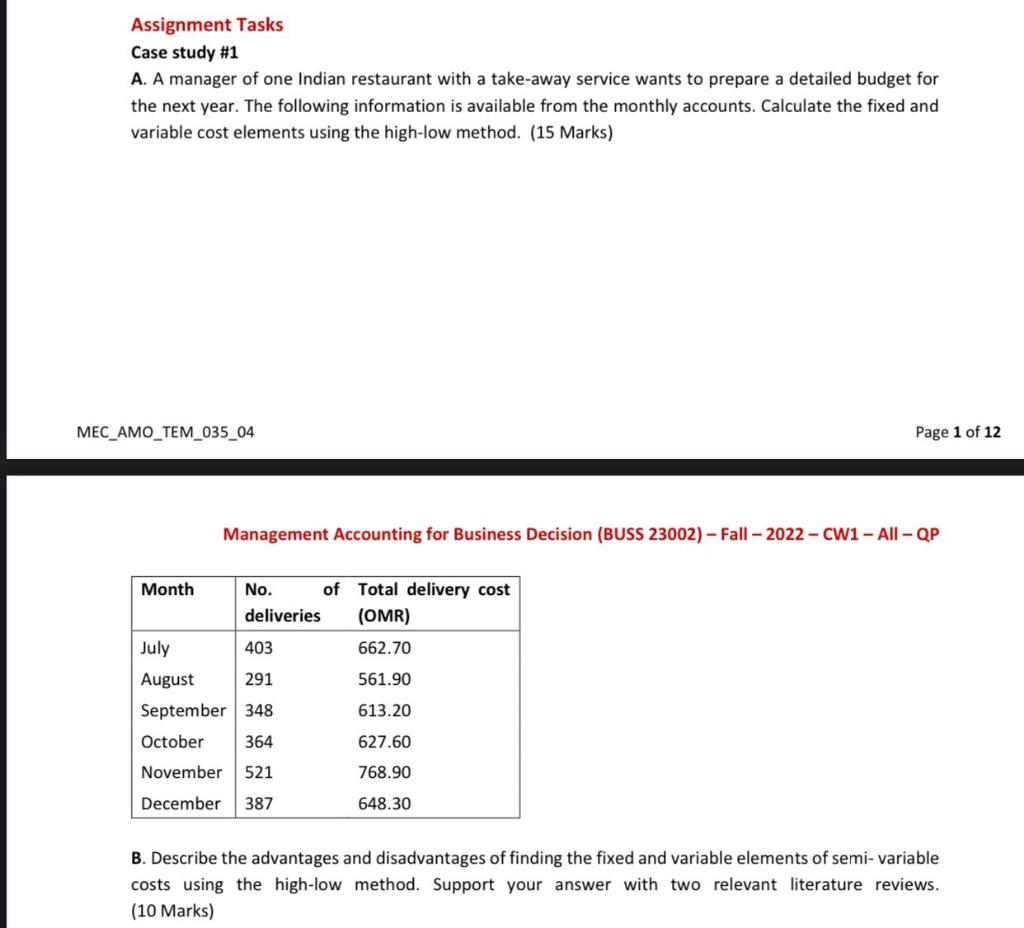

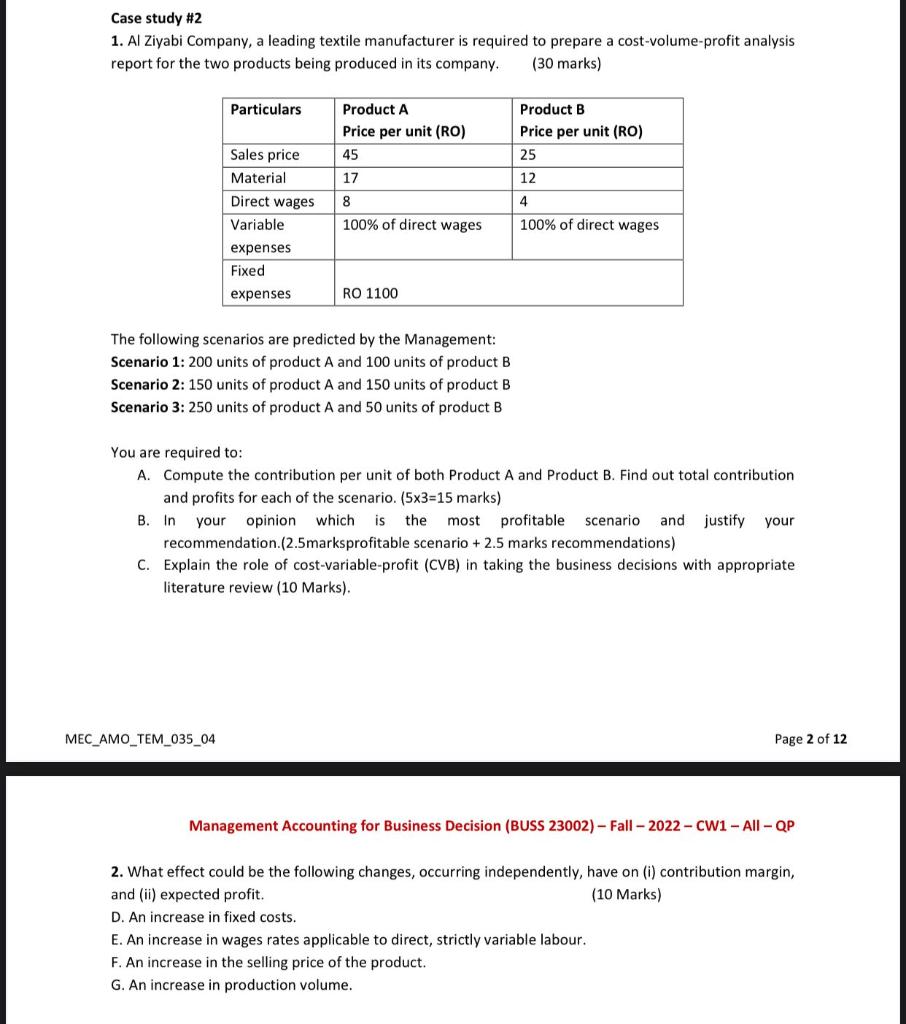

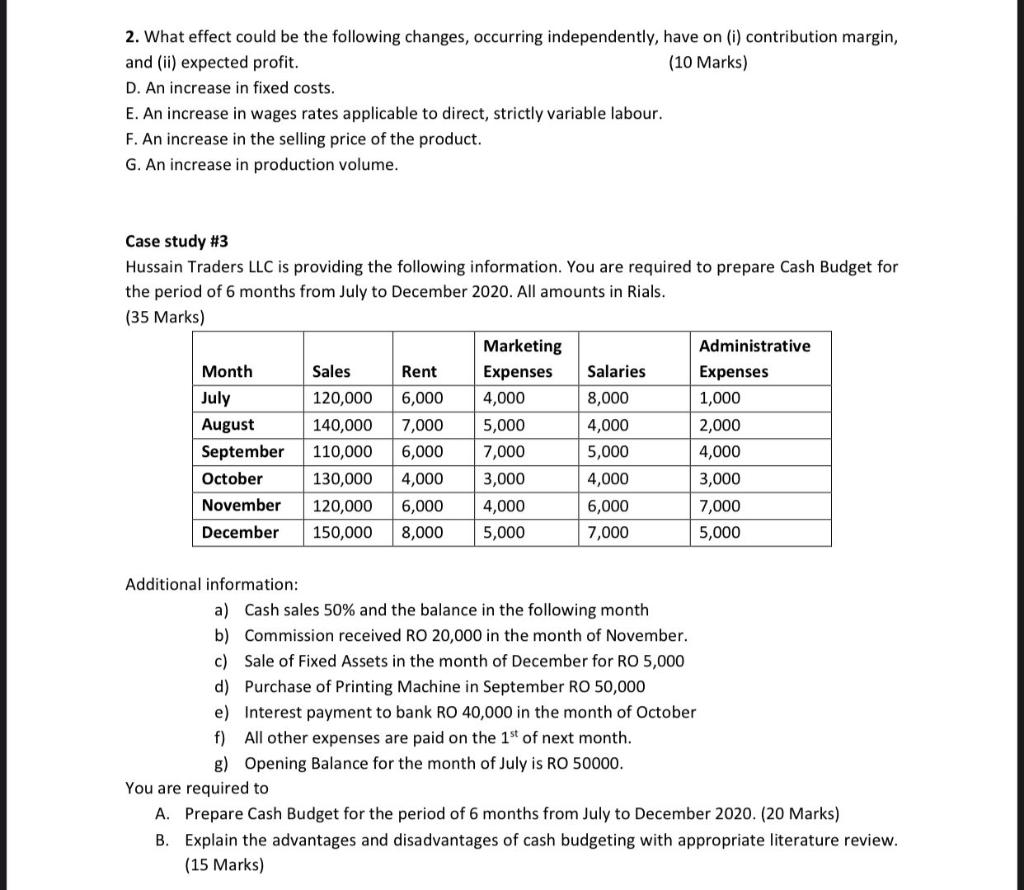

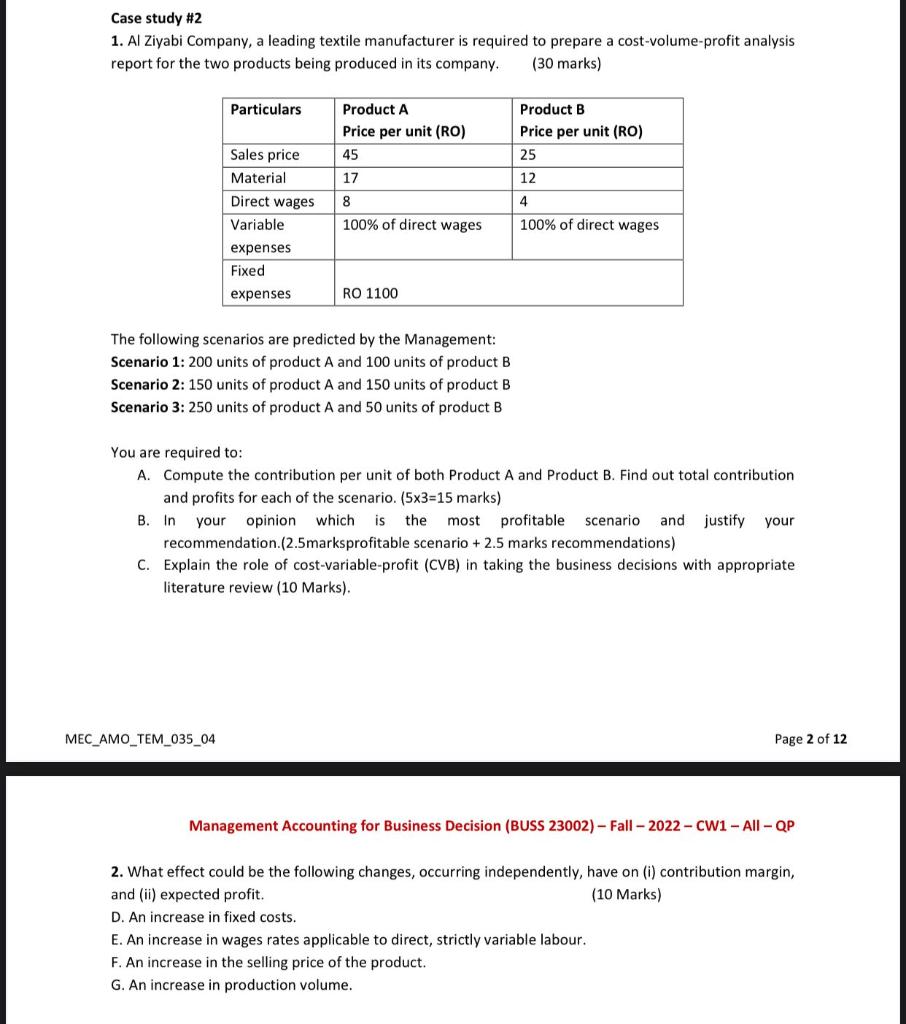

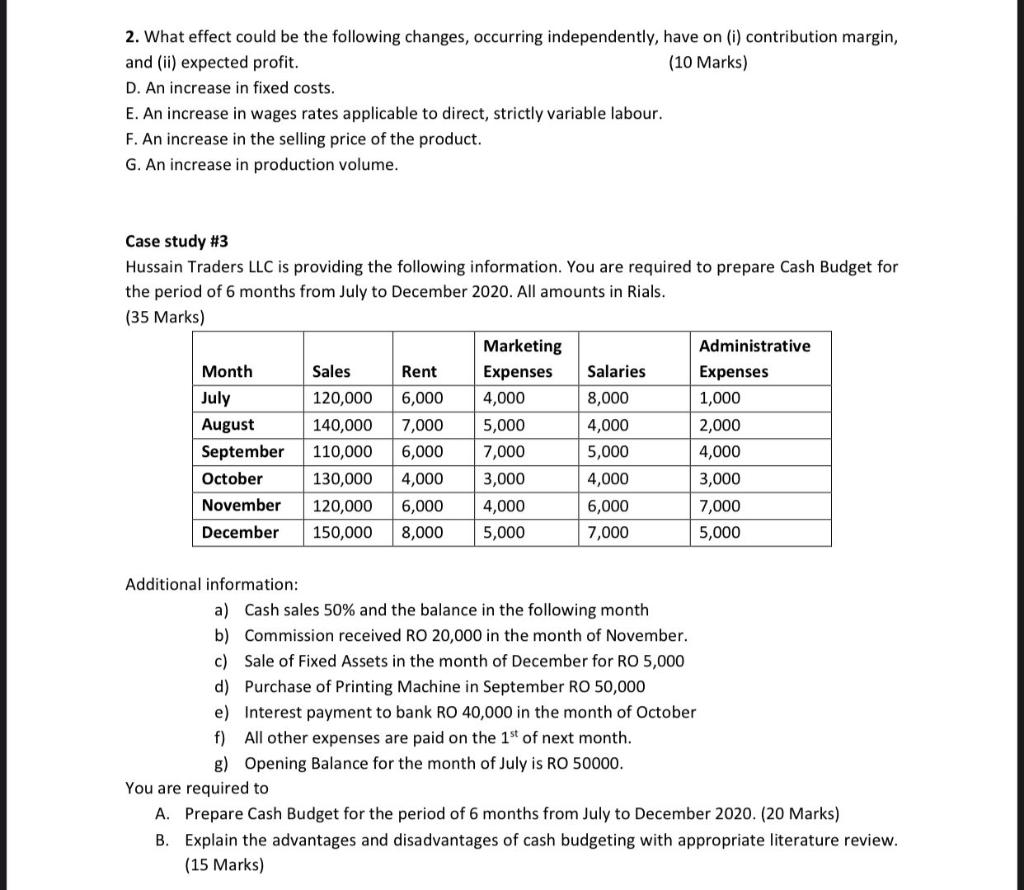

Assignment Tasks Case study \#1 A. A manager of one Indian restaurant with a take-away service wants to prepare a detailed budget for the next year. The following information is available from the monthly accounts. Calculate the fixed and variable cost elements using the high-low method. (15 Marks) AMO_TEM_035_04 Page 1 Management Accounting for Business Decision (BUSS 23002) - Fall - 2022 - CW1 - All - QP B. Describe the advantages and disadvantages of finding the fixed and variable elements of semi- variable costs using the high-low method. Support your answer with two relevant literature reviews. (10 Marks) Case study \#2 1. Al Ziyabi Company, a leading textile manufacturer is required to prepare a cost-volume-profit analysis report for the two products being produced in its company. (30 marks) The following scenarios are predicted by the Management: Scenario 1: 200 units of product A and 100 units of product B Scenario 2: 150 units of product A and 150 units of product B Scenario 3: 250 units of product A and 50 units of product B You are required to: A. Compute the contribution per unit of both Product A and Product B. Find out total contribution and profits for each of the scenario. ( 53=15 marks) B. In your opinion which is the most profitable scenario and justify your recommendation. (2.5marksprofitable scenario +2.5 marks recommendations) C. Explain the role of cost-variable-profit (CVB) in taking the business decisions with appropriate literature review (10 Marks). Management Accounting for Business Decision (BUSS 23002) - Fall - 2022 - CW1 - All - QP 2. What effect could be the following changes, occurring independently, have on (i) contribution margin, and (ii) expected profit. (10 Marks) D. An increase in fixed costs. E. An increase in wages rates applicable to direct, strictly variable labour. F. An increase in the selling price of the product. G. An increase in production volume. 2. What effect could be the following changes, occurring independently, have on (i) contribution margin, and (ii) expected profit. (10 Marks) D. An increase in fixed costs. E. An increase in wages rates applicable to direct, strictly variable labour. F. An increase in the selling price of the product. G. An increase in production volume. Case study \#3 Hussain Traders LLC is providing the following information. You are required to prepare Cash Budget for the period of 6 months from July to December 2020 . All amounts in Rials. (35 Marks) Additional information: a) Cash sales 50% and the balance in the following month b) Commission received RO20,000 in the month of November. c) Sale of Fixed Assets in the month of December for RO 5,000 d) Purchase of Printing Machine in September RO 50,000 e) Interest payment to bank RO 40,000 in the month of October f) All other expenses are paid on the 1st of next month. g) Opening Balance for the month of July is RO 50000. You are required to A. Prepare Cash Budget for the period of 6 months from July to December 2020. (20 Marks) B. Explain the advantages and disadvantages of cash budgeting with appropriate literature review. (15 Marks) Assignment Tasks Case study \#1 A. A manager of one Indian restaurant with a take-away service wants to prepare a detailed budget for the next year. The following information is available from the monthly accounts. Calculate the fixed and variable cost elements using the high-low method. (15 Marks) AMO_TEM_035_04 Page 1 Management Accounting for Business Decision (BUSS 23002) - Fall - 2022 - CW1 - All - QP B. Describe the advantages and disadvantages of finding the fixed and variable elements of semi- variable costs using the high-low method. Support your answer with two relevant literature reviews. (10 Marks) Case study \#2 1. Al Ziyabi Company, a leading textile manufacturer is required to prepare a cost-volume-profit analysis report for the two products being produced in its company. (30 marks) The following scenarios are predicted by the Management: Scenario 1: 200 units of product A and 100 units of product B Scenario 2: 150 units of product A and 150 units of product B Scenario 3: 250 units of product A and 50 units of product B You are required to: A. Compute the contribution per unit of both Product A and Product B. Find out total contribution and profits for each of the scenario. ( 53=15 marks) B. In your opinion which is the most profitable scenario and justify your recommendation. (2.5marksprofitable scenario +2.5 marks recommendations) C. Explain the role of cost-variable-profit (CVB) in taking the business decisions with appropriate literature review (10 Marks). Management Accounting for Business Decision (BUSS 23002) - Fall - 2022 - CW1 - All - QP 2. What effect could be the following changes, occurring independently, have on (i) contribution margin, and (ii) expected profit. (10 Marks) D. An increase in fixed costs. E. An increase in wages rates applicable to direct, strictly variable labour. F. An increase in the selling price of the product. G. An increase in production volume. 2. What effect could be the following changes, occurring independently, have on (i) contribution margin, and (ii) expected profit. (10 Marks) D. An increase in fixed costs. E. An increase in wages rates applicable to direct, strictly variable labour. F. An increase in the selling price of the product. G. An increase in production volume. Case study \#3 Hussain Traders LLC is providing the following information. You are required to prepare Cash Budget for the period of 6 months from July to December 2020 . All amounts in Rials. (35 Marks) Additional information: a) Cash sales 50% and the balance in the following month b) Commission received RO20,000 in the month of November. c) Sale of Fixed Assets in the month of December for RO 5,000 d) Purchase of Printing Machine in September RO 50,000 e) Interest payment to bank RO 40,000 in the month of October f) All other expenses are paid on the 1st of next month. g) Opening Balance for the month of July is RO 50000. You are required to A. Prepare Cash Budget for the period of 6 months from July to December 2020. (20 Marks) B. Explain the advantages and disadvantages of cash budgeting with appropriate literature review. (15 Marks)