Answered step by step

Verified Expert Solution

Question

1 Approved Answer

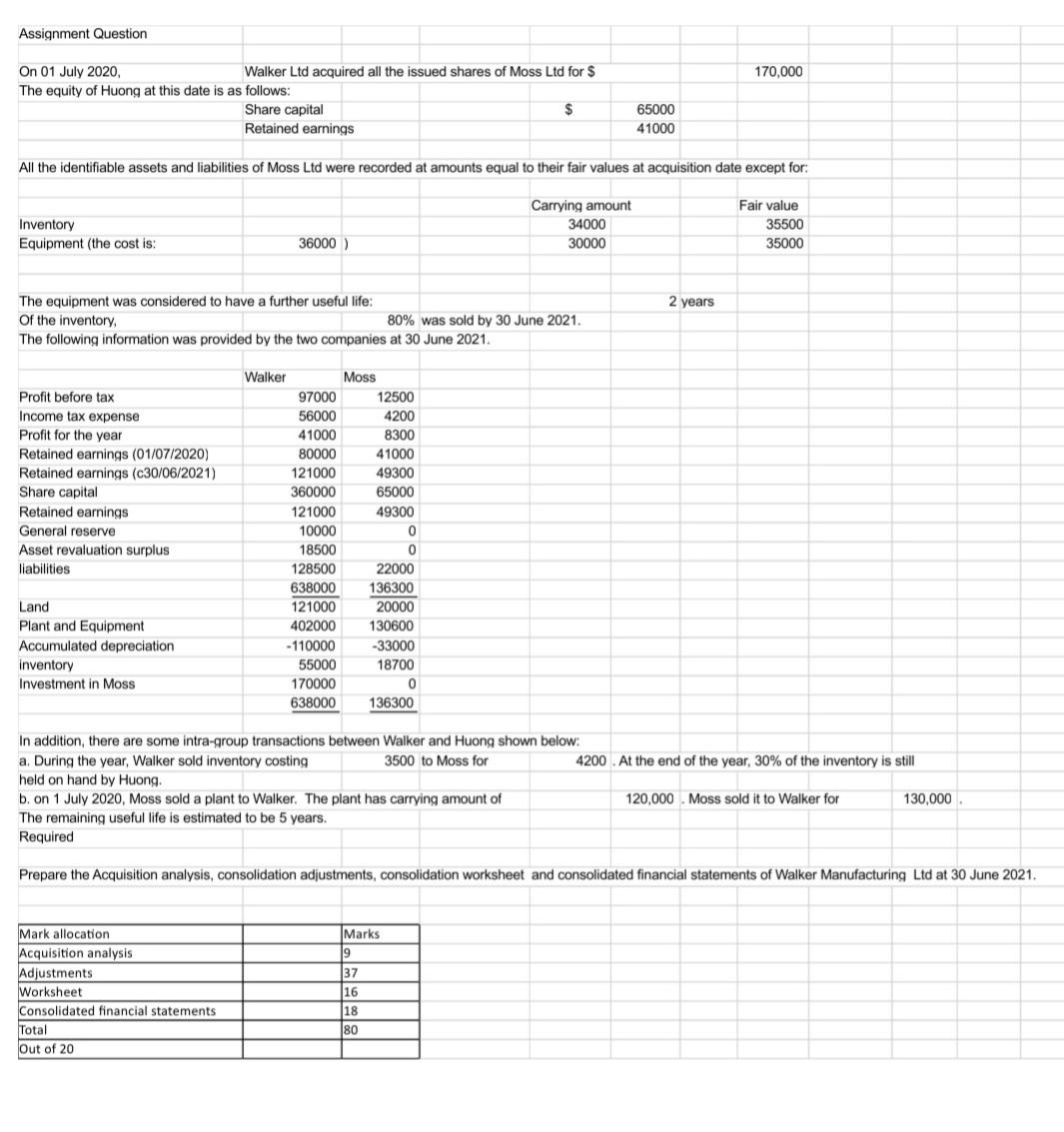

Assignment Question 170,000 On 01 July 2020, Walker Ltd acquired all the issued shares of Moss Ltd for $ The equity of Huong at this

Assignment Question 170,000 On 01 July 2020, Walker Ltd acquired all the issued shares of Moss Ltd for $ The equity of Huong at this date is as follows: Share capital $ Retained earnings 65000 41000 All the identifiable assets and liabilities of Moss Ltd were recorded at amounts equal to their fair values at acquisition date except for: Inventory Equipment (the cost is: Carrying amount 34000 30000 Fair value 35500 35000 36000) 2 years The equipment was considered to have a further useful life: of the inventory 80% was sold by 30 June 2021. The following information was provided by the two companies at 30 June 2021. Profit before tax Income tax expense Profit for the year Retained earnings (01/07/2020) Retained earnings (c30/06/2021) Share capital Retained earnings General reserve Asset revaluation surplus liabilities Walker Moss 97000 12500 56000 4200 41000 8300 80000 41000 121000 49300 360000 65000 121000 49300 10000 0 18500 0 128500 22000 638000 136300 121000 20000 402000 130600 -110000 -33000 55000 18700 170000 0 638000 136300 Land Plant and Equipment Accumulated depreciation inventory Investment in Moss In addition, there are some intra-group transactions between Walker and Huong shown below: a. During the year, Walker sold inventory costing 3500 to Moss for 4200. At the end of the year, 30% of the inventory is still held on hand by Huong. b. on 1 July 2020, Moss sold a plant to Walker. The plant has carrying amount of 120,000 . Moss sold it to Walker for 130,000 The remaining useful life is estimated to be 5 years. Required Prepare the Acquisition analysis, consolidation adjustments, consolidation worksheet and consolidated statements of Manufacturing Ltd at 30 June 021. Marks Mark allocation Acquisition analysis Adjustments Worksheet Consolidated financial statements Total Out of 20 19 37 16 18 80 Assignment Question 170,000 On 01 July 2020, Walker Ltd acquired all the issued shares of Moss Ltd for $ The equity of Huong at this date is as follows: Share capital $ Retained earnings 65000 41000 All the identifiable assets and liabilities of Moss Ltd were recorded at amounts equal to their fair values at acquisition date except for: Inventory Equipment (the cost is: Carrying amount 34000 30000 Fair value 35500 35000 36000) 2 years The equipment was considered to have a further useful life: of the inventory 80% was sold by 30 June 2021. The following information was provided by the two companies at 30 June 2021. Profit before tax Income tax expense Profit for the year Retained earnings (01/07/2020) Retained earnings (c30/06/2021) Share capital Retained earnings General reserve Asset revaluation surplus liabilities Walker Moss 97000 12500 56000 4200 41000 8300 80000 41000 121000 49300 360000 65000 121000 49300 10000 0 18500 0 128500 22000 638000 136300 121000 20000 402000 130600 -110000 -33000 55000 18700 170000 0 638000 136300 Land Plant and Equipment Accumulated depreciation inventory Investment in Moss In addition, there are some intra-group transactions between Walker and Huong shown below: a. During the year, Walker sold inventory costing 3500 to Moss for 4200. At the end of the year, 30% of the inventory is still held on hand by Huong. b. on 1 July 2020, Moss sold a plant to Walker. The plant has carrying amount of 120,000 . Moss sold it to Walker for 130,000 The remaining useful life is estimated to be 5 years. Required Prepare the Acquisition analysis, consolidation adjustments, consolidation worksheet and consolidated statements of Manufacturing Ltd at 30 June 021. Marks Mark allocation Acquisition analysis Adjustments Worksheet Consolidated financial statements Total Out of 20 19 37 16 18 80

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started