Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume a Modigliani Miller world without taxes and insolvency costs. You calculated the value of a company called StoneSpring yesterday evening to present to

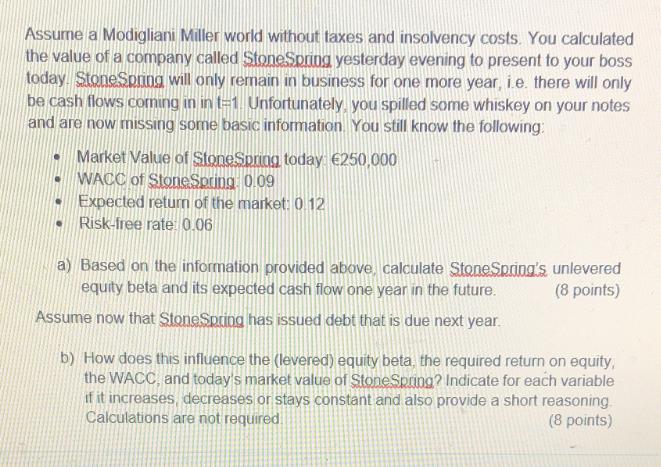

Assume a Modigliani Miller world without taxes and insolvency costs. You calculated the value of a company called StoneSpring yesterday evening to present to your boss today StoneSpring will only remain in business for one more year, i.e. there will only be cash flows coming in in t=1. Unfortunately, you spilled some whiskey on your notes and are now missing some basic information. You still know the following: . Market Value of StoneSpring today: 250,000 WACC of StoneSpring: 0.09 Expected return of the market: 0.12 Risk-free rate: 0.06 a) Based on the information provided above, calculate StoneSpring's equity beta and its expected cash flow one year in the future. Assume now that StoneSpring has issued debt that is due next year. unlevered (8 points) b) How does this influence the (levered) equity beta, the required return on equity, the WACC, and today's market value of StoneSpring? Indicate for each variable if it increases, decreases or stays constant and also provide a short reasoning Calculations are not required (8 points)

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a Unlevered Equity Beta and Expected Cash Flow in One Year To calculate the unlevered equity beta we can use the Hamada equation which is used to find ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started