Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume a firm which is only active for one period. All investors are risk-neutral, the discount rate is zero, and there are no taxes.

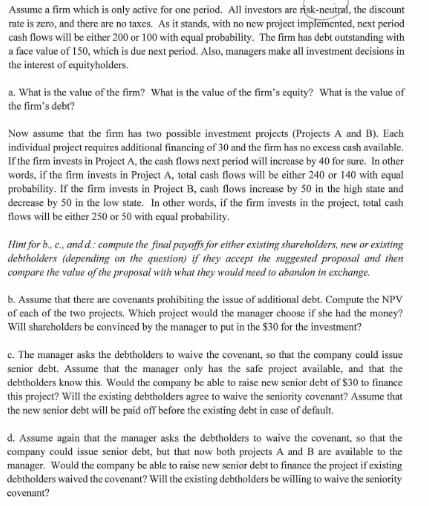

Assume a firm which is only active for one period. All investors are risk-neutral, the discount rate is zero, and there are no taxes. As it stands, with no new project implemented, next period cash flows will be either 200 or 100 with equal probability. The firm has debt outstanding with a face value of 150, which is due next period. Also, managers make all investment decisions in the interest of equityholders. a. What is the value of the firm? What is the value of the firm's equity? What is the value of the firm's debt? Now assume that the firm has two possible investment projects (Projects A and B). Each individual project requires additional financing of 30 and the firm has no excess cash available. If the firm invests in Project A, the cash flows next period will increase by 40 for sure. In other words, if the firm invests in Project A, total cash flows will be either 240 or 140 with equal probability. If the firm invests in Project B, cash flows increase by 50 in the high state and decrease by 50 in the low state. In other words, if the firm invests in the project, total cash flows will be either 250 or 50 with equal probability. Hint for b., c., and d.: compute the final payoffs for either existing shareholders, new or existing debtholders (depending on the question) if they accept the suggested proposal and then compare the value of the proposal with what they would need to abandon in exchange. b. Assume that there are covenants prohibiting the issue of additional debt. Compute the NPV of each of the two projects. Which project would the manager choose if she had the money? Will shareholders be convinced by the manager to put in the $30 for the investment? c. The manager asks the debtholders to waive the covenant, so that the company could issue senior debt. Assume that the manager only has the safe project available, and that the debtholders know this. Would the company be able to raise new senior debt of $30 to finance this project? Will the existing debtholders agree to waive the seniority covenant? Assume that the new senior debt will be paid off before the existing debt in case of default. d. Assume again that the manager asks the debtholders to waive the covenant, so that the company could issue senior debt, but that now both projects A and B are available to the manager. Would the company be able to raise new senior debt to finance the project if existing debtholders waived the covenant? Will the existing debtholders be willing to waive the seniority covenant?

Step by Step Solution

★★★★★

3.44 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

a Without any new projects the firms cash flows next period will be either 200 or 100 with equal pro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started