Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume an investor acquired 100% of the voting common stock of an investee on January X1, 2012 in a transaction that qualifies as a

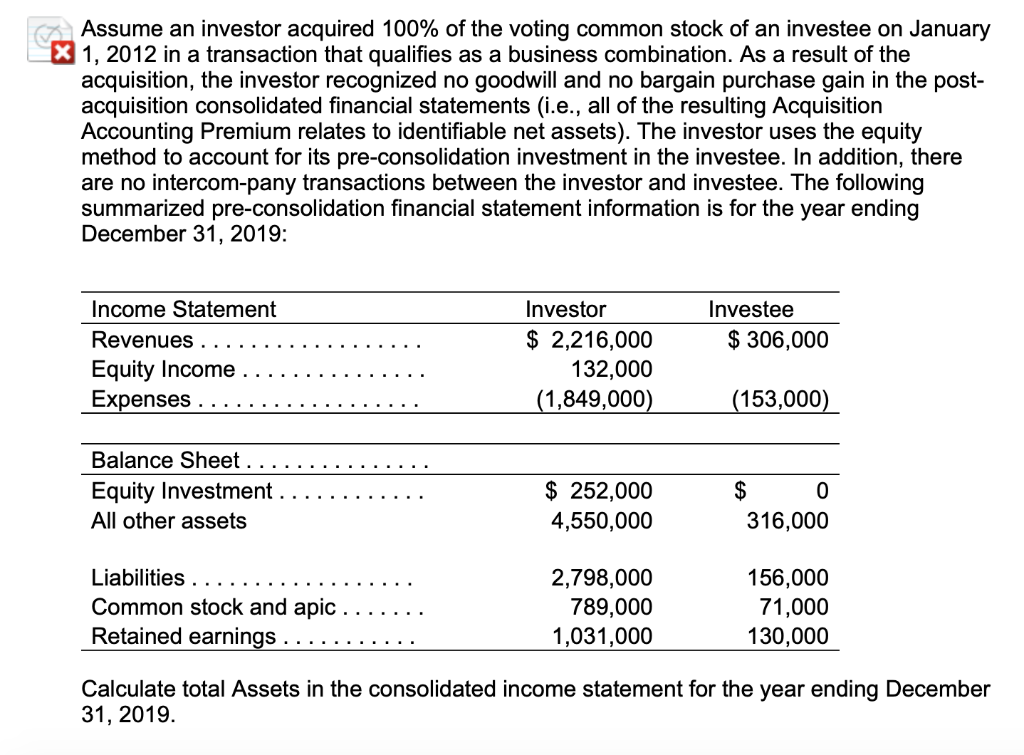

Assume an investor acquired 100% of the voting common stock of an investee on January X1, 2012 in a transaction that qualifies as a business combination. As a result of the acquisition, the investor recognized no goodwill and no bargain purchase gain in the post- acquisition consolidated financial statements (i.e., all of the resulting Acquisition Accounting Premium relates to identifiable net assets). The investor uses the equity method to account for its pre-consolidation investment in the investee. In addition, there are no intercom-pany transactions between the investor and investee. The following summarized pre-consolidation financial statement information is for the year ending December 31, 2019: Income Statement Revenues Equity Income Expenses Balance Sheet. Equity Investment All other assets Liabilities Common stock and apic Retained earnings Investor $ 2,216,000 132,000 (1,849,000) $ 252,000 4,550,000 2,798,000 789,000 1,031,000 Investee $ 306,000 (153,000) $ 0 316,000 156,000 71,000 130,000 Calculate total Assets in the consolidated income statement for the year ending December 31, 2019.

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER 4550000 316000 4866000 EXPLAN...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started