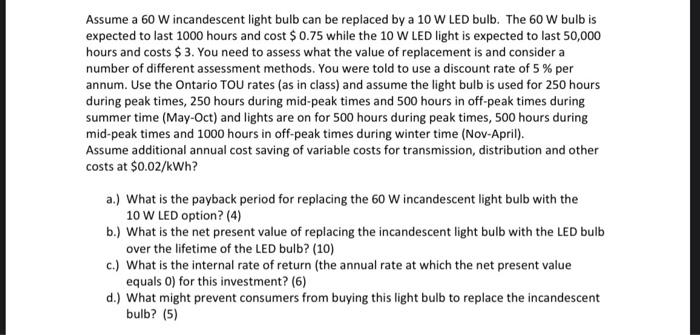

Assume a 60 W incandescent light bulb can be replaced by a 10 W LED bulb. The 60 W bulb is expected to last 1000 hours and cost $ 0.75 while the 10 W LED light is expected to last 50,000 hours and costs $ 3. You need to assess what the value of replacement is and consider a number of different assessment methods. You were told to use a discount rate of 5% per annum. Use the Ontario TOU rates (as in class) and assume the light bulb is used for 250 hours during peak times, 250 hours during mid-peak times and 500 hours in off-peak times during summer time (May-Oct) and lights are on for 500 hours during peak times, 500 hours during mid-peak times and 1000 hours in off-peak times during winter time (Nov-April). Assume additional annual cost saving of variable costs for transmission, distribution and other costs at $0.02/kWh? a.) What is the payback period for replacing the 60 W incandescent light bulb with the 10 W LED option? (4) b.) What is the net present value of replacing the incandescent light bulb with the LED bulb over the lifetime of the LED bulb? (10) c.) What is the internal rate of return (the annual rate at which the net present value equals 0) for this investment? (6) d.) What might prevent consumers from buying this light bulb to replace the incandescent bulb? (5) Assume a 60 W incandescent light bulb can be replaced by a 10 W LED bulb. The 60 W bulb is expected to last 1000 hours and cost $ 0.75 while the 10 W LED light is expected to last 50,000 hours and costs $ 3. You need to assess what the value of replacement is and consider a number of different assessment methods. You were told to use a discount rate of 5% per annum. Use the Ontario TOU rates (as in class) and assume the light bulb is used for 250 hours during peak times, 250 hours during mid-peak times and 500 hours in off-peak times during summer time (May-Oct) and lights are on for 500 hours during peak times, 500 hours during mid-peak times and 1000 hours in off-peak times during winter time (Nov-April). Assume additional annual cost saving of variable costs for transmission, distribution and other costs at $0.02/kWh? a.) What is the payback period for replacing the 60 W incandescent light bulb with the 10 W LED option? (4) b.) What is the net present value of replacing the incandescent light bulb with the LED bulb over the lifetime of the LED bulb? (10) c.) What is the internal rate of return (the annual rate at which the net present value equals 0) for this investment? (6) d.) What might prevent consumers from buying this light bulb to replace the incandescent bulb