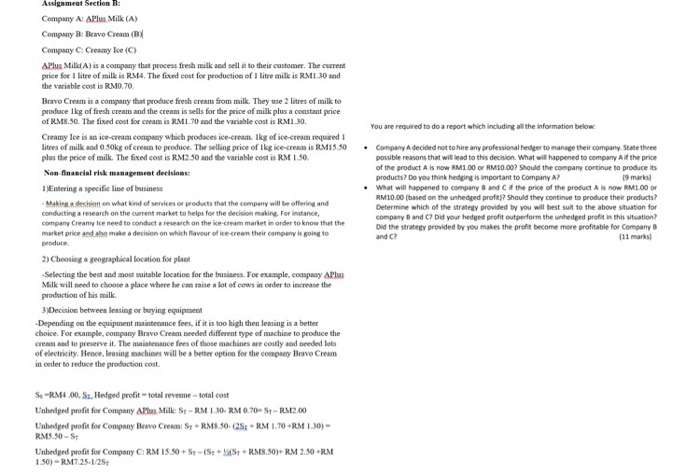

Assignment Section : Company Al APlus Milk (A) Company B Bravo Cream (BY Company C Creamy Ice (C) APlus Milk A) is a company that process fresh milk and sell it to their customer. The current price for 1 litre of milk is RM4. The fixed cost for production of 1 litre milk is RM1.30 and the variable cost is RM0.70 Bravo Cream is a company that produce fresh cream from milk. They use 2 litres of milk to produce lkg of fresh cream and the cream is sells for the price of milk plus a constant price of Rs.50. The fixed cost for cream is RM1.70 and the variable cost is RM1.30. Creamy Ice is an ice-cream company which produces ice-cream. Ikg of ice-cream required litres of milk and Osoke of cream to produce. The selling price of Ikg ice-cream is RM15.50 plus the price of milk. The fixed cost is RM2.50 and the variable cost is RM 1.50. Non financial risk management decisions Entering a specific line of business Making on what kind of services or products that the company will be offering and conducting a research on the current market to helps for the decision making. For instance, company Creamy le need to conducta research on the ice-cream market in order to know that the market price and also make a decision on which flavour of ice-cream their company is going to produce 2) Choosing a geographical location for plant Selecting the best and most suitable location for the business. For example.company APlus Milk will need to choose a place where he can raise a lot of cows in order to increase the production of his milk 3)Decision between leasing or buying equipment -Depending on the equipment maintenance fees, if it is too high then leasing is a better choice. For example, company Bravo Cream needed different type of machine to produce the cream and to preserve it. The maintenance fees of those machines are costly and needed lots of electricity. Hence, leasing machines will be a better option for the company Bravo Cream in order to reduce the production cost. You are required to do a report which including all the information below. Company Adecided not to hire any professional ledger to manage their company. State three possible reasons that will lead to this decision. What will happened to company Aif the price of the product A is now RM100 or RM10.00? Should the company continue to produce its products? Do you think hedging is important to Company A? 19 marks What will happened to company B and the price of the product is now RM1.00 or RM10.00 (based on the unhedged profe)? Should they continue to produce their products? Determine which of the strategy provided by you will best suit to the above situation for company B and C? Did your hedged profit outperform the unhedged profit in this situation? Did the strategy provided by you makes the profit become more profitable for Company and C? (11 marks S. -RM4.00. Sr. Hedged profit - total revenue - total cost Unhedged profit for Company Aplus Milk: S+ - RM 1.30 RM 0.70-$- RM2,00 Unhedged profit for Company Bewo Croam Sy + RM8.50-C2S: + RM 1.90 +RM1.30) RMS 50 - St Unhedged profit for Company C: RM 15.50 S - (S: AS RM8.50)+ RM 2.50 RM 1.50) - RM7.25.1/25 Assignment Section : Company Al APlus Milk (A) Company B Bravo Cream (BY Company C Creamy Ice (C) APlus Milk A) is a company that process fresh milk and sell it to their customer. The current price for 1 litre of milk is RM4. The fixed cost for production of 1 litre milk is RM1.30 and the variable cost is RM0.70 Bravo Cream is a company that produce fresh cream from milk. They use 2 litres of milk to produce lkg of fresh cream and the cream is sells for the price of milk plus a constant price of Rs.50. The fixed cost for cream is RM1.70 and the variable cost is RM1.30. Creamy Ice is an ice-cream company which produces ice-cream. Ikg of ice-cream required litres of milk and Osoke of cream to produce. The selling price of Ikg ice-cream is RM15.50 plus the price of milk. The fixed cost is RM2.50 and the variable cost is RM 1.50. Non financial risk management decisions Entering a specific line of business Making on what kind of services or products that the company will be offering and conducting a research on the current market to helps for the decision making. For instance, company Creamy le need to conducta research on the ice-cream market in order to know that the market price and also make a decision on which flavour of ice-cream their company is going to produce 2) Choosing a geographical location for plant Selecting the best and most suitable location for the business. For example.company APlus Milk will need to choose a place where he can raise a lot of cows in order to increase the production of his milk 3)Decision between leasing or buying equipment -Depending on the equipment maintenance fees, if it is too high then leasing is a better choice. For example, company Bravo Cream needed different type of machine to produce the cream and to preserve it. The maintenance fees of those machines are costly and needed lots of electricity. Hence, leasing machines will be a better option for the company Bravo Cream in order to reduce the production cost. You are required to do a report which including all the information below. Company Adecided not to hire any professional ledger to manage their company. State three possible reasons that will lead to this decision. What will happened to company Aif the price of the product A is now RM100 or RM10.00? Should the company continue to produce its products? Do you think hedging is important to Company A? 19 marks What will happened to company B and the price of the product is now RM1.00 or RM10.00 (based on the unhedged profe)? Should they continue to produce their products? Determine which of the strategy provided by you will best suit to the above situation for company B and C? Did your hedged profit outperform the unhedged profit in this situation? Did the strategy provided by you makes the profit become more profitable for Company and C? (11 marks S. -RM4.00. Sr. Hedged profit - total revenue - total cost Unhedged profit for Company Aplus Milk: S+ - RM 1.30 RM 0.70-$- RM2,00 Unhedged profit for Company Bewo Croam Sy + RM8.50-C2S: + RM 1.90 +RM1.30) RMS 50 - St Unhedged profit for Company C: RM 15.50 S - (S: AS RM8.50)+ RM 2.50 RM 1.50) - RM7.25.1/25