Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assignment question: Can you please calculate the indirect cost allocation or overhead costing for each product category, using the following 2 methods: A- Based on

Assignment question:

Can you please calculate the indirect cost allocation or overhead costing for each product category, using the following 2 methods:

A- Based on amount of material used

B- Based on time or machine hours ?

Please compare,

Thank you very much

Case study- Sapphire Textile Mills Limited: Refined Costing. Additional info if needed:

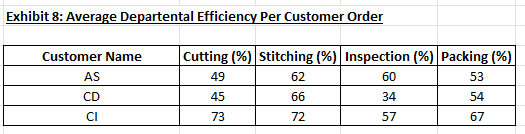

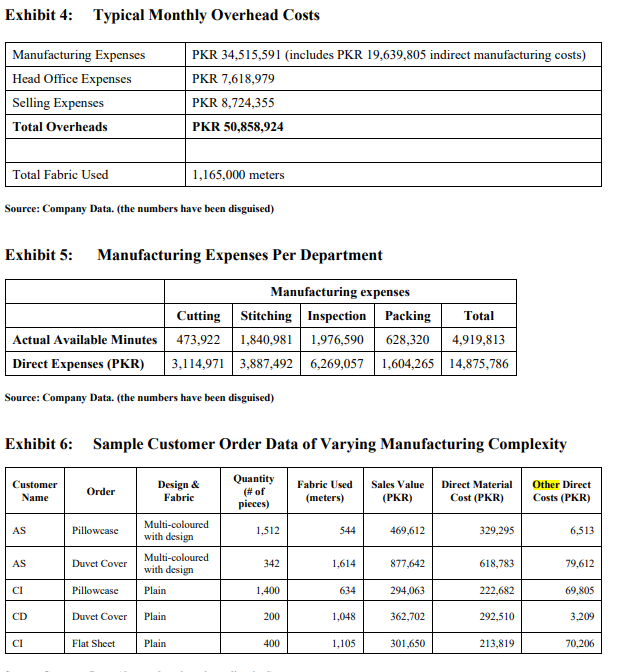

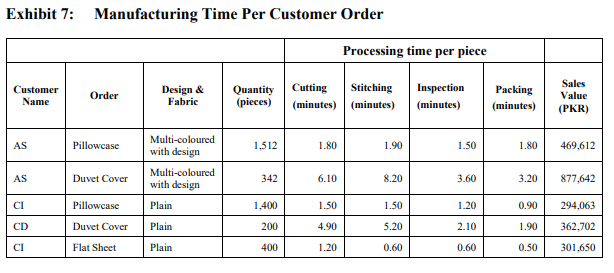

Exhibit 8: Average Departental Efficiency Per Customer Order \begin{tabular}{|c|c|c|c|c|} \hline Customer Name & Cutting (\%) & Stitching (\%) & Inspection (\%) & Packing (\%) \\ \hline AS & 49 & 62 & 60 & 53 \\ \hline CD & 45 & 66 & 34 & 54 \\ \hline Cl & 73 & 72 & 57 & 67 \\ \hline \end{tabular} Exhibit 4: Typical Monthly Overhead Costs Source: Company Data. (the numbers have been disguised) Exhibit 5: Manufacturing Expenses Per Department Source: Company Data. (the numbers have been disguised) Exhibit 6: Sample Customer Order Data of Varying Manufacturing Complexity Fxhihit 7* Manufacturino Tima Par Cuctomar Ordar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started