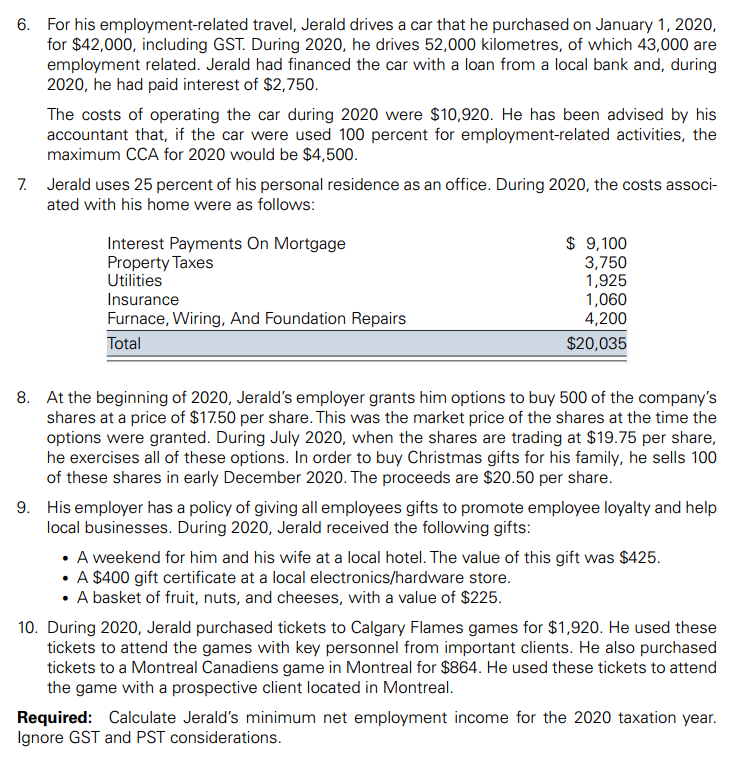

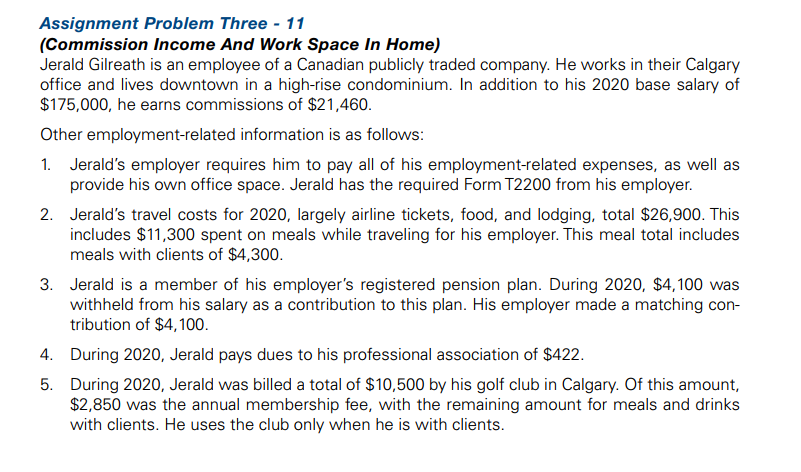

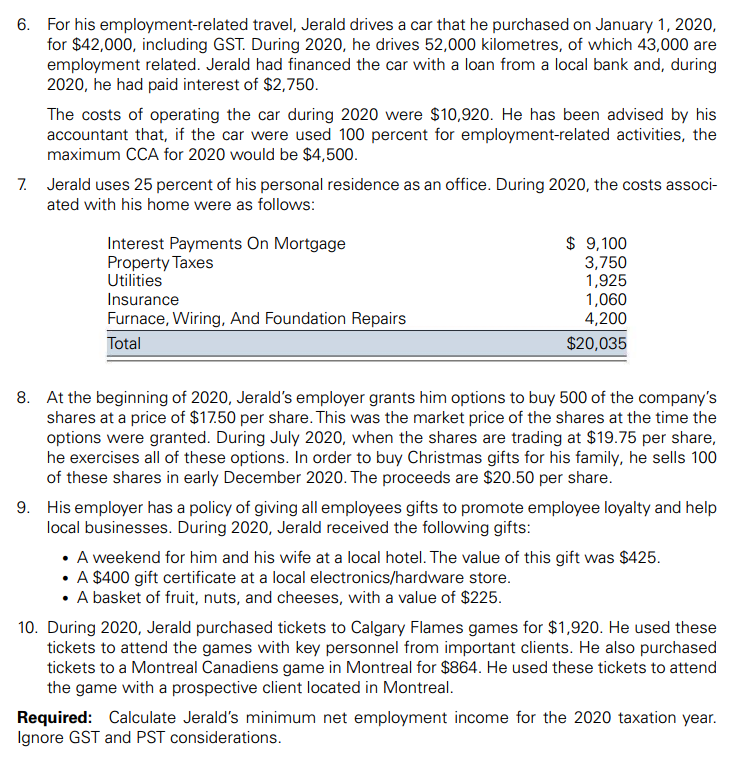

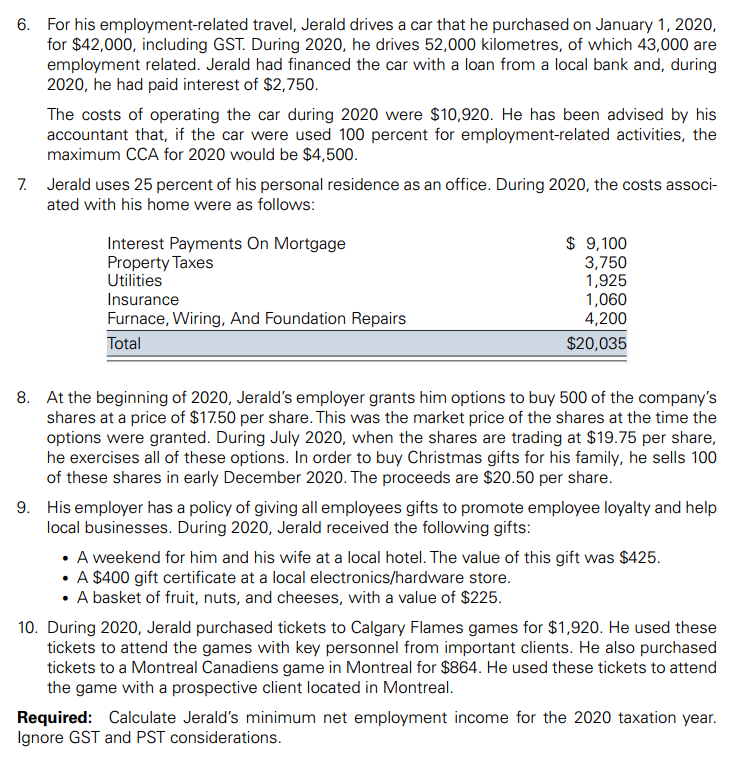

Assignment Problem Three - 11 (Commission Income And Work Space l'n Home) Jerald lGilreath is an employee of a Canadian publicly traded company. He works in their Calgary office and lives downtown in a highrise condominium. In addition to his 2020 base salary of $175,000. he earns commissions of $21,460. Other employmentrelated information is as follows: 1. Jerald's employer requires him to pay all of his employmentrelated expenses. as well as provide his own office space. Jerald has the required Form T2200 from his employer. Jerald's travel costs for 2020, largely airline tickets. food, and lodging. total $26300. This includes $11.300 spent on meals while traveling for his employer. This meal total includes meals with clients of $4.300. Jerald is a member of his employer's registered pension plan. During 2020, $4,100 was withheld from his salary as a contribution to this plan. His employer made a matching con tribution of $4.100. During 2020. Jerald pays dues to his professional association of $422. During 2020, Jerald was billed a total of $10,500 by his golf club in Calgary. Of this amount, $2.850 was the annual membership fee. with the remaining amount for meals and drinks with clients. He uses the club only when he is with clients. 6. 10. For his employmenH-elated travel, Jerald drives a car that he purchased on January 1, 2020, for $42,000, including GST. During 2020, he drives 52,000 kilometres, of which 43,000 are employment related. Jerald had financed the car with a loan from a local bank and, during 2020, he had paid interest of $2,750. The costs of operating the car during 2020 were $10,920. He has been advised by his accountant that, if the car were used 100 percent for employmentrelated activities, the maximum CCA for 2020 would be $4,500. Jerald uses 25 percent of his personal residence as an office. During 2020, the costs associ ated with his home were as follows: Interest Payments Cin Mortgage $ 9,100 PropertyTaxes 3,250 Utilities 1,925 Insurance 1,050 Furnace, Wiring, And Foundation Repairs 4,200 Total $20,035 At the beginning of 2020. Jerald's employer grants him options to buy 500 of the company's shares at a price of $1250 per share. This was the market price of the shares at the time the options were granted. During July 2020. when the shares are trading at $19.75 per share. he exercises all of these options. In order to buy Christmas gifts for his family, he sells 100 of these shares in early December 2020. The proceeds are $20.50 per share. His employer has a policy of giving all employees gifts to promote employee loyalty and help local businesses. During 2020, Jerald received the following gifts: - A weekend for him and his wife at a local hotel.The value of this gift was $425. - A $400 gift certificate at a local electronicsfhardware store. - A basket of fruit, nuts, and cheeses. with a value of $225. During 2020, Jerald purchased tickets to Calgary Flames games for $1,920. He used these tickets to attend the games with key personnel from important clients. He also purchased tickets to a Montreal Canadiens game in Montreal for $864. He used these tickets to attend the game with a prospective client located in Montreal. Required: Calculate Jerald's minimum net employment income for the 2020 taxation year. Ignore GST and PST considerations