Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assimo owns several pieces of land He decided to sell some of it in the current year Lot 1 is his personal investment in

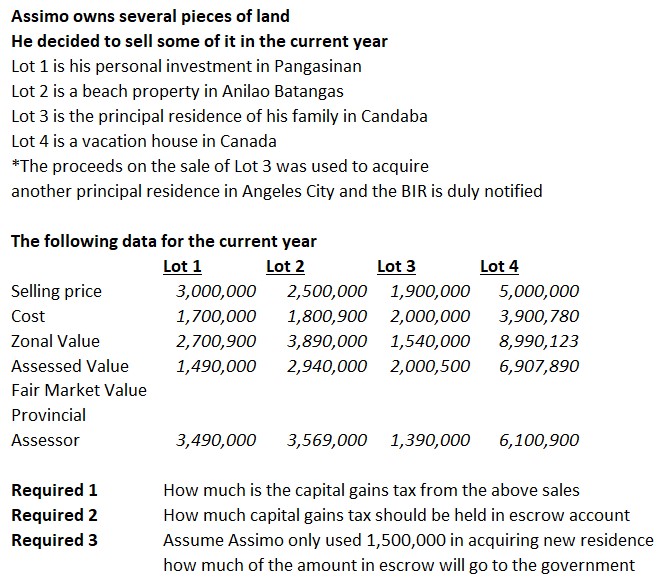

Assimo owns several pieces of land He decided to sell some of it in the current year Lot 1 is his personal investment in Pangasinan Lot 2 is a beach property in Anilao Batangas Lot 3 is the principal residence of his family in Candaba Lot 4 is a vacation house in Canada *The proceeds on the sale of Lot 3 was used to acquire another principal residence in Angeles City and the BIR is duly notified The following data for the current year Lot 1 Lot 2 Lot 3 Lot 4 Selling price 3,000,000 2,500,000 1,900,000 5,000,000 Cost 1,700,000 1,800,900 2,000,000 3,900,780 Zonal Value 2,700,900 3,890,000 1,540,000 8,990,123 Assessed Value 1,490,000 2,940,000 2,000,500 6,907,890 Fair Market Value Provincial Assessor 3,490,000 3,569,000 1,390,000 6,100,900 Required 1 Required 2 Required 3 How much is the capital gains tax from the above sales How much capital gains tax should be held in escrow account Assume Assimo only used 1,500,000 in acquiring new residence how much of the amount in escrow will go to the government

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution To calculate the capital gains tax we need to determine the gain from each sale and then ap...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started