Answered step by step

Verified Expert Solution

Question

1 Approved Answer

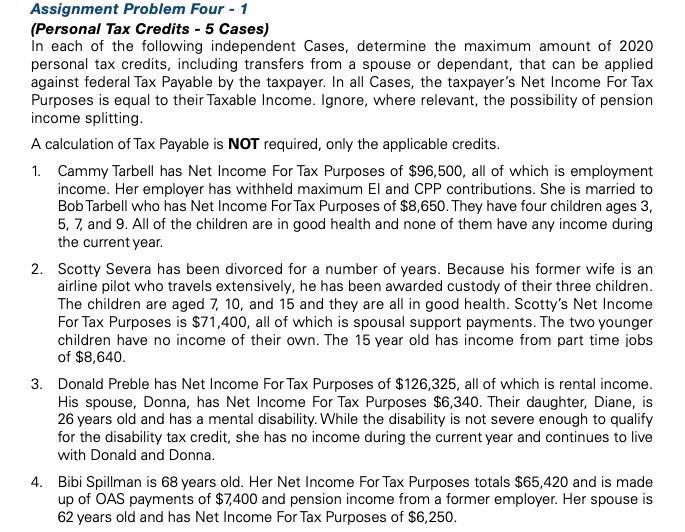

Assignment Problem Four - 1 (Personal Tax Credits - 5 Cases) In each of the following independent Cases, determine the maximum amount of 2020

Assignment Problem Four - 1 (Personal Tax Credits - 5 Cases) In each of the following independent Cases, determine the maximum amount of 2020 personal tax credits, including transfers from a spouse or dependant, that can be applied against federal Tax Payable by the taxpayer. In all Cases, the taxpayer's Net Income For Tax Purposes is equal to their Taxable Income. Ignore, where relevant, the possibility of pension income splitting. A calculation of Tax Payable is NOT required, only the applicable credits. 1. Cammy Tarbell has Net Income For Tax Purposes of $96,500, all of which is employment income. Her employer has withheld maximum El and CPP contributions. She is married to Bob Tarbell who has Net Income For Tax Purposes of $8,650. They have four children ages 3, 5, 7, and 9. All of the children are in good health and none of them have any income during the current year. 2. Scotty Severa has been divorced for a number of years. Because his former wife is an airline pilot who travels extensively, he has been awarded custody of their three children. The children are aged 7, 10, and 15 and they are all in good health. Scotty's Net Income For Tax Purposes is $71,400, all of which is spousal support payments. The two younger children have no income of their own. The 15 year old has income from part time jobs of $8,640. 3. Donald Preble has Net Income For Tax Purposes of $126,325, all of which is rental income. His spouse, Donna, has Net Income For Tax Purposes $6,340. Their daughter, Diane, is 26 years old and has a mental disability. While the disability is not severe enough to qualify for the disability tax credit, she has no income during the current year and continues to live with Donald and Donna. 4. Bibi Spillman is 68 years old. Her Net Income For Tax Purposes totals $65,420 and is made up of OAS payments of $7,400 and pension income from a former employer. Her spouse is 62 years old and has Net Income For Tax Purposes of $6,250.

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

to go to test to to PPPP 3 EI and CPP Deductions for Maximum Employee Answert Haximum Employer ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started