Answered step by step

Verified Expert Solution

Question

1 Approved Answer

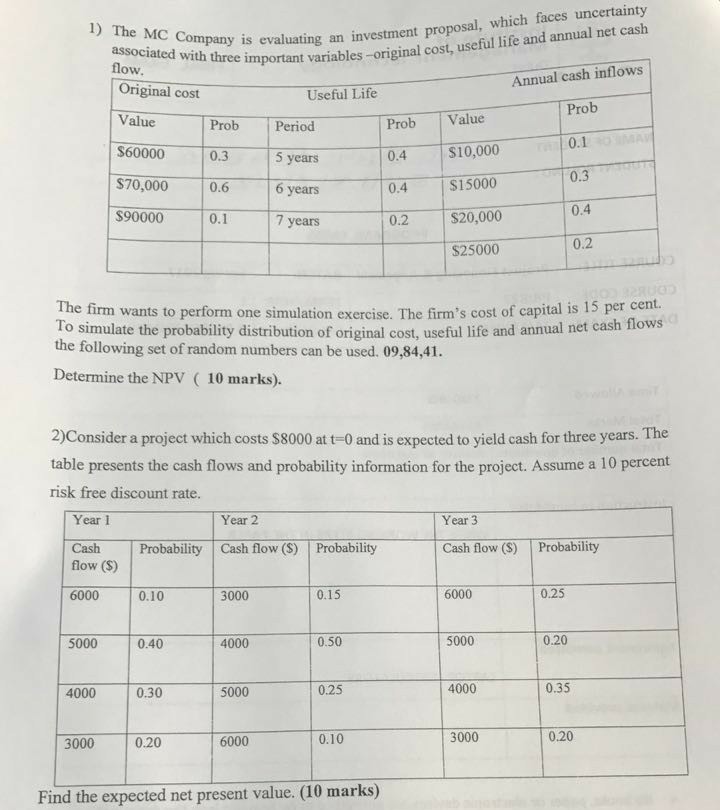

associated wihny is evaing an investment proposal, which faces uncertainty tfree important variables -original cost, useful life and annual net cash Annual cash inflows flow

associated wihny is evaing an investment proposal, which faces uncertainty tfree important variables -original cost, useful life and annual net cash Annual cash inflows flow Original cost ValueProb Period S60000 $70,000 $90000 Useful Life Prob Prob Value 0.4 |$10,000 0.4 S15000 0.2 0.1 0.3 0.4 0.2 0.3 5 years 6 years 7 years 0.6 $20,000 $25000 The firm wants to perform one simulation exercise. The firm's cost of capital is 15 per cent. To simulate the probability distribution of original cost, useful life and annual net cash 1ows the following set of random numbers can be used. 09,84,41. Determine the NPV ( 10 marks). 2)Consider a project which costs $8000 att-0 and is expected to yield cash for three years. The table presents the cash flows and probability information for the project. Assume a 10 percent risk free discount rate. Year i Year 2 Year 3 Cash Probability Cash flow (S) Probability low (S) 6000 Cash flow (S) Probability 0.10 3000 0.15 6000 0.25 5000 0.40 4000 0.50 5000 0.20 4000 0.30 5000 0.25 4000 0.35 3000 0.20 6000 0.10 3000 0.20 Find the expected net present value. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started