Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume all income, capital gains, interest, salary, dividends and carried interest in private equity funds are taxed at the same rate. No deductions and

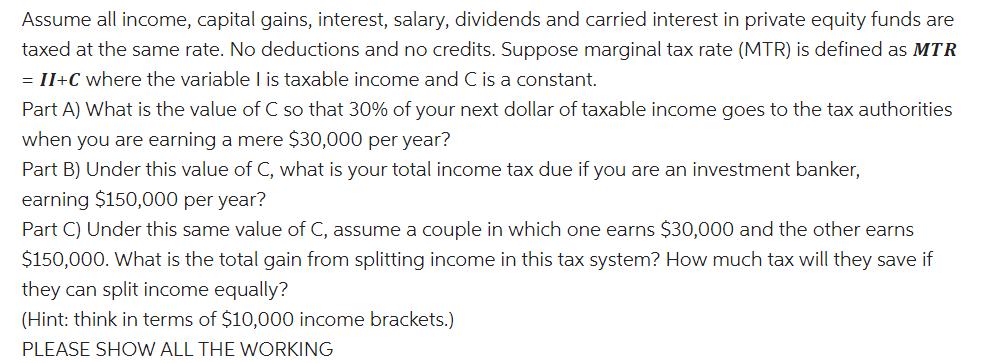

Assume all income, capital gains, interest, salary, dividends and carried interest in private equity funds are taxed at the same rate. No deductions and no credits. Suppose marginal tax rate (MTR) is defined as MTR = II+C where the variable is taxable income and C is a constant. Part A) What is the value of C so that 30% of your next dollar of taxable income goes to the tax authorities when you are earning a mere $30,000 per year? Part B) Under this value of C, what is your total income tax due if you are an investment banker, earning $150,000 per year? Part C) Under this same value of C, assume a couple in which one earns $30,000 and the other earns $150,000. What is the total gain from splitting income in this tax system? How much tax will they save if they can split income equally? (Hint: think in terms of $10,000 income brackets.) PLEASE SHOW ALL THE WORKING

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

A If your taxable income is 30 000 then your marginal tax r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started