Answered step by step

Verified Expert Solution

Question

1 Approved Answer

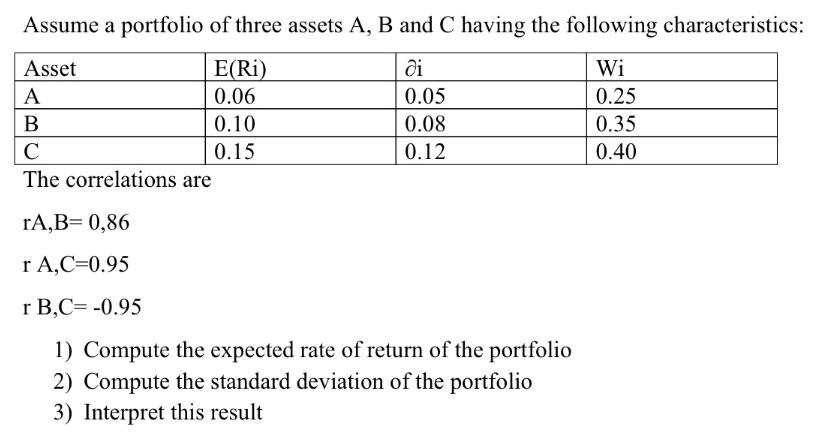

Assume a portfolio of three assets A, B and C having the following characteristics: di Wi 0.05 0.25 0.08 0.35 0.12 0.40 Asset A

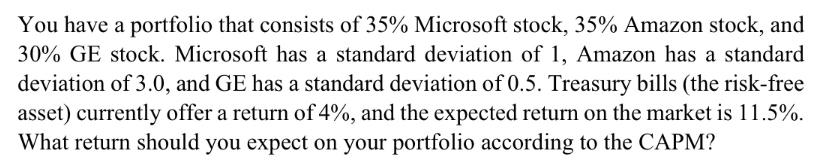

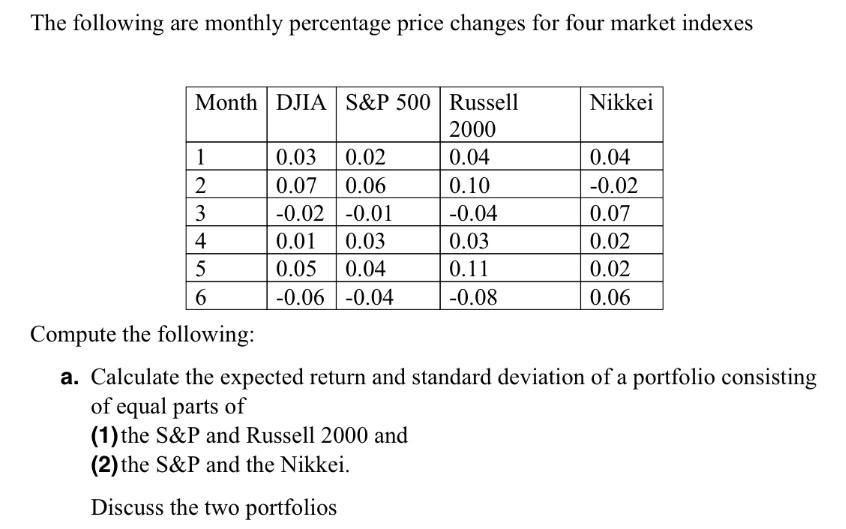

Assume a portfolio of three assets A, B and C having the following characteristics: di Wi 0.05 0.25 0.08 0.35 0.12 0.40 Asset A B E(Ri) 0.06 0.10 0.15 C The correlations are rA,B= 0,86 r A,C=0.95 r B,C= -0.95 1) Compute the expected rate of return of the portfolio 2) Compute the standard deviation of the portfolio 3) Interpret this result You have a portfolio that consists of 35% Microsoft stock, 35% Amazon stock, and 30% GE stock. Microsoft has a standard deviation of 1, Amazon has a standard deviation of 3.0, and GE has a standard deviation of 0.5. Treasury bills (the risk-free asset) currently offer a return of 4%, and the expected return on the market is 11.5%. What return should you expect on your portfolio according to the CAPM? The following are monthly percentage price changes for four market indexes Month DJIA S&P 500 Russell 2000 0.04 0.10 -0.04 0.03 0.11 -0.08 1 2 3 4 5 6 Compute the following: a. Calculate the expected return and standard deviation of a portfolio consisting of equal parts of 0.03 0.02 0.07 0.06 -0.02 -0.01 0.01 0.03 0.05 0.04 -0.06 -0.04 Nikkei (1) the S&P and Russell 2000 and (2) the S&P and the Nikkei. Discuss the two portfolios 0.04 -0.02 0.07 0.02 0.02 0.06

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Here are the stepbystep calculations for the portfolio questions 1 Compute the expected rate of return of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started