Answered step by step

Verified Expert Solution

Question

1 Approved Answer

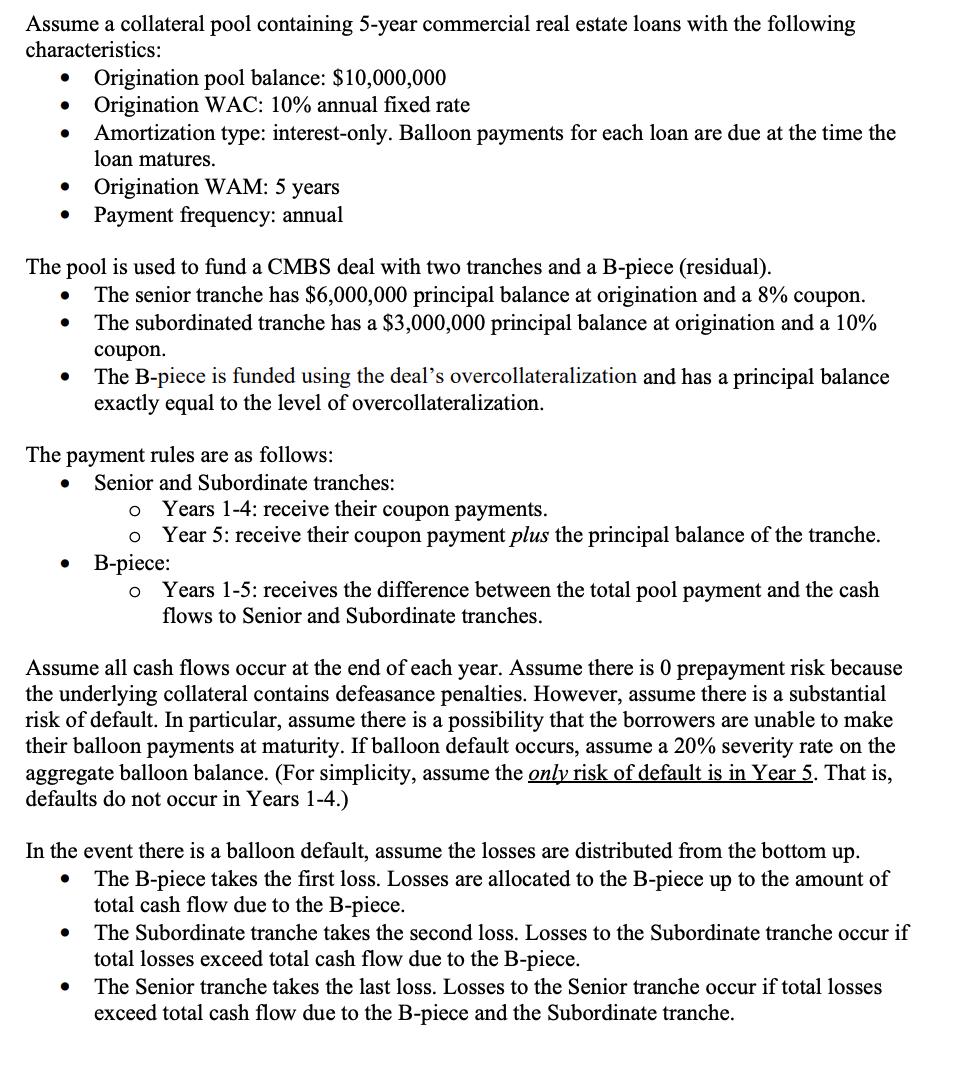

Assume a collateral pool containing 5-year commercial real estate loans with the following characteristics: The pool is used to fund a CMBS deal with

![]()

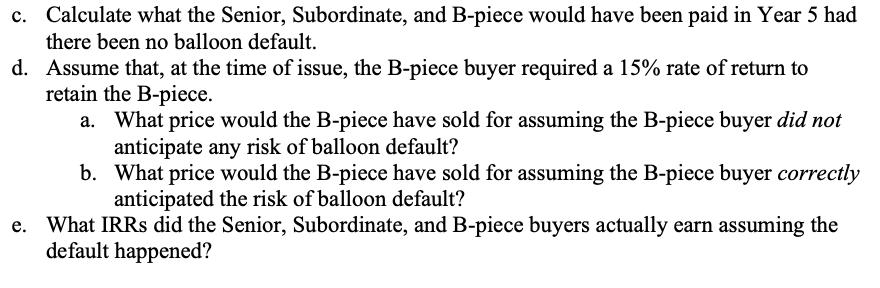

Assume a collateral pool containing 5-year commercial real estate loans with the following characteristics: The pool is used to fund a CMBS deal with two tranches and a B-piece (residual). The senior tranche has $6,000,000 principal balance at origination and a 8% coupon. The subordinated tranche has a $3,000,000 principal balance at origination and a 10% coupon. Origination pool balance: $10,000,000 Origination WAC: 10% annual fixed rate Amortization type: interest-only. Balloon payments for each loan are due at the time the loan matures. Origination WAM: 5 years Payment frequency: annual The B-piece is funded using the deal's overcollateralization and has a principal balance exactly equal to the level of overcollateralization. The payment rules are as follows: Senior and Subordinate tranches: Years 1-4: receive their coupon payments. Year 5: receive their coupon payment plus the principal balance of the tranche. O O B-piece: O Years 1-5: receives the difference between the total pool payment and the cash flows to Senior and Subordinate tranches. Assume all cash flows occur at the end of each year. Assume there is O prepayment risk because the underlying collateral contains defeasance penalties. However, assume there is a substantial risk of default. In particular, assume there is a possibility that the borrowers are unable to make their balloon payments at maturity. If balloon default occurs, assume a 20% severity rate on the aggregate balloon balance. (For simplicity, assume the only risk of default is in Year 5. That is, defaults do not occur in Years 1-4.) In the event there is a balloon default, assume the losses are distributed from the bottom up. The B-piece takes the first loss. Losses are allocated to the B-piece up to the amount of total cash flow due to the B-piece. The Subordinate tranche takes the second loss. Losses to the Subordinate tranche occur if total losses exceed total cash flow due to the B-piece. The Senior tranche takes the last loss. Losses to the Senior tranche occur if total losses exceed total cash flow due to the B-piece and the Subordinate tranche. Assume that a balloon default occurs in Year 5 and complete the following. c. Calculate what the Senior, Subordinate, and B-piece would have been paid in Year 5 had there been no balloon default. d. Assume that, at the time of issue, the B-piece buyer required a 15% rate of return to retain the B-piece. a. What price would the B-piece have sold for assuming the B-piece buyer did not anticipate any risk of balloon default? b. What price would the B-piece have sold for assuming the B-piece buyer correctly anticipated the risk of balloon default? e. What IRRs did the Senior, Subordinate, and B-piece buyers actually earn assuming the default happened?

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To analyze the cash flows losses and prices in this scenario lets go step by step Step 1 Calculate t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started