Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ASSIGNMENT QUESTIONS 1. What were PAEs total costs per year prior to the new price structure when the Series 10 generators price was $410? Was

ASSIGNMENT QUESTIONS

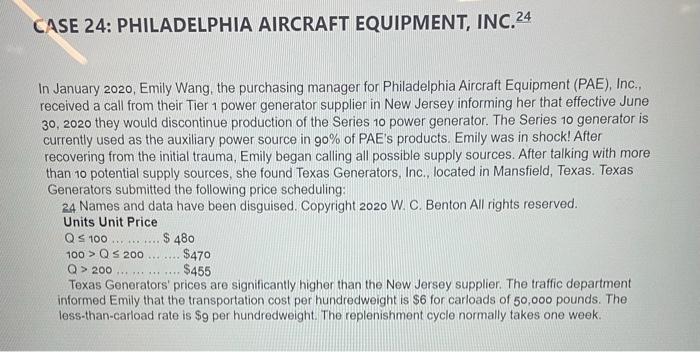

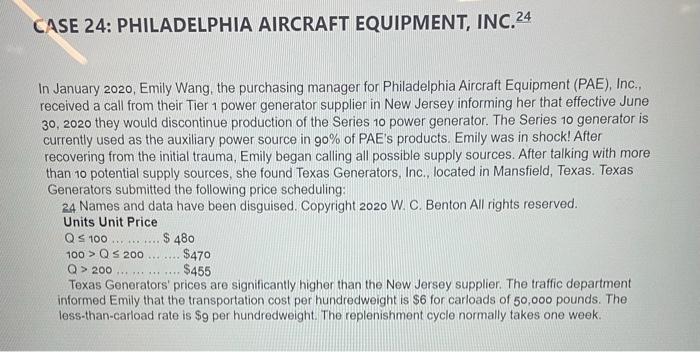

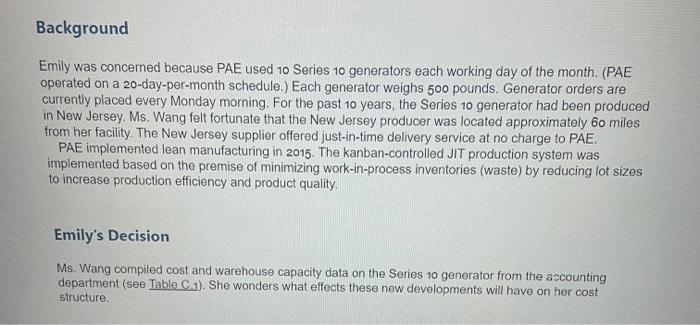

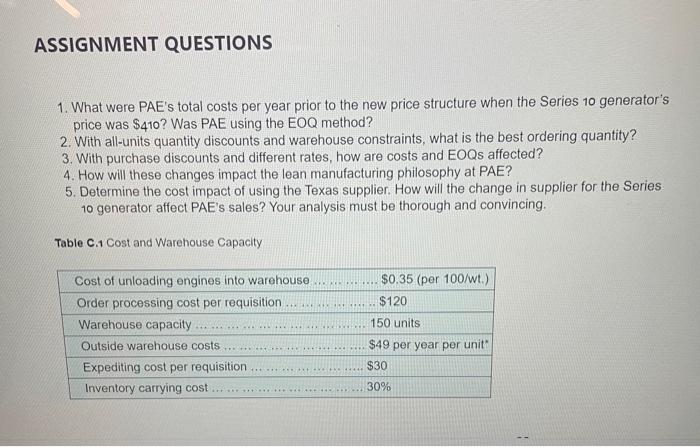

1. What were PAEs total costs per year prior to the new price structure when the Series 10 generators price was $410? Was PAE using the EOQ method?

2. With all-units quantity discounts and warehouse constraints, what is the best ordering quantity?

3. With purchase discounts and different rates, how are costs and EOQs affected?

4. How will these changes impact the lean manufacturing philosophy at PAE?

5. Determine the cost impact of using the Texas supplier. How will the change in supplier for the Series 10 generator affect PAEs sales? Your analysis must be thorough and convincing.

1. What were PAEs total costs per year prior to the new price structure when the Series 10 generators price was $410? Was PAE using the EOQ method?

2. With all-units quantity discounts and warehouse constraints, what is the best ordering quantity?

3. With purchase discounts and different rates, how are costs and EOQs affected?

4. How will these changes impact the lean manufacturing philosophy at PAE?

5. Determine the cost impact of using the Texas supplier. How will the change in supplier for the Series 10 generator affect PAEs sales? Your analysis must be thorough and convincing.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started