Answered step by step

Verified Expert Solution

Question

1 Approved Answer

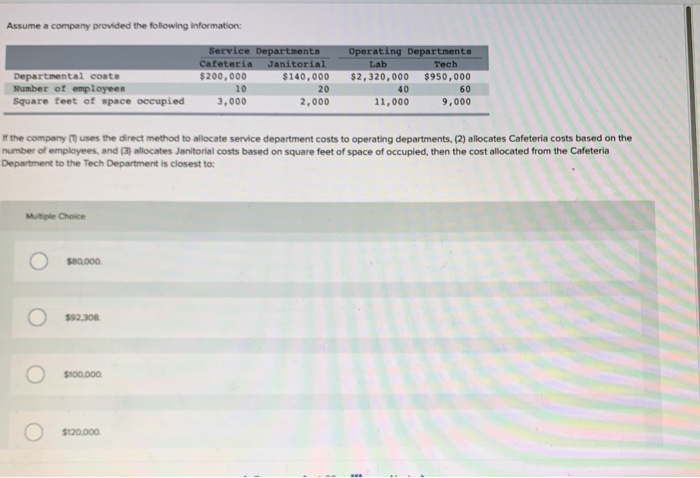

Assume a company provided the following information: Departmental costs Number of employees Square feet of space occupied Multiple Choice $80,000 $92,308 $100,000. Service Departments

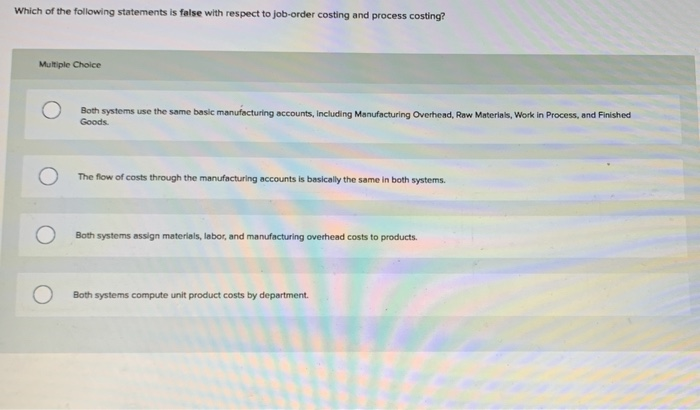

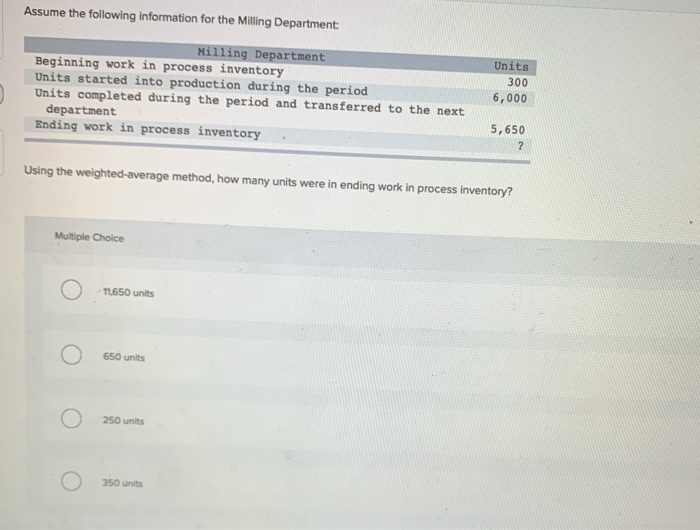

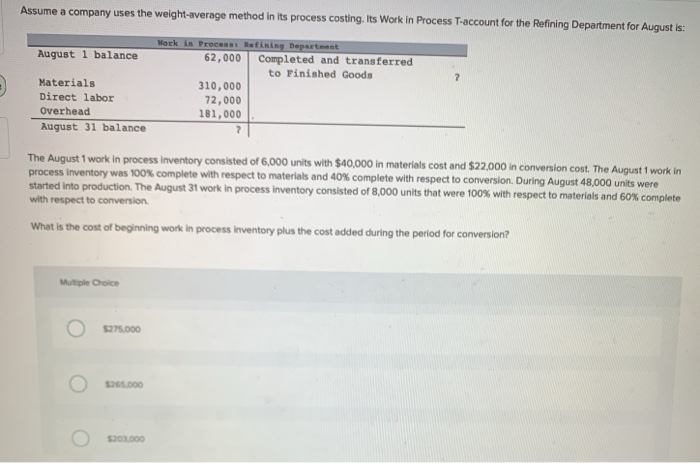

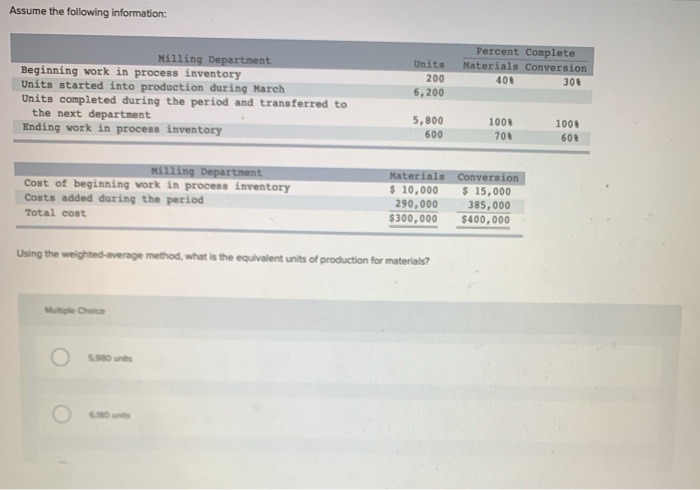

Assume a company provided the following information: Departmental costs Number of employees Square feet of space occupied Multiple Choice $80,000 $92,308 $100,000. Service Departments Cafeteria Janitorial $200,000 $140,000 If the company (1) uses the direct method to allocate service department costs to operating departments, (2) allocates Cafeteria costs based on the number of employees, and (3) allocates Janitorial costs based on square feet of space of occupied, then the cost allocated from the Cafeteria Department to the Tech Department is closest to: $120,000 10 3,000 20 2,000 Operating Departments Lab $2,320,000 Tech $950,000 60 9,000 40 11,000 Which of the following statements is false with respect to job-order costing and process costing? Multiple Choice Both systems use the same basic manufacturing accounts, including Manufacturing Overhead, Raw Materials, Work in Process, and Finished Goods. The flow of costs through the manufacturing accounts is basically the same in both systems. Both systems assign materials, labor, and manufacturing overhead costs to products. Both systems compute unit product costs by department. Assume the following information for the Milling Department: Milling Department Beginning work in process inventory Units started into production during the period Units completed during the period and transferred to the next department Ending work in process inventory Multiple Choice Using the weighted-average method, how many units were in ending work in process inventory? 11,650 units 650 units 250 units Units 300 6,000 350 units 5,650 2 Assume a company uses the weight-average method in its process costing. Its Work in Process T-account for the Refining Department for August is: August 1 balance Materials Direct labor Overhead. August 31 balance Multiple Choice $275,000 The August 1 work in process inventory consisted of 6,000 units with $40,000 in materials cost and $22,000 in conversion cost. The August 1 work in process inventory was 100% complete with respect to materials and 40% complete with respect to conversion. During August 48,000 units were started into production. The August 31 work in process inventory consisted of 8,000 units that were 100% with respect to materials and 60% complete with respect to conversion. What is the cost of beginning work in process inventory plus the cost added during the period for conversion? $265,000 Work in Process: Refining Department 62,000 $203.000 310,000 72,000 181,000 Completed and transferred to Finished Goods Assume the following information: Beginning work in process inventory Units started into production during March Units completed during the period and transferred to the next department Ending work in process inventory Milling Department Milling Department Cost of beginning work in process inventory Costs added during the period Total cost Multiple Choice 6180 uni Units 200 6,200 5,800 600 Using the weighted-average method, what is the equivalent units of production for materials? Percent Complete Materials Conversion 40% 100% 70% Materials Conversion $ 10,000 $ 15,000 290,000 385,000 $300,000 $400,000 30% 100% 60%

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started