,000 96,000 326,000 Other information related to the company's depreciable assets is as follows: 1. During 2020, the company acquired additional manufacturing and processing equip- ment at a cost of $106,000 2. During 2020, there were additions to Class 50 with a capital cost of $15,600 3. During 2020, three passenger vehicles were acquired at a cost of $22,000 each. In addi tion, a delivery van with a capital cost of $43,000 was sold for $21,000 4. The only asset in Class 10.1 was the CEO's $462,000 Bentley. Because of public rela- tions concerns with such an extravagant vehicle, the car was sold during 2020 for $283,000 5. The January 1, 2020, balance in Class 13 reflected improvements that were made in 2018, the year in which the lease commenced. These improvements were made on a property leased as office space for the company's executives. The basic lease term is for eight years, with an option to renew for a period of two years. Additional improvements, costing $52,000, were made during 2020 6. During 2020, the company acquired Class 8 assets at a cost of $146,000. Class 8 assets with a capital cost of $85,000 were sold for proceeds of $56,000. None of the individual assets sold had proceeds that exceeded their individual capital cost. 7. During 2020, one of the buildings in Class 3 burned to the ground. It had a capital cost of $285,000. The insurance proceeds totaled $310,000. 8. During 2020, a new factory building was acquired at a cost of $1,327,000. The estimated value of the land included in the purchase price is $270,000. The building will be used 100 percent for manufacturing and processing activity. It will be allocated to a separate class Carlson Manutacturing always takes maximum CCA on each Class of depreciable assets. Required: Calculate the maximum CCA that can be taken by Carlson Manufacturing on each class of assets for the year ending December 31, 2020, and calculate the UCC for each class of assets on January 1, 2021. In addition, determine the amount of any capital gain, recapture, or terminal loss that arises. Ignore GST/HST/PST considerations and the replacement property rules that are covered in Chapter 8