Assume A, B, C and D are partners sharing profits 40%, 20%, 20%, 20%, respectively. On January 1, 2019, they agree to liquidate. A

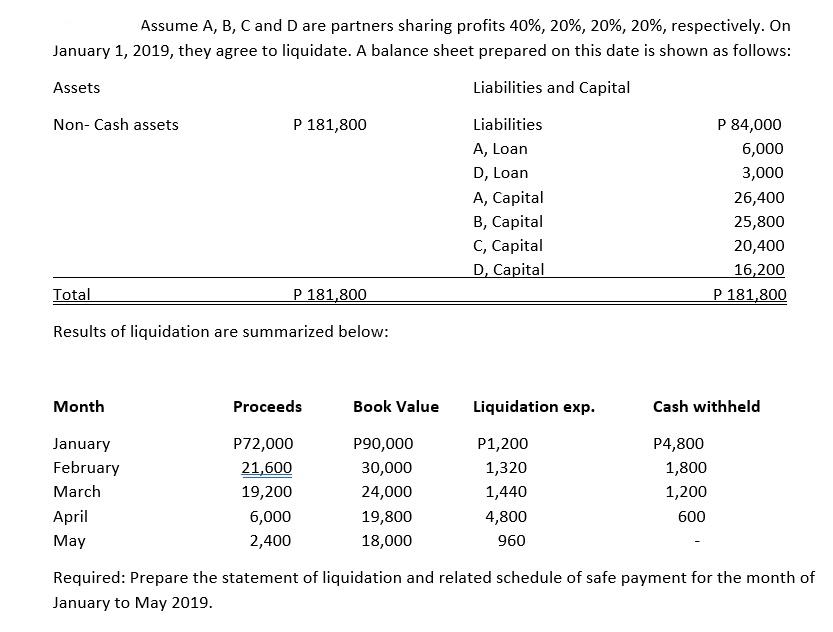

Assume A, B, C and D are partners sharing profits 40%, 20%, 20%, 20%, respectively. On January 1, 2019, they agree to liquidate. A balance sheet prepared on this date is shown as follows: Assets Liabilities and Capital Non- Cash assets P 181,800 Liabilities P 84,000 A, Loan 6,000 D, Loan 3,000 A, Capital 26,400 B, Capital 25,800 C, Capital D, Capital 20,400 16,200 Total P 181,800 P 181,800 Results of liquidation are summarized below: Month Proceeds Book Value Liquidation exp. Cash withheld January P72,000 P90,000 P1,200 P4,800 February 21,600 30,000 1,320 1,800 March 19,200 24,000 1,440 1,200 April 6,000 19,800 4,800 600 May 2,400 18,000 960 Required: Prepare the statement of liquidation and related schedule of safe payment for the month of January to May 2019.

Step by Step Solution

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

STATEMENT OF LIQUIDATION Particulars CashProceeds Assets Liabilities LiabilitiesLoan A Liabilities L...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started