Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume a U . S . software firm sells software to an Indian firm in the amount of INR 5 , 0 0 0 ,

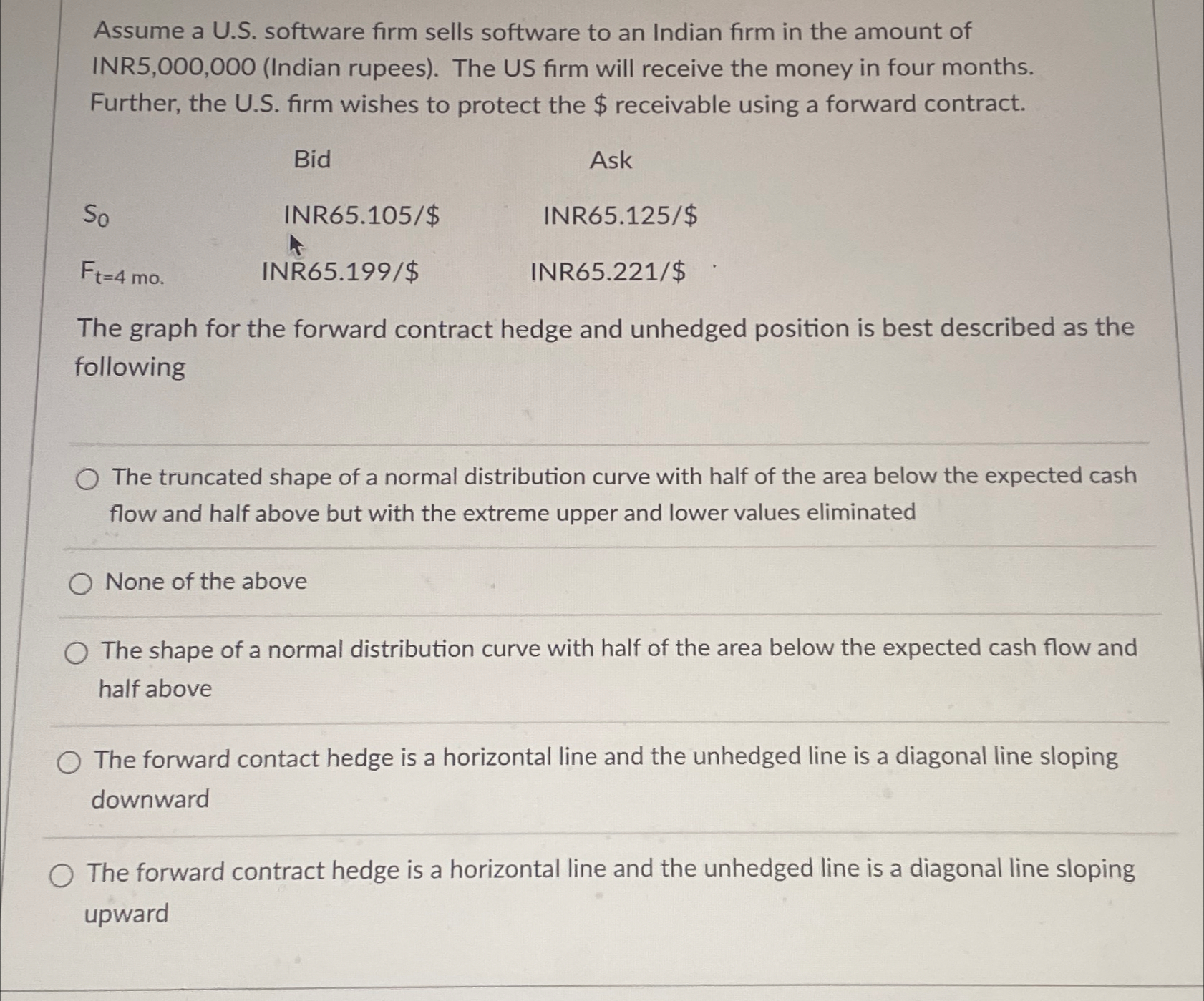

Assume a US software firm sells software to an Indian firm in the amount of INRIndian rupees The US firm will receive the money in four months. Further, the US firm wishes to protect the $ receivable using a forward contract.

tableBid,AskSoINR$INR$INR$INR$

The graph for the forward contract hedge and unhedged position is best described as the following

The truncated shape of a normal distribution curve with half of the area below the expected cash flow and half above but with the extreme upper and lower values eliminated

None of the above

The shape of a normal distribution curve with half of the area below the expected cash flow and half above

The forward contact hedge is a horizontal line and the unhedged line is a diagonal line sloping downward

The forward contract hedge is a horizontal line and the unhedged line is a diagonal line sloping upward

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started