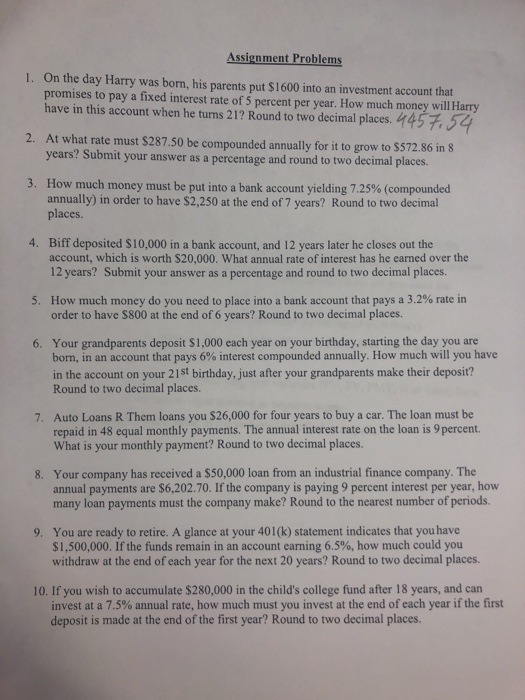

Assignment Problems 1. On the day Harry was born, his parents put $1600 into an investment account that promises to pay a fixed interest rate of 5 percent per year. How much money will Harry have in this account when he turms 21? Round to two decimal places. 4457 5 At what rate must $287.50 be compounded annually for it to grow to $572.86 in 8 years? Submit your answer as a percentage and round to two decimal places. 2. How much money must be put into a bank account yielding 7.25% (compounded annually) in order to have $2,250 at the end of 7 years? Round to two decimal places 3, 4. Biff deposited $10,000 in a bank account, and 12 years later he closes out the account, which is worth $20,000. What annual rate of interest has he earned over the 12 years? Submit your answer as a percentage and round to two decimal places. How much money do you need to place into a bank account that pays a 3.2% rate in order to have $800 at the end of 6 years? Round to two decimal places. 5, Your grandparents deposit $1,000 each year on your birthday, starting the day you are born, in an account that pays 6% interest compounded annually. How much will you have in the account on your 21st birthday, just after your grandparents make their deposit? Round to two decimal places. 6. Auto Loans R Them loans you $26,000 for four years to buy a car. The loan must be repaid in 48 equal monthly payments. The annual interest rate on the loan is 9percent. What is your monthly payment? Round to two decimal places. 7. Your company has received a $50,000 loan from an industrial finance company. The annual payments are $6,202.70. If the company is paying 9 percent interest per year, how many loan payments must the company make? Round to the nearest number of periods. 8. You are ready to retire. A glance at your 401(k) statement indicates that you have $1,500,000. If the funds remain in an account earning 6.5%, how much could you withdraw at the end of each year for the next 20 years? Round to two decimal places. 9. 10. If you wish to accumulate $280,000 in the child's college fund after 18 years, and can invest at a 7.5% annual rate, how much must you invest at the end of each year if the first deposit is made at the end of the first year? Round to two decimal places