Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume a proposed project is being evaluated using the standard method of estimating the initial investment required, annual revenues and expenses, the salvage value at

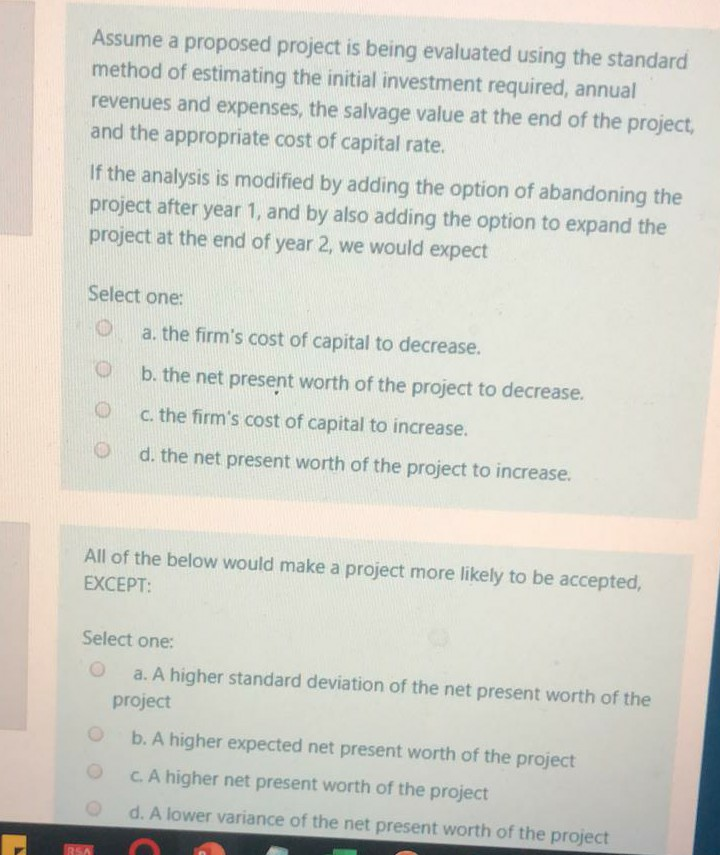

Assume a proposed project is being evaluated using the standard method of estimating the initial investment required, annual revenues and expenses, the salvage value at the end of the project, and the appropriate cost of capital rate. If the analysis is modified by adding the option of abandoning the project after year 1, and by also adding the option to expand the project at the end of year 2, we would expect Select one: O a. the firm's cost of capital to decrease. O b. the net present worth of the project to decrease, c. the firm's cost of capital to increase. O d. the net present worth of the project to increase. All of the below would make a project more likely to be accepted, EXCEPT: Select one: a. A higher standard deviation of the net present worth of the project b. A higher expected net present worth of the project C. A higher net present worth of the project d. A lower variance of the net present worth of the project

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started