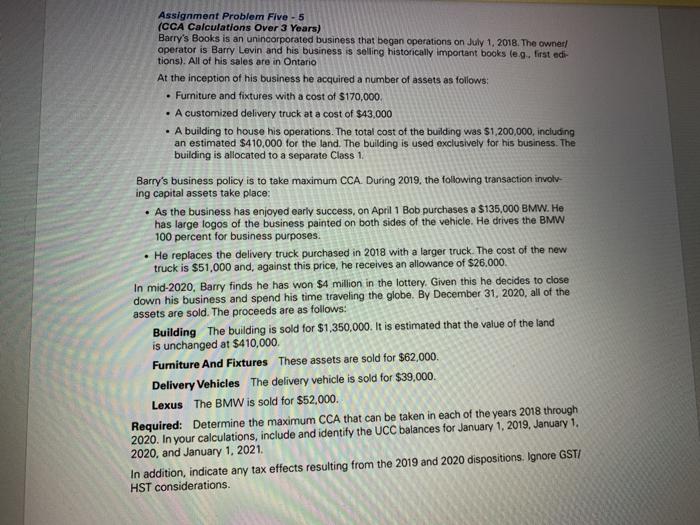

Assignment Problem Five - 5 (CCA Calculations Over 3 Years) Barry's Books is an unincorporated business that began operations on July 1, 2018. The owner/ operator is Barry Levin and his business is selling historically important books (eg. first edi- tions). All of his sales are in Ontario At the inception of his business he acquired a number of assets as follows: Furniture and fixtures with a cost of $170,000 A customized delivery truck at a cost of $43,000 . A building to house his operations. The total cost of the building was $1,200,000, including an estimated $410,000 for the land. The building is used exclusively for his business. The building is allocated to a separate Class 1, Barry's business policy is to take maximum CCA. During 2019, the following transaction involv ing capital assets take place: As the business has enjoyed early success, on April 1 Bob purchases a $135,000 BMW. He has large logos of the business painted on both sides of the vehicle. He drives the BMW 100 percent for business purposes. He replaces the delivery truck purchased in 2018 with a larger truck. The cost of the new truck is $51,000 and, against this price, he receives an allowance of $26.000 In mid-2020, Barry finds he has won $4 million in the lottery. Given this he decides to close down his business and spend his time traveling the globe. By December 31, 2020, all of the assets are sold. The proceeds are as follows: Building The building is sold for $1,350,000. It is estimated that the value of the land is unchanged at $410,000 Furniture And Fixtures These assets are sold for $62,000, Delivery Vehicles The delivery vehicle is sold for $39,000 Lexus The BMW is sold for $52,000. Required: Determine the maximum CCA that can be taken in each of the years 2018 through 2020. In your calculations, include and identify the UCC balances for January 1, 2019, January 1, 2020, and January 1, 2021. In addition, indicate any tax effects resulting from the 2019 and 2020 dispositions. Ignore GST/ HST considerations. Assignment Problem Five - 5 (CCA Calculations Over 3 Years) Barry's Books is an unincorporated business that began operations on July 1, 2018. The owner/ operator is Barry Levin and his business is selling historically important books (eg. first edi- tions). All of his sales are in Ontario At the inception of his business he acquired a number of assets as follows: Furniture and fixtures with a cost of $170,000 A customized delivery truck at a cost of $43,000 . A building to house his operations. The total cost of the building was $1,200,000, including an estimated $410,000 for the land. The building is used exclusively for his business. The building is allocated to a separate Class 1, Barry's business policy is to take maximum CCA. During 2019, the following transaction involv ing capital assets take place: As the business has enjoyed early success, on April 1 Bob purchases a $135,000 BMW. He has large logos of the business painted on both sides of the vehicle. He drives the BMW 100 percent for business purposes. He replaces the delivery truck purchased in 2018 with a larger truck. The cost of the new truck is $51,000 and, against this price, he receives an allowance of $26.000 In mid-2020, Barry finds he has won $4 million in the lottery. Given this he decides to close down his business and spend his time traveling the globe. By December 31, 2020, all of the assets are sold. The proceeds are as follows: Building The building is sold for $1,350,000. It is estimated that the value of the land is unchanged at $410,000 Furniture And Fixtures These assets are sold for $62,000, Delivery Vehicles The delivery vehicle is sold for $39,000 Lexus The BMW is sold for $52,000. Required: Determine the maximum CCA that can be taken in each of the years 2018 through 2020. In your calculations, include and identify the UCC balances for January 1, 2019, January 1, 2020, and January 1, 2021. In addition, indicate any tax effects resulting from the 2019 and 2020 dispositions. Ignore GST/ HST considerations