Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume a book value per share of $ 6 and a price per share of $ 8. What is the market value added of

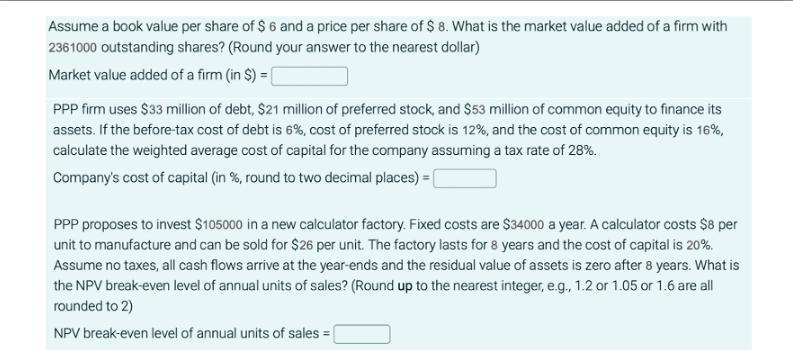

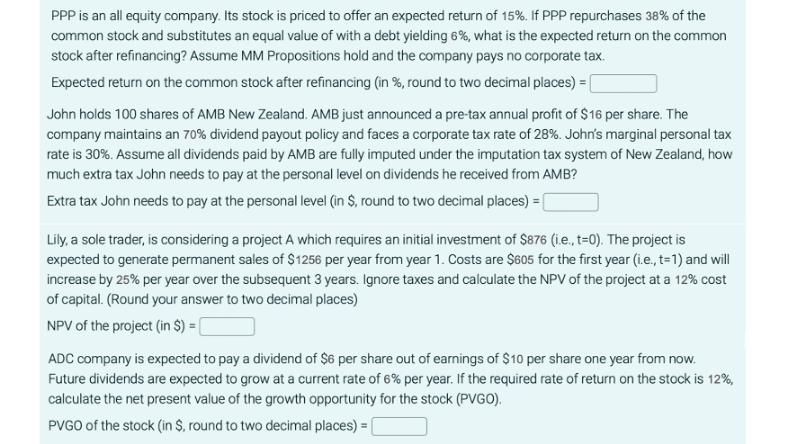

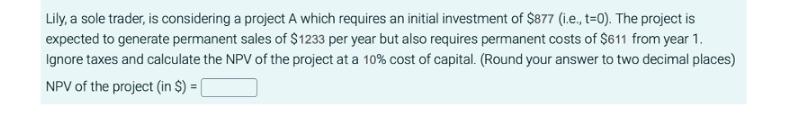

Assume a book value per share of $ 6 and a price per share of $ 8. What is the market value added of a firm with 2361000 outstanding shares? (Round your answer to the nearest dollar) Market value added of a firm (in $) = [ PPP firm uses $33 million of debt, $21 million of preferred stock, and $53 million of common equity to finance its assets. If the before-tax cost of debt is 6%, cost of preferred stock is 12%, and the cost of common equity is 16%, calculate the weighted average cost of capital for the company assuming a tax rate of 28%. Company's cost of capital (in %, round to two decimal places) = [ PPP proposes to invest $105000 in a new calculator factory. Fixed costs are $34000 a year. A calculator costs $8 per unit to manufacture and can be sold for $26 per unit. The factory lasts for 8 years and the cost of capital is 20%. Assume no taxes, all cash flows arrive at the year-ends and the residual value of assets is zero after 8 years. What is the NPV break-even level of annual units of sales? (Round up to the nearest integer, e.g., 1.2 or 1.05 or 1.6 are all rounded to 2) NPV break-even level of annual units of sales = [ PPP is an all equity company. Its stock is priced to offer an expected return of 15%. If PPP repurchases 38% of the common stock and substitutes an equal value of with a debt yielding 6%, what is the expected return on the common stock after refinancing? Assume MM Propositions hold and the company pays no corporate tax. Expected return on the common stock after refinancing (in %, round to two decimal places) = [ John holds 100 shares of AMB New Zealand. AMB just announced a pre-tax annual profit of $16 per share. The company maintains an 70% dividend payout policy and faces a corporate tax rate of 28%. John's marginal personal tax rate is 30%. Assume all dividends paid by AMB are fully imputed under the imputation tax system of New Zealand, how much extra tax John needs to pay at the personal level on dividends he received from AMB? Extra tax John needs to pay at the personal level (in $, round to two decimal places) = Lily, a sole trader, is considering a project A which requires an initial investment of $876 (i.e., t=0). The project is expected to generate permanent sales of $1256 per year from year 1. Costs are $605 for the first year (i.e., t=1) and will increase by 25% per year over the subsequent 3 years. Ignore taxes and calculate the NPV of the project at a 12% cost of capital. (Round your answer to two decimal places) NPV of the project (in $) = ADC company is expected to pay a dividend of $6 per share out of earnings of $10 per share one year from now. Future dividends are expected to grow at a current rate of 6% per year. If the required rate of return on the stock is 12%, calculate the net present value of the growth opportunity for the stock (PVGO). PVGO of the stock (in $, round to two decimal places) = [ Lily, a sole trader, is considering a project A which requires an initial investment of $877 (i.e., t=0). The project is expected to generate permanent sales of $1233 per year but also requires permanent costs of $611 from year 1. Ignore taxes and calculate the NPV of the project at a 10% cost of capital. (Round your answer to two decimal places) NPV of the project (in $)=[

Step by Step Solution

★★★★★

3.30 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Lets tackle each question one by one Market Value Added of the Firm Market Value Added MVA is calculated as the difference between the market value of equity and the book value of equity Given ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started