Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assignment Score: 61.00% Submit Assignment for Grading Keyboard Navigation Help Lons Problem 18-05 (Pricing Stock Issues in an IPO) Question 5 of 5 Check My

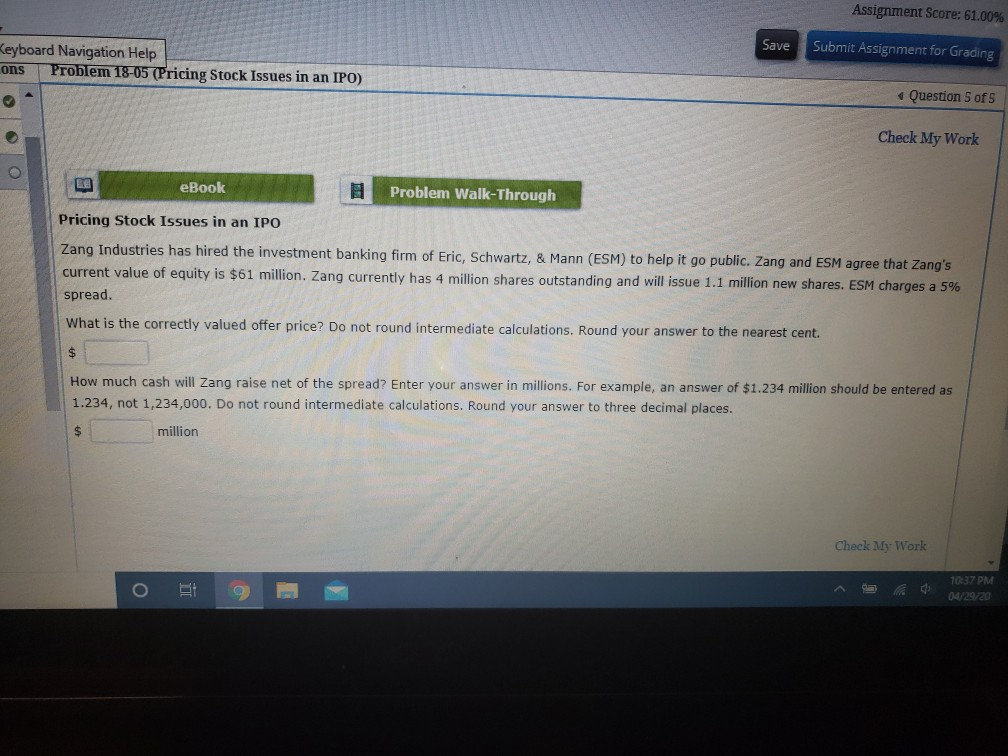

Assignment Score: 61.00% Submit Assignment for Grading Keyboard Navigation Help Lons Problem 18-05 (Pricing Stock Issues in an IPO) Question 5 of 5 Check My Work eBook Problem Walk-Through Pricing Stock Issues in an IPO Zang Industries has hired the investment banking firm of Eric, Schwartz, & Mann (ESM) to help it go public. Zang and ESM agree that Zang's current value of equity is $61 million. Zang currently has 4 million shares outstanding and will issue 1.1 million new shares. ESM charges a 5% spread. What is the correctly valued offer price? Do not round intermediate calculations. Round your answer to the nearest cent. How much cash will Zang raise net of the spread? Enter your answer in millions. For example, an answer of $1.234 million should be entered as 1.234, not 1,234,000. Do not round intermediate calculations. Round your answer to three decimal places. million Check My Work 10:37 PM 04/29/20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started