Answered step by step

Verified Expert Solution

Question

1 Approved Answer

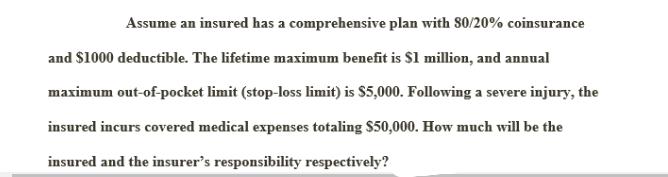

Assume an insured has a comprehensive plan with 80/20% coinsurance and $1000 deductible. The lifetime maximum benefit is $1 million, and annual maximum out-of-pocket

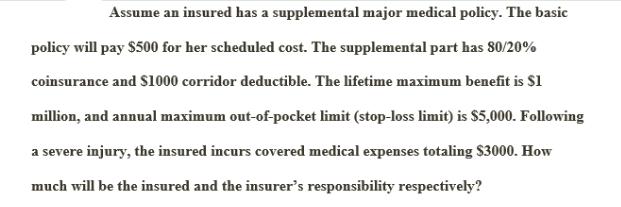

Assume an insured has a comprehensive plan with 80/20% coinsurance and $1000 deductible. The lifetime maximum benefit is $1 million, and annual maximum out-of-pocket limit (stop-loss limit) is $5,000. Following a severe injury, the insured incurs covered medical expenses totaling $50,000. How much will be the insured and the insurer's responsibility respectively? Assume an insured has a supplemental major medical policy. The basic policy will pay $500 for her scheduled cost. The supplemental part has 80/20% coinsurance and $1000 corridor deductible. The lifetime maximum benefit is $1 million, and annual maximum out-of-pocket limit (stop-loss limit) is $5,000. Following a severe injury, the insured incurs covered medical expenses totaling $3000. How much will be the insured and the insurer's responsibility respectively?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Case 1 Comprehensive Plan Given Coinsurance 8020 Deductible 1000 Lifetime Maximum Benefit 1 million Annual Maximum OutofPocket Limit StopLoss Limit 50...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started