Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assignment Problem Six - 1 (Reserves) Olivia Smith is the owner of an unincorporated business that does landscaping. The business began operations on January

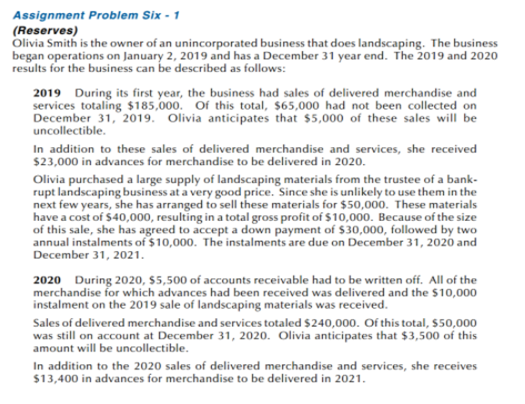

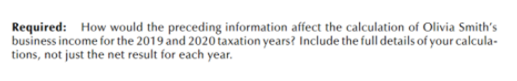

Assignment Problem Six - 1 (Reserves) Olivia Smith is the owner of an unincorporated business that does landscaping. The business began operations on January 2, 2019 and has a December 31 year end. The 2019 and 2020 results for the business can be described as follows: 2019 During its first year, the business had sales of delivered merchandise and services totaling $185,000. Of this total, $65,000 had not been collected on December 31, 2019. Olivia anticipates that $5,000 of these sales will be uncollectible. In addition to these sales of delivered merchandise and services, she received $23,000 in advances for merchandise to be delivered in 2020. Olivia purchased a large supply of landscaping materials from the trustee of a bank- rupt landscaping business at a very good price. Since she is unlikely to use them in the next few years, she has arranged to sell these materials for $50,000. These materials have a cost of $40,000, resulting in a total gross profit of $10,000. Because of the size of this sale, she has agreed to accept a down payment of $30,000, followed by two annual instalments of $10,000. The instalments are due on December 31, 2020 and December 31, 2021. 2020 During 2020, $5,500 of accounts receivable had to be written off. All of the merchandise for which advances had been received was delivered and the $10,000 instalment on the 2019 sale of landscaping materials was received. Sales of delivered merchandise and services totaled $240,000. Of this total, $50,000 was still on account at December 31, 2020. Olivia anticipates that $3,500 of this amount will be uncollectible. In addition to the 2020 sales of delivered merchandise and services, she receives $13,400 in advances for merchandise to be delivered in 2021.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started