Assist in solving the given problems

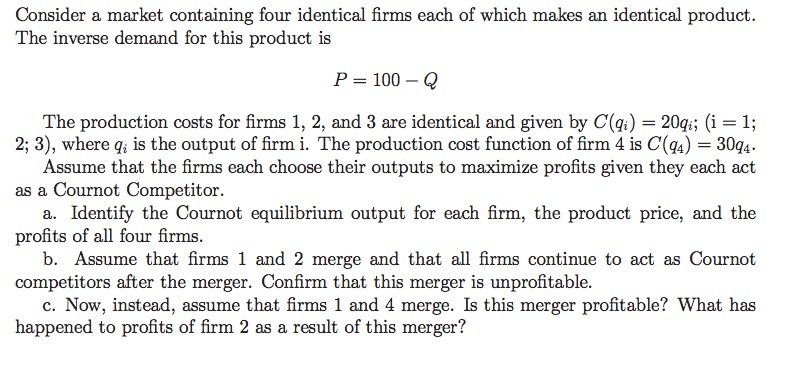

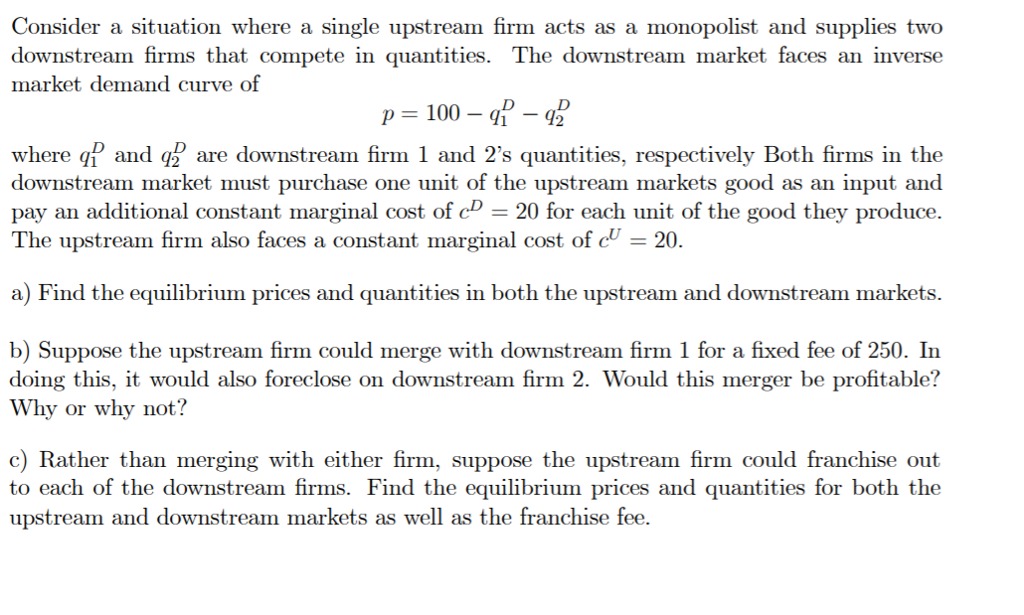

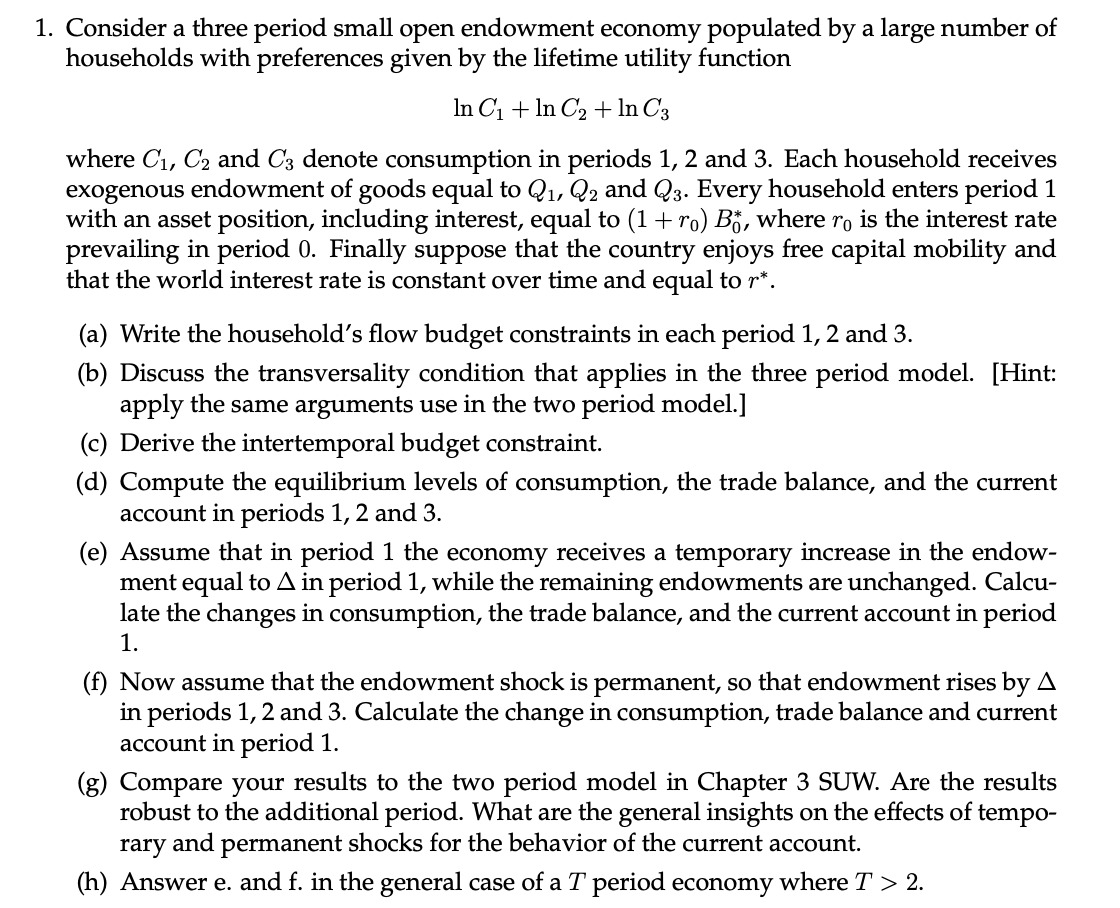

Consider a market containing four identical firms each of which makes an identical product. The inverse demand for this product is P = 100 - Q The production costs for firms 1, 2, and 3 are identical and given by C(qi) = 20q; (i = 1; 2; 3), where qi is the output of firm i. The production cost function of firm 4 is C(q4) = 30q4. Assume that the firms each choose their outputs to maximize profits given they each act as a Cournot Competitor. a. Identify the Cournot equilibrium output for each firm, the product price, and the profits of all four firms. b. Assume that firms 1 and 2 merge and that all firms continue to act as Cournot competitors after the merger. Confirm that this merger is unprofitable. c. Now, instead, assume that firms 1 and 4 merge. Is this merger profitable? What has happened to profits of firm 2 as a result of this merger?Consider a situation where a single upstream rm acts as a monopolist and supplies two downstream rms that compete in quantities. The downstream market faces an inverse market demand curve of p=100q1\"q where 1.319 and q? are downstream rm 1 and 2's quantities, respectively Both rms in the downstream market must purchase one unit of the upstream markets good as an input and pay an additional constant marginal cost of CD = 20 for each unit of the good they produce. The upstream rm also faces a constant marginal cost of c\" = 20. :1) Find the equilibrium prices and quantities in both the upstream and downstream markets. b) Suppose the upstream rm could merge with downstream rm 1 for a xed fee of 250. In doing this, it would also foreclose on downstream rm 2. Would this merger be protable? Why or why not? (3) Rather than merging with either rm, suppose the upstream rm could franchise out to each of the downstream rms. Find the equilibrium prices and quantities for both the upstream and downstream markets as well as the franchise fee. 1. Consider a three period small open endowment economy populated by a large number of households with preferences given by the lifetime utility function 11101 +11102 +1DC3 where 01, 02 and 03 denote consumption in periods 1, 2 and 3. Each household receives exogenous endowment of goods equal to Q1, Q2 and Q3. Every household enters period 1 with an asset position, including interest, equal to (1 + r0) 33, where m is the interest rate prevailing in period 0. Finally suppose that the country enjoys free capital mobility and that the world interest rate is constant over time and equal to r". (a) Write the household's ow budget constraints in each period 1, 2 and 3. (b) Discuss the transversality condition that applies in the three period model. [I-Iint: apply the same arguments use in the two period model.] (C) Derive the intertemporal budget constraint. (d) Compute the equilibrium levels of consumption, the trade balance, and the current account in periods 1, 2 and 3. (e) Assume that in period 1 the economy receives a temporary increase in the endow- ment equal to A in period 1, while the remaining endowments are unchanged. Calcu- late the changes in consumption, the trade balance, and the current account in period 1. (1') Now assume that the endowment shock is permanent, so that endowment rises by A in periods 1, 2 and 3. Calculate the change in consumption, trade balance and current account in period 1. (g) Compare your results to the two period model in Chapter 3 SUW. Are the results robust to the additional period. What are the general insights on the effects of tempo- rary and permanent shocks for the behavior of the current account. (11) Answer e. and f. in the general case of a T period economy where T > 2