Assignment question 1

Case study - Cloud 9

Part 1 - Materiality

W&S Partners commenced planning the Cloud 9 audit by gaining an understanding of the client's structure and its business environment. A major task is to consider the concept of materiality as it applies to the client. The auditor will design procedures in order to identify and correct errors or irregularities that would have a material effect on the financial report and affect the decision making of the users of the financial report. Materiality is used in determining audit procedures and sample selections, and evaluating differences from client records to audit results. It is the maximum amount of misstatement, individually or in aggregate, that can be accepted in the financial report. In selecting the base figure to be used to calculate materiality, an auditor should consider the key drivers of the business. They should ask, 'What are the end users (that is, shareholders, banks etc.) of the accounts going to be looking at?' For example, will shareholders be interested in profit figures that can be used to pay dividends and increase share price?

W&S Partners' audit methodology dictates that one planning materiality (PM) amount is to be used for the financial report as a whole (that is, rather than separate PMs for the income statement and the balance sheet). Further, only one basis should be selected ? a blended approach or average should not be used. The basis selected is the one determined to be the key driver of the business.

W&S Partners use the following percentages as starting points for the various bases:

These starting points can be increased or decreased by taking into account qualitative client factors, which could be:

? the nature of the client's business and industry (for example, rapidly changing, either through growth or downsizing, or an unstable environment)

? if the client is a listed entity (or subsidiary of) subject to regulations

? the knowledge of or high risk of fraud.

Typically, profit before tax is used; however, it cannot be used if reporting a loss for the year, if profitability is impacted significantly by 'one off' adjustments or transactions, or if the users of the financial report are not basing their investment (or other) decisions on a profit basis.

When calculating PM based on interim figures, it may be necessary to annualise the results. This allows the auditor to plan the audit properly based on an approximate projected year-end balance. Then, at year-end, the figure is adjusted, if necessary, to reflect the actual results.

Required

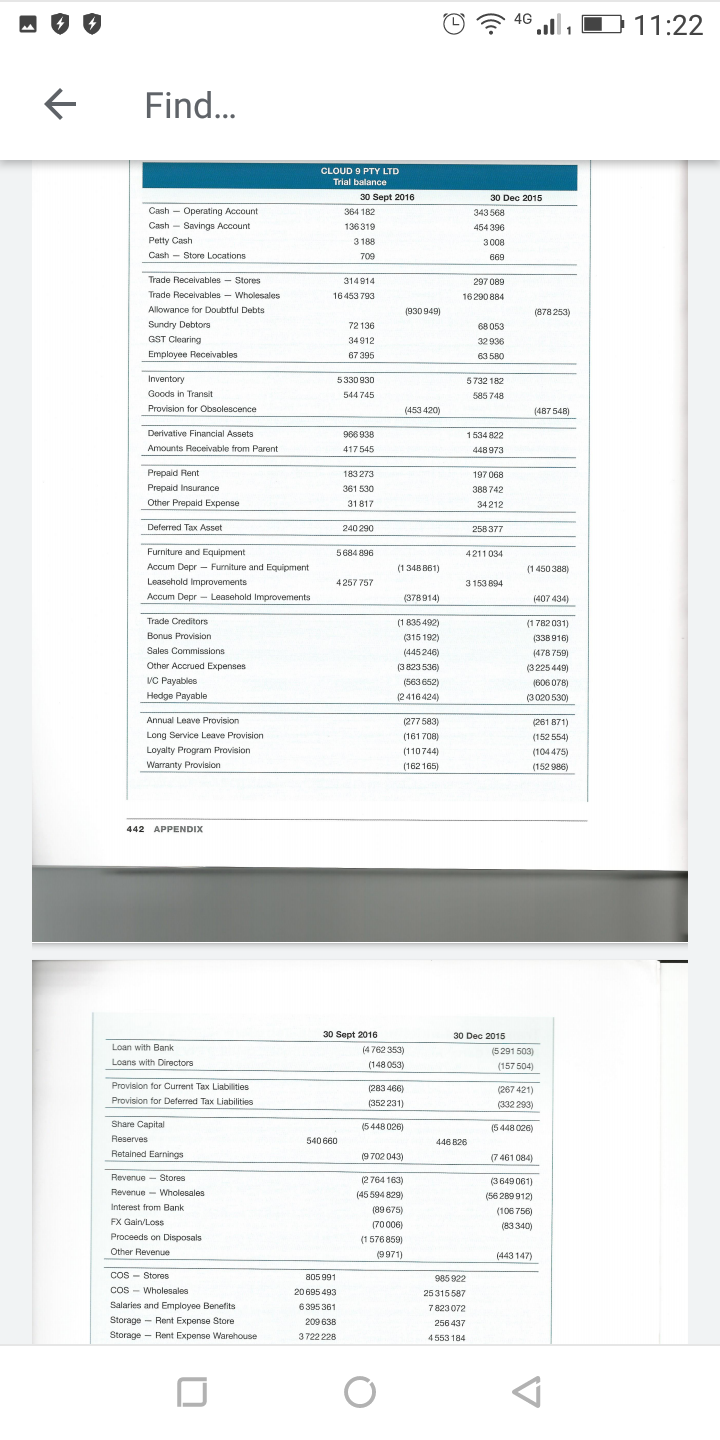

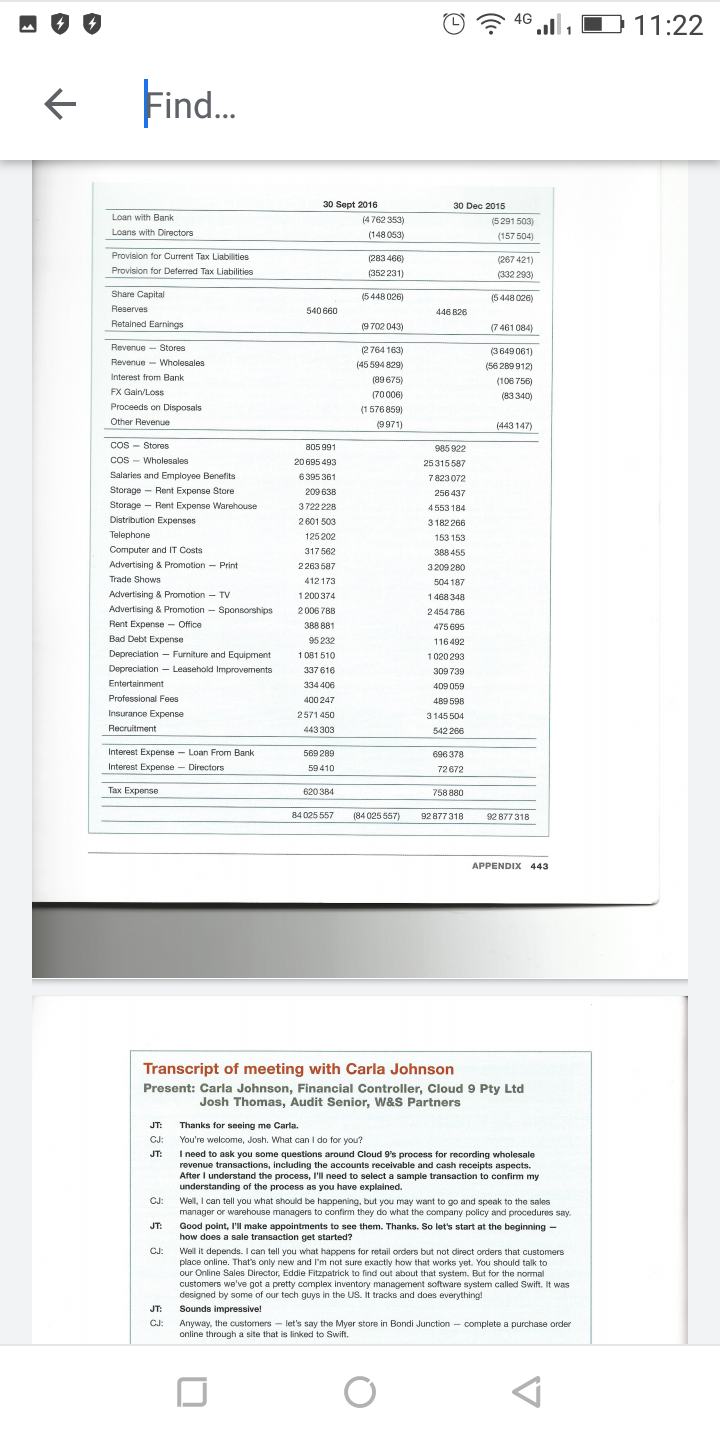

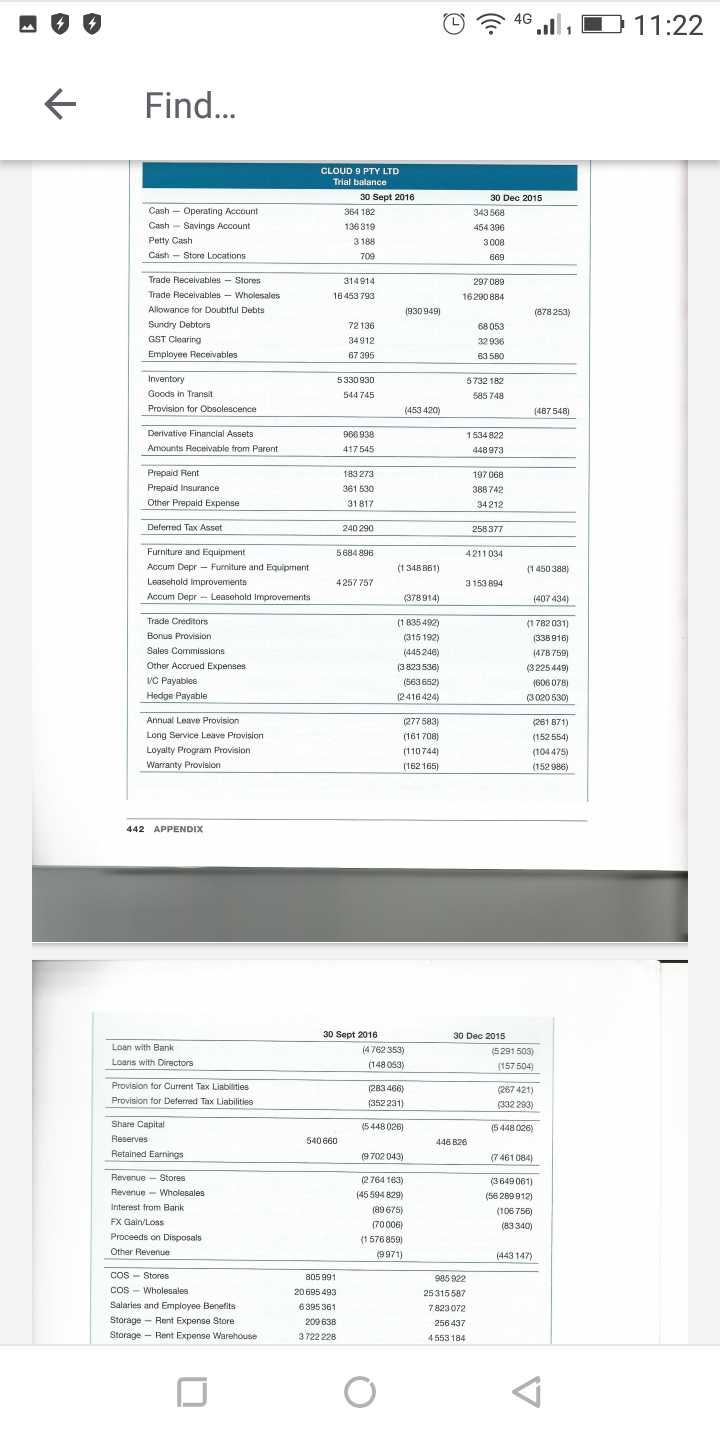

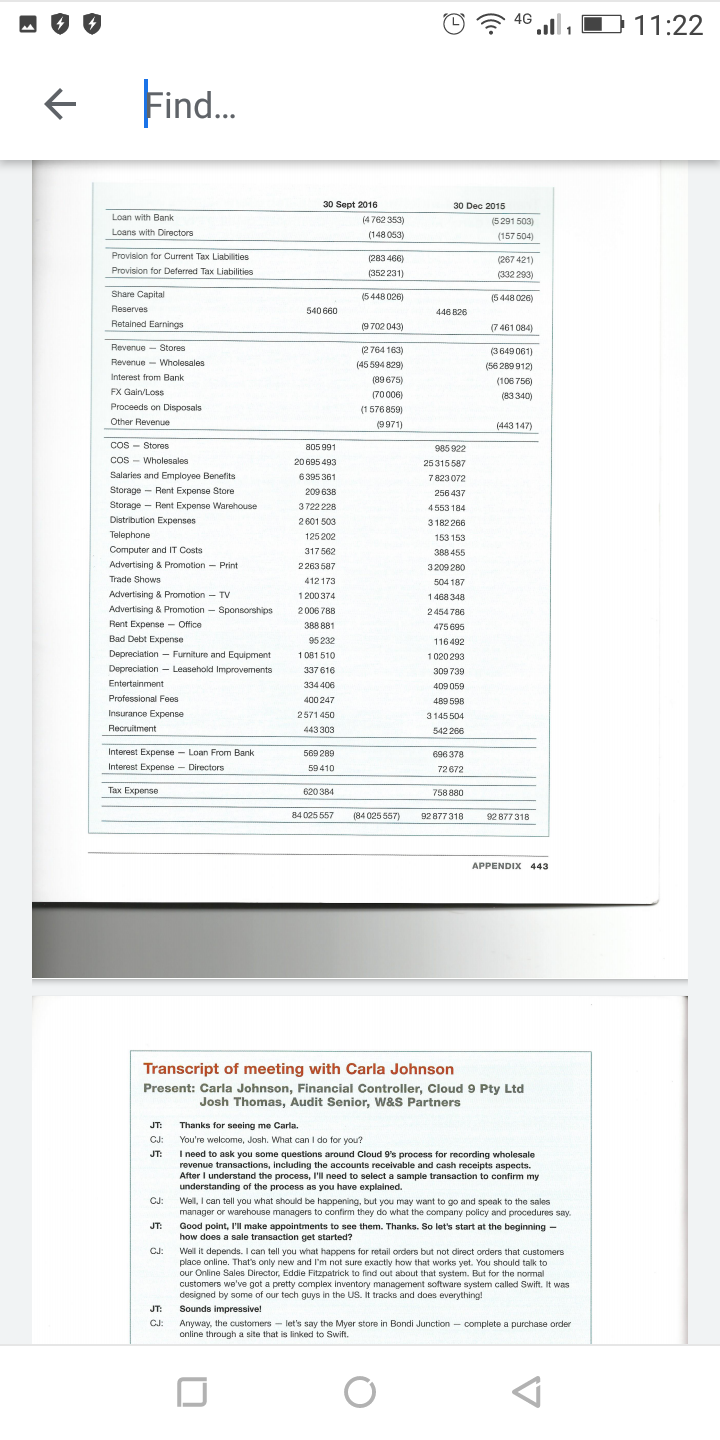

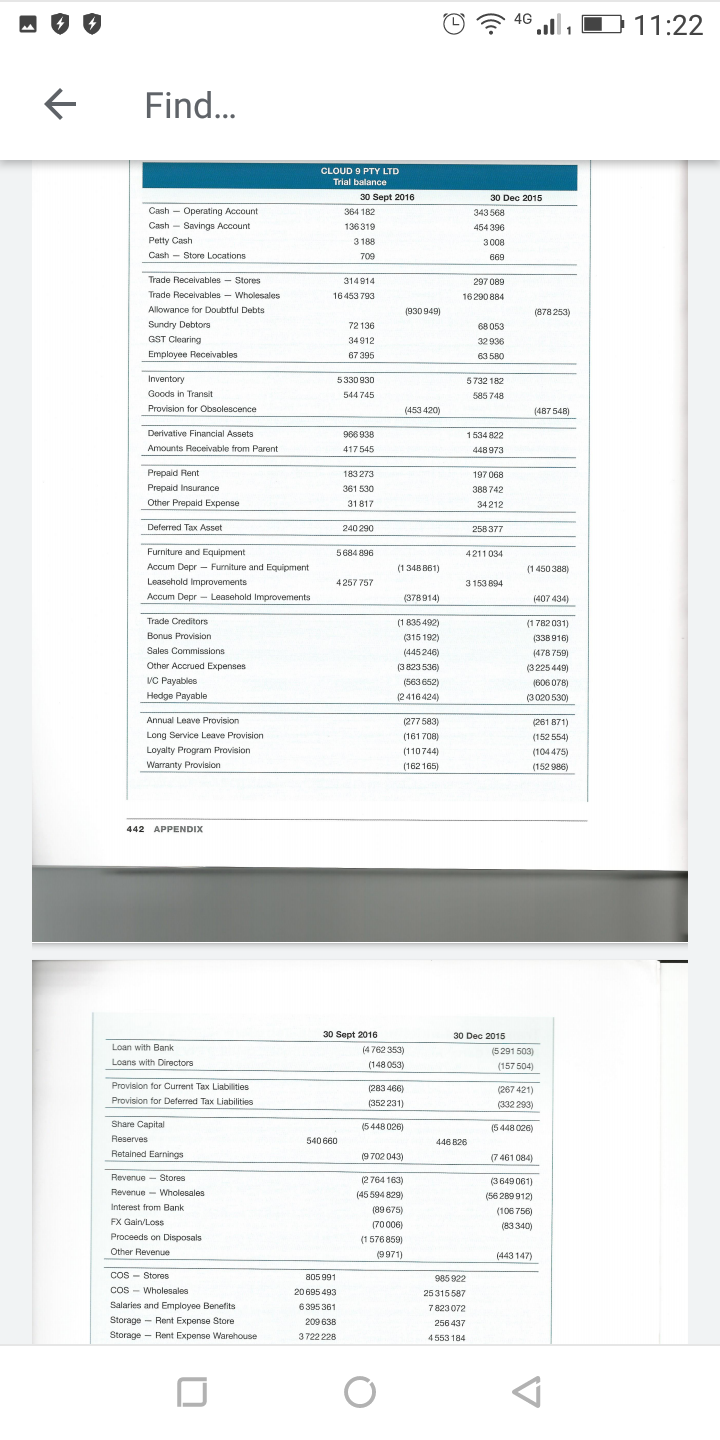

Using the 30 September 2016 trial balance (in the appendix to this text), calculate planning materiality and include the justification for the basis that you have used for your calculation.

When you are answering the question, you should refer to the information presented for Cloud 9 in the appendix to this text and in the current and earlier chapters. You should also consider your answers to the case study questions in earlier chapter

L 4G all. 011:22 Find... CLOUD 9 PTY LTD Trial balance 30 Sept 2016 30 Dec 2015 Cash - Operating Account 364 182 343 568 Cash - Savings Account 136 319 454 396 Petty Cash 3 188 3008 Cash - Store Locations 709 869 Trade Receivables - Stores 314914 297 089 Trade Receivables - Wholesales 16 453 793 16 290 884 Allowance for Doubtful Debts 930 949) (878 253) Sundry Debtors 72 136 68 053 GST Clearing 34912 32 936 Employee Receivables 37 395 3580 Inventory 5330 930 5 732 182 Goods in Transit 544 745 585 748 Provision for Obsolescence (453 420) (487 548) Derivative Financial Assets 966 938 1 534 822 Amounts Receivable from Parent 417 545 448 973 Prepaid Rent 183 273 197 068 Prepaid Insurance 361 530 388 742 Other Prepaid Expense 31 817 34 212 Deferred Tax Asset 240 290 258 377 Furniture and Equipment 5 684 896 4 211 034 Accum Depr - Furniture and Equipment (1 346 861) (1 450 388) Leasehold Improvements 4 257 757 3 153 694 Accum Depr - Leasehold Improvements (378 914) (407 434) Trade Creditors (1 835 492) (1 782 031) Bonus Provision (315 192) (336 916) Sales Commissions (445246) (478 759) Other Accrued Expenses (3 823 536) (3225 449) VC Payables (563 652) (606 078) Hedge Payable (2416 424) (3 020 530) Annual Leave Provision (277 583) 261 871) Long Service Leave Provision (161708) (152 554) Loyalty Program Provision (110744) (104 475) Warranty Provision (162 165) (152 986) 442 APPENDIX 30 Sept 2016 30 Dec 2015 Loan with Bank (4 762 353) (5 291 503) Loans with Directors (148 053) (157 504) Provision for Current Tax Liabilities (283 466) (267 421) Provision for Deferred Tax Liabilities (352 231) (332 293) Share Capital (5 448 026) (5 448 026) Reserves 540 660 446 826 Retained Earnings (9 702 043) (7 461 084) Revenue - Stores (2 764 163) (3 649 061) Revenue - Wholesales (45 594 829) (56 269 912) Interest from Bank (89 675) (106 756) FX Gain/Loss (70 006) (83 340) Proceeds on Disposals (1 576 859) Other Revenue (9 971) (443 147) COS - Stores 805 891 985 922 COS - Wholesales 20 695 493 25 315 587 Salaries and Employee Benefits 6 395 361 7 823 072 Storage - Rent Expense Store 209 638 256 437 Storage - Rent Expense Warehouse 3 722 228 4 553 184 OL 4G all, 011:22 Find .. 30 Sept 2016 30 Dec 2015 Loan with Bank (4 762 353) (5 291 503) Loans with Directors (148 053) (157 504) Provision for Current Tax Liabilities (283 466) (267 421) Provision for Deferred Tax Liabilities 352 231} (332 293) Share Capital (5 448 026) (5 448 026) Reserves 540 660 446 626 Retained Earnings (9 702 043) 7 461 084) Revenue - Stores (2 764 163) (3649 061) Revenue - Wholesales (45 594 829) (56 269 912) Interest from Bank (89 675) (106 756) FX Gain/Loss (70 006) (83 340) Proceeds on Disposals (1 576 859) Other Revenue (9 971) (443 147) COS - Stores 805 991 905 922 COS - Wholesales 20 695 493 25 315 587 Salaries and Employee Benefits 6 395 361 7 823 072 Storage - Rent Expense Store 209 636 256 437 Storage - Rent Expense Warehouse 3 722 228 4 553 184 Distribution Expenses 2 601 503 3 182 266 Telephone 125 202 153 153 Computer and IT Costs 317 562 388 455 Advertising & Promotion - Print 2 263 587 3 209 280 Trade Shows 412173 504 187 Advertising & Promotion - TV 1 200 374 1 468 348 Advertising & Promotion - Sponsorships 2006 78B 2 454 786 Rent Expense - Office 388 881 475 695 Bad Debt Expense 95 232 116 492 Depreciation - Furniture and Equipment 1 081 510 1020 293 Depreciation - Leasehold Improvements 337 616 309 739 Entertainment 334 406 409 059 Professional Fees 400 247 489 598 Insurance Expense 2571 450 3145 504 Recruitment 443 303 542 266 Interest Expense - Loan From Bank 569 289 896 378 Interest Expense - Directors 59 410 72 672 Tax Expense 620 384 758 880 84 025 557 (84 025 557) 92877 318 $2 877 318 APPENDIX 443 Transcript of meeting with Carla Johnson Present: Carla Johnson, Financial Controller, Cloud 9 Pty Ltd Josh Thomas, Audit Senior, W&S Partners IT: Thanks for seeing me Carla. CJ: You're welcome, Josh. What can I do for you? JT: I need to ask you some questions around Cloud 9's process for recording wholesale revenue transactions, including the accounts receivable and cash receipts aspects. After I understand the process, I'll need to select a sample transaction to confirm my understanding of the process as you have explained. CJ Well, I can tell you what should be happening, but you may want to go and speak to the sales manager or warehouse ma jers to confirm they do what the company policy and procedures say. JT: Good point, I'll make appointments to see them. Thanks. So let's start at the beginning - how does a sale transaction get started? Well it depends. I can tell you what happens for retail orders but not direct orders that customers place online. That's only new and I'm not sure exactly how that works yet. You should talk to our Online Sales Director, Eddie Fitzpatrick to find out about that system. But for the normal customers we've got a pretty complex inventory management software system called Swift. It was designed by some of our tech guys in the US. It tracks and does everything! JT: Sounds impressive! Anyway, the customers - let's say the Myer store in Bondi Junction - complete a purchase order online through a site that is linked to Swift. O