Assignment Problem Twenty-One - 4 (Regular GST Return) Lotor Inc. (Lotor) is a Canadian controlled private corporation (CCPC) that was incorporated in Alberta in

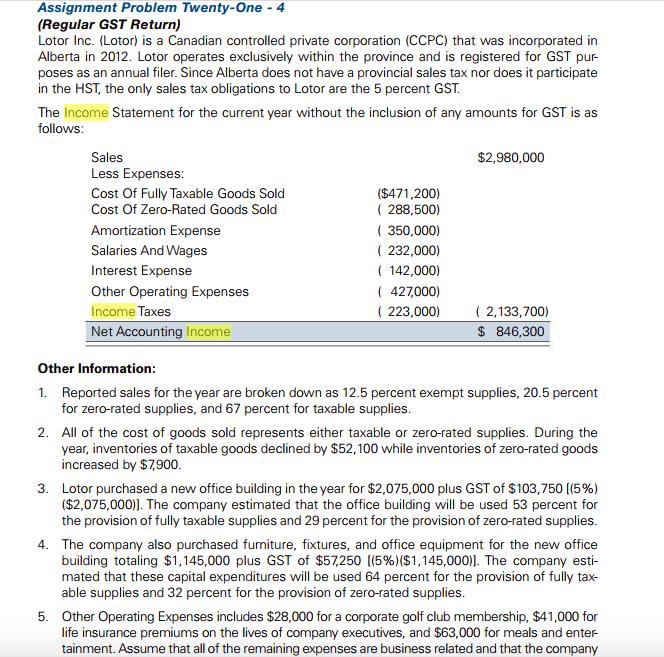

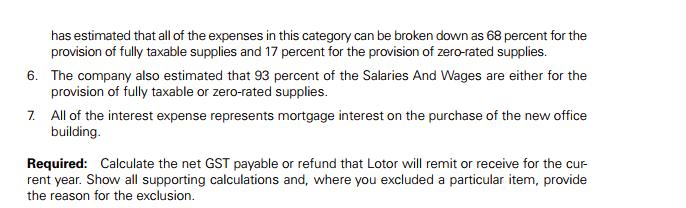

Assignment Problem Twenty-One - 4 (Regular GST Return) Lotor Inc. (Lotor) is a Canadian controlled private corporation (CCPC) that was incorporated in Alberta in 2012. Lotor operates exclusively within the province and is registered for GST pur- poses as an annual filer. Since Alberta does not have a provincial sales tax nor does it participate in the HST, the only sales tax obligations to Lotor are the 5 percent GST. The Income Statement for the current year without the inclusion of any amounts for GST is as follows: Sales Less Expenses: Cost Of Fully Taxable Goods Sold Cost Of Zero-Rated Goods Sold Amortization Expense Salaries And Wages Interest Expense Other Operating Expenses Income Taxes Net Accounting Income ($471,200) (288,500) (350,000) (232,000) ( 142,000) (427,000) (223,000) $2,980,000 (2,133,700) $ 846,300 Other Information: 1. Reported sales for the year are broken down as 12.5 percent exempt supplies, 20.5 percent for zero-rated supplies, and 67 percent for taxable supplies. 2. All of the cost of goods sold represents either taxable or zero-rated supplies. During the year, inventories of taxable goods declined by $52,100 while inventories of zero-rated goods increased by $7,900. 3. Lotor purchased a new office building in the year for $2,075,000 plus GST of $103,750 [(5%) ($2,075,000)]. The company estimated that the office building will be used 53 percent for the provision of fully taxable supplies and 29 percent for the provision of zero-rated supplies. 4. The company also purchased furniture, fixtures, and office equipment for the new office building totaling $1,145,000 plus GST of $57,250 [(5%) ($1,145,000)]. The company esti- mated that these capital expenditures will be used 64 percent for the provision of fully tax- able supplies and 32 percent for the provision of zero-rated supplies. 5. Other Operating Expenses includes $28,000 for a corporate golf club membership, $41,000 for life insurance premiums on the lives of company executives, and $63,000 for meals and enter- tainment. Assume that all of the remaining expenses are business related and that the company has estimated that all of the expenses in this category can be broken down as 68 percent for the provision of fully taxable supplies and 17 percent for the provision of zero-rated supplies. 6. The company also estimated that 93 percent of the Salaries And Wages are either for the provision of fully taxable or zero-rated supplies. 7. All of the interest expense represents mortgage interest on the purchase of the new office building. Required: Calculate the net GST payable or refund that Lotor will remit or receive for the cur- rent year. Show all supporting calculations and, where you excluded a particular item, provide the reason for the exclusion.

Step by Step Solution

3.51 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Net GST payable total GST payable total ITCs Total GST payable 125 x 2980000 67 x 2980000 5 x 207500...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started