Assume an environment of rising prices. Would DDSs retained earnings be higher, lower, or the same if they valued their inventory using FIFO, Why?

Assume an environment of rising prices. Would DDSs retained earnings be higher, lower, or the same if they valued their inventory using FIFO, Why?

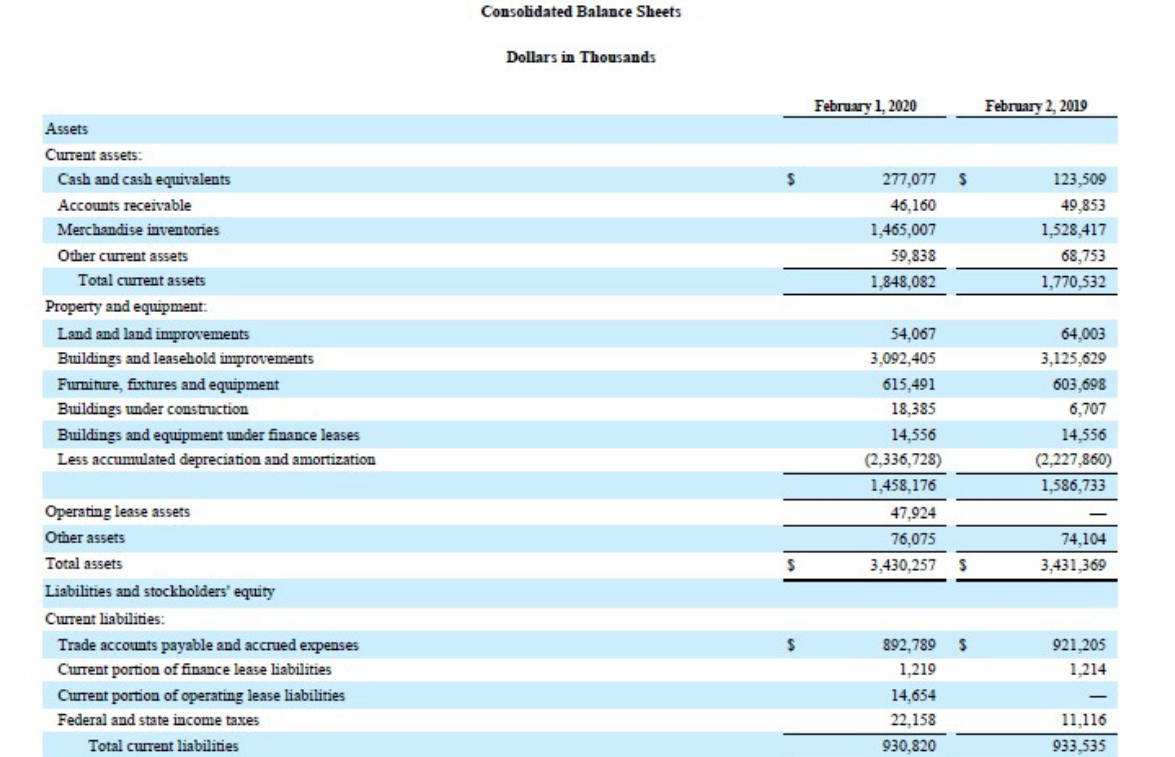

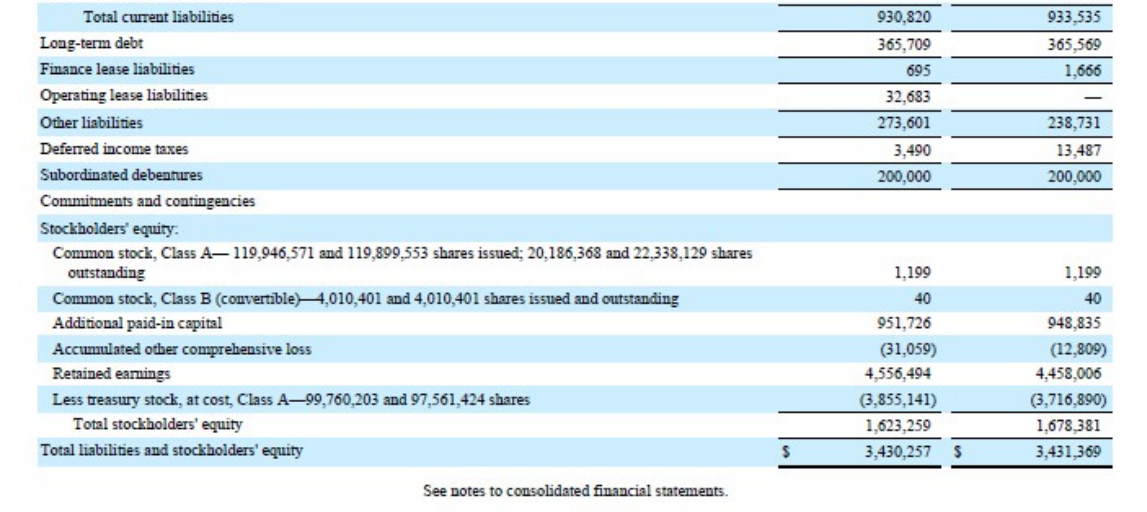

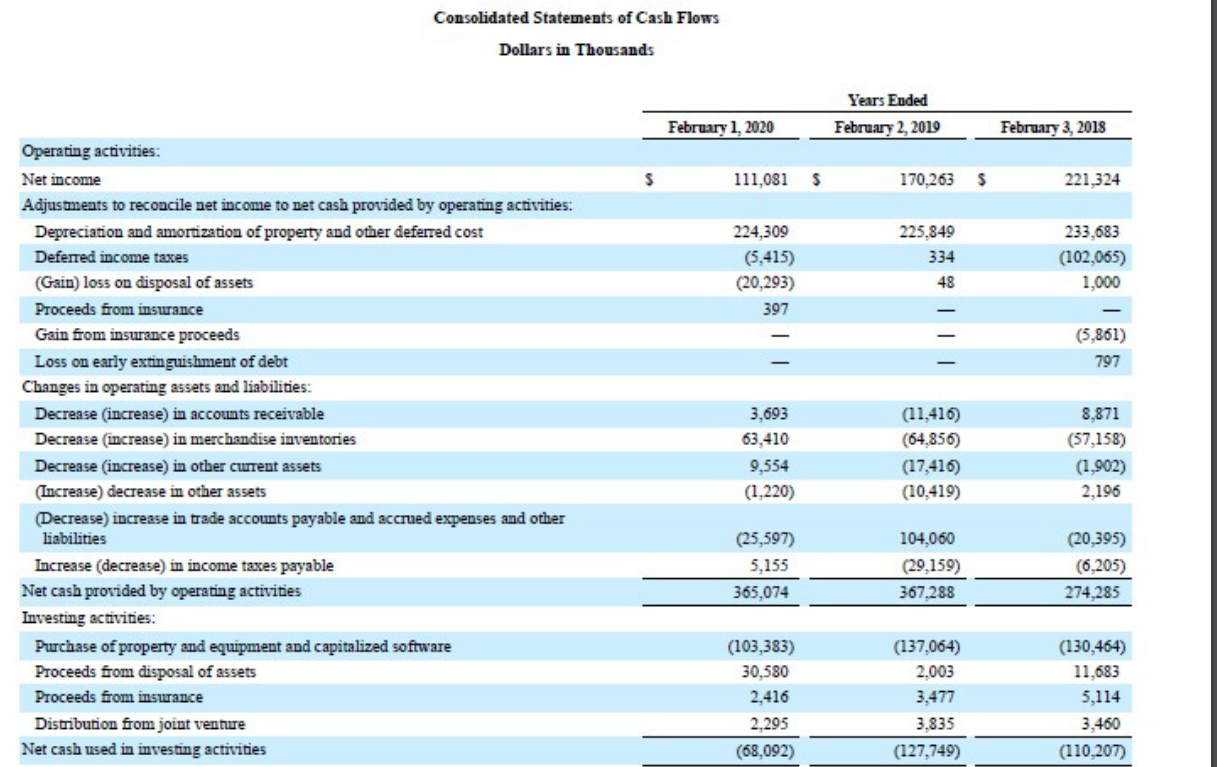

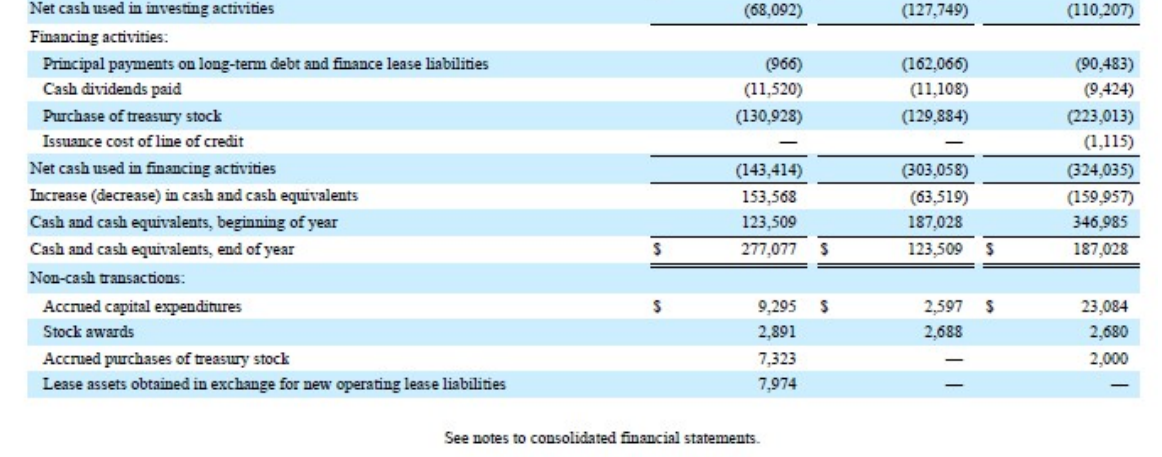

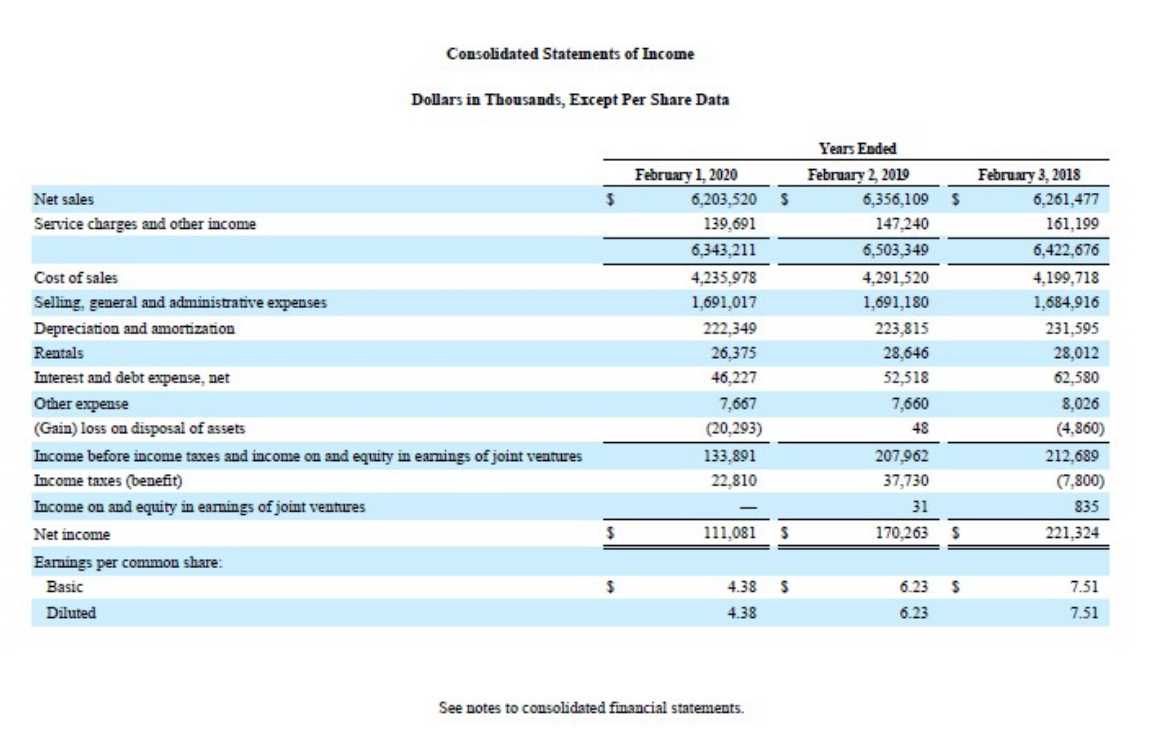

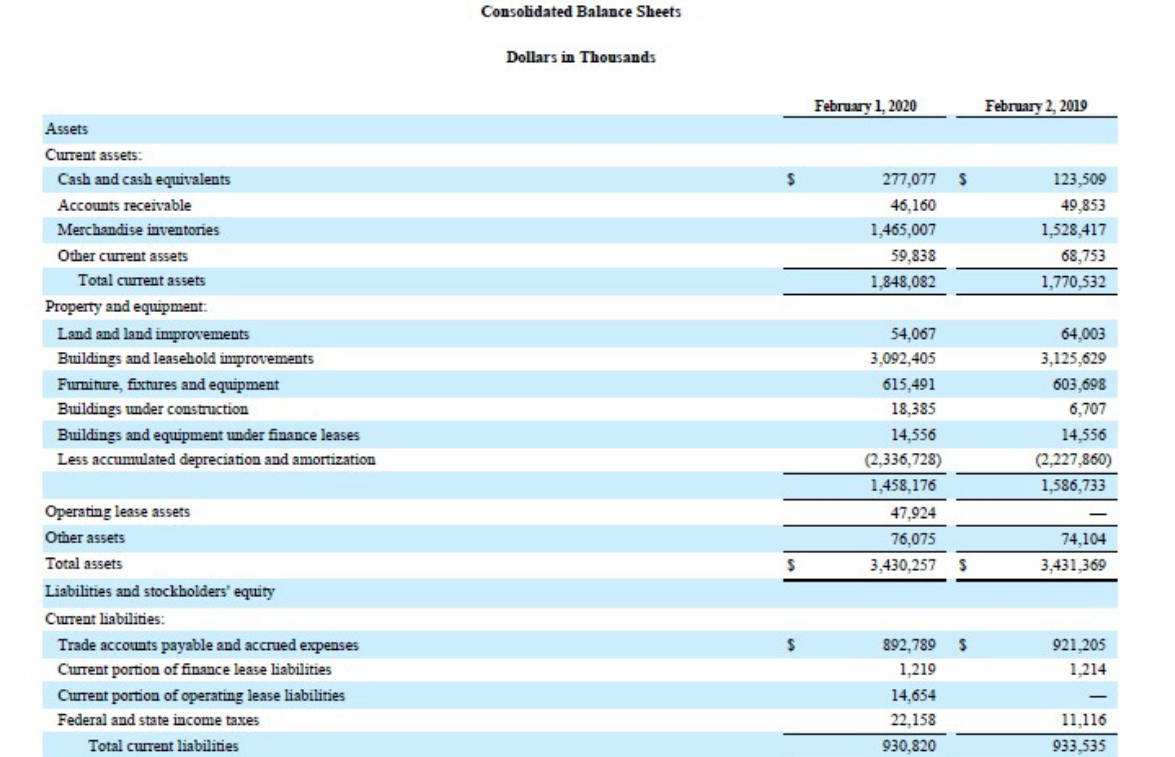

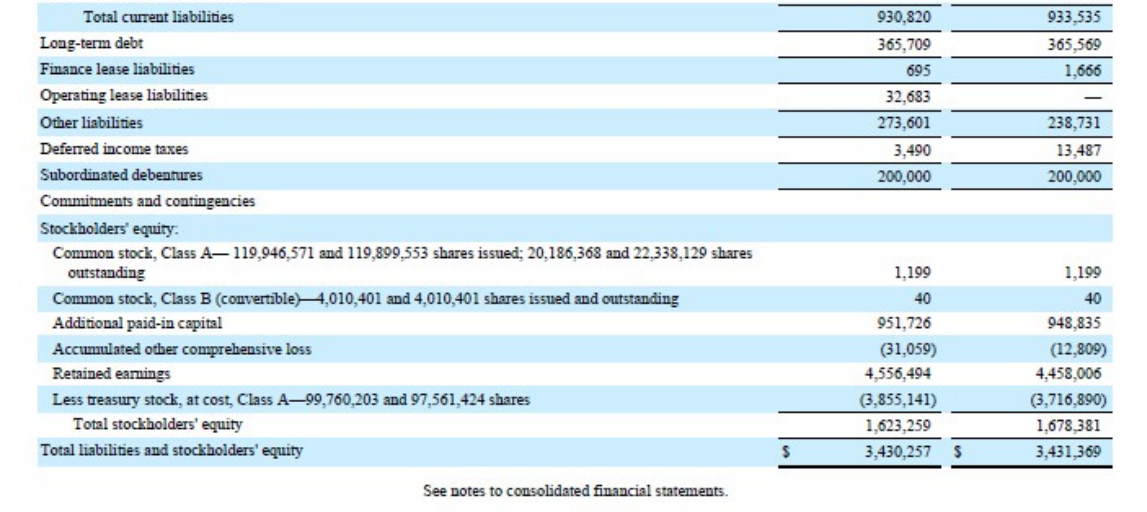

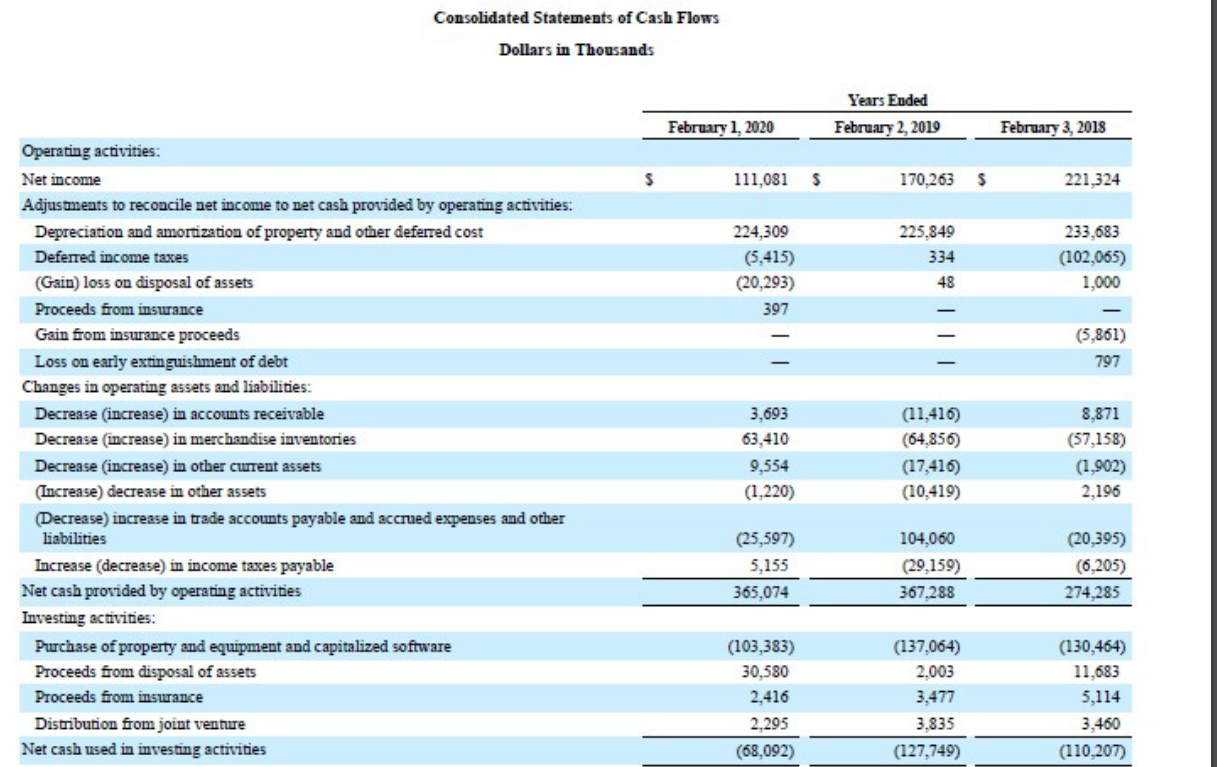

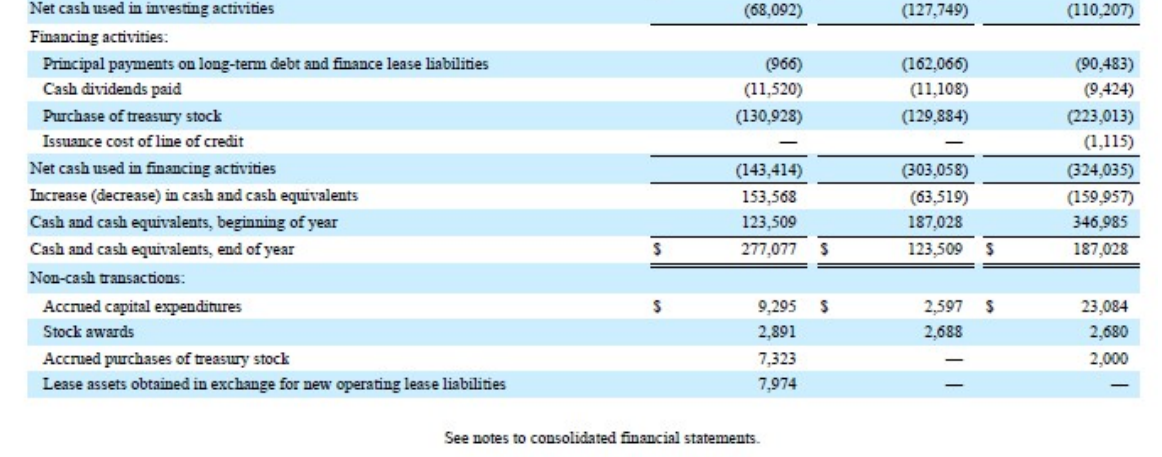

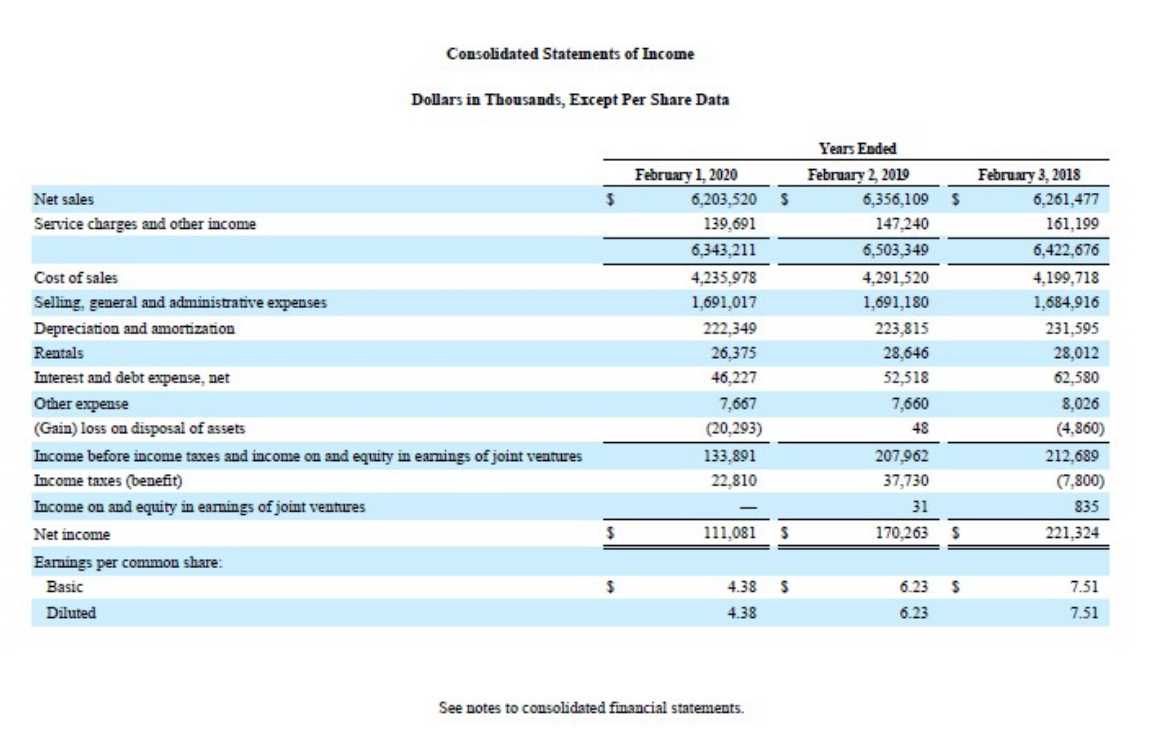

Consolidated Balance Sheets Dollars in Thousands February 1, 2020 February 2, 2019 $ $ 277,077 46,160 1,465,007 59,838 1,848,082 123,509 49,853 1,528,417 68,753 1,770,532 Assets Current assets: Cash and cash equivalents Accounts receivable Merchandise inventories Other current assets Total curent assets Property and equipment: Land and land improvements Buildings and leasehold improvements Furniture, fixtures and equipment Buildings under construction Buildings and equipment under finance leases Less accumulated depreciation and amortization 54,067 3,092,405 615,491 18,385 14,556 (2.336,728) 1,458,176 47,924 76,075 3,430,257 64,003 3,125,629 603,698 6,707 14,556 (2,227,860) 1,586,733 74,104 3,431,369 $ $ Operating lease assets Other assets Total assets Liabilities and stockholders' equity Current liabilities: Trade accounts payable and accrued expenses Curent portion of finance lease liabilities Current portion of operating lease liabilities Federal and state income taxes Total current liabilities $ $ 921,205 1,214 892,789 1,219 14,654 22.158 930,820 11,116 933,535 933,535 365,569 1,666 930,820 365,709 695 32,683 273,601 3,490 200,000 238,731 13,487 200,000 Total curent liabilities Long-term debt Finance lease liabilities Operating lease liabilities Other liabilities Deferred income taxes Subordinated debentures Commitments and contingencies Stockholders' equiry Common stock, Class A - 119,946,571 and 119,899,553 shares issued: 20,186,368 and 22,338,129 shares outstanding Common stock, Class B (convertible)44,010,401 and 4,010,401 shares issued and outstanding Additional paid-in capital Accumulated other comprehensive loss Retained earnings Less treasury stock, at cost, Class A99,760,203 and 97,561,424 shares Total stockholders' equity Total liabilities and stockholders' equity 1,199 40 951,726 (31,059) 4,556,494 (3,855,141) 1,623,259 3,430,257 1,199 40 948,835 (12,809) 4,458,006 (3,716,890) 1,678,381 3,431,369 $ $ See notes to consolidated financial statements. Consolidated Statements of Cash Flows Dollars in Thousands Years Ended February 2, 2019 February 1, 2020 February 3, 2018 $ 111,081 $ 170,263 $ 221,324 224,309 (5,415) (20,293) 397 225,849 334 48 233,683 (102,065) 1,000 (5,861) 797 Operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization of property and other deferred cost Deferred income taxes (Gain) loss on disposal of assets Proceeds from insurance Gain from insurance proceeds Loss on early extinguishment of debt Changes in operating assets and liabilities: Decrease increase) in accounts receivable Decrease increase) in merchandise inventories Decrease increase) in other curent assets (Increase) decrease in other assets (Decrease) increase in trade accounts payable and accrued expenses and other liabilities Increase (decrease) in income taxes payable Net cash provided by operating activities Investing activities: Purchase of property and equipment and capitalized software Proceeds from disposal of assets Proceeds from insurance Distribution from joint venture Net cash used in investing activities 3,693 63,410 9,554 (1,220) (11,410) (64.856) (17,416) (10,419) 8,871 (57,158) (1,902) 2,196 (25,597) 5,155 365,074 104,060 (29,159) 367.288 (20,395) (6,205) 274,285 (103,383) 30,580 2,416 2,295 (68,092) (137,064) 2.003 3,477 3,835 (127,749) (130,464) 11,683 5,114 3,460 (110,207) (68,092) (127,749) (110,207) (966) (11,520) (130,928) (162,066) (11,108) (129,884) Net cash used in investing activities Financing activities: Principal payments on long-term debt and finance lease liabilities Cash dividends paid Purchase of treasury stock Issuance cost of line of credit Net cash used in financing activities Increase (decrease) in cash and cash equivalents Cash and cash equivalents, beginning of year Cash and cash equivalents, end of year Non-cash transactions: Accrued capital expenditures Stock awards Accrued purchases of treasury stock Lease assets obtained in exchange for new operating lease liabilities (90,483) (9,424) (223,013) (1,115) (324,035) (159,957) 346,985 187,028 (143,414) 153,568 123,509 277,077 (303,058) (63,519) 187,028 123,509 $ $ $ $ $ 2.597 2.688 9,295 2,891 7,323 7,974 23,084 2,680 2,000 See notes to consolidated financial statements Consolidated Statements of Income Dollars in Thousands, Except Per Share Data $ $ $ Net sales Service charges and other income Cost of sales Selling, general and administrative expenses Depreciation and amortization Rentals Interest and debt expense, net Other expense (Gain) loss on disposal of assets Income before income taxes and income on and equity in earnings of joint ventures Income taxes (benefit) Income on and equity in earnings of joint ventures Net income Earings per common share: Basic Diluted February 1, 2020 6,203,520 139,691 6.343.211 4,235,978 1,691,017 222,349 26.375 46,227 7,667 (20,293) 133,891 22.810 Years Ended February 2, 2019 6,356,109 147,240 6,503,349 4,291,520 1,691,180 223,815 28,646 52,518 7,660 48 207,962 37,730 31 170,263 February 3, 2018 6,261,477 161,199 6,422,676 4,199,718 1,684,916 231,595 28,012 62,580 8,026 (4.860) 212,689 (7,800) 835 221,324 $ 111,081 $ $ $ 4.38 $ 6.23 $ 7.51 7.51 4.38 6.23 See notes to consolidated financial statements

Assume an environment of rising prices. Would DDSs retained earnings be higher, lower, or the same if they valued their inventory using FIFO, Why?

Assume an environment of rising prices. Would DDSs retained earnings be higher, lower, or the same if they valued their inventory using FIFO, Why?