Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume an M&M world with taxes. Your company's EBIT is currently $ 2 0 , 0 0 0 , 0 0 0 , and EBIT

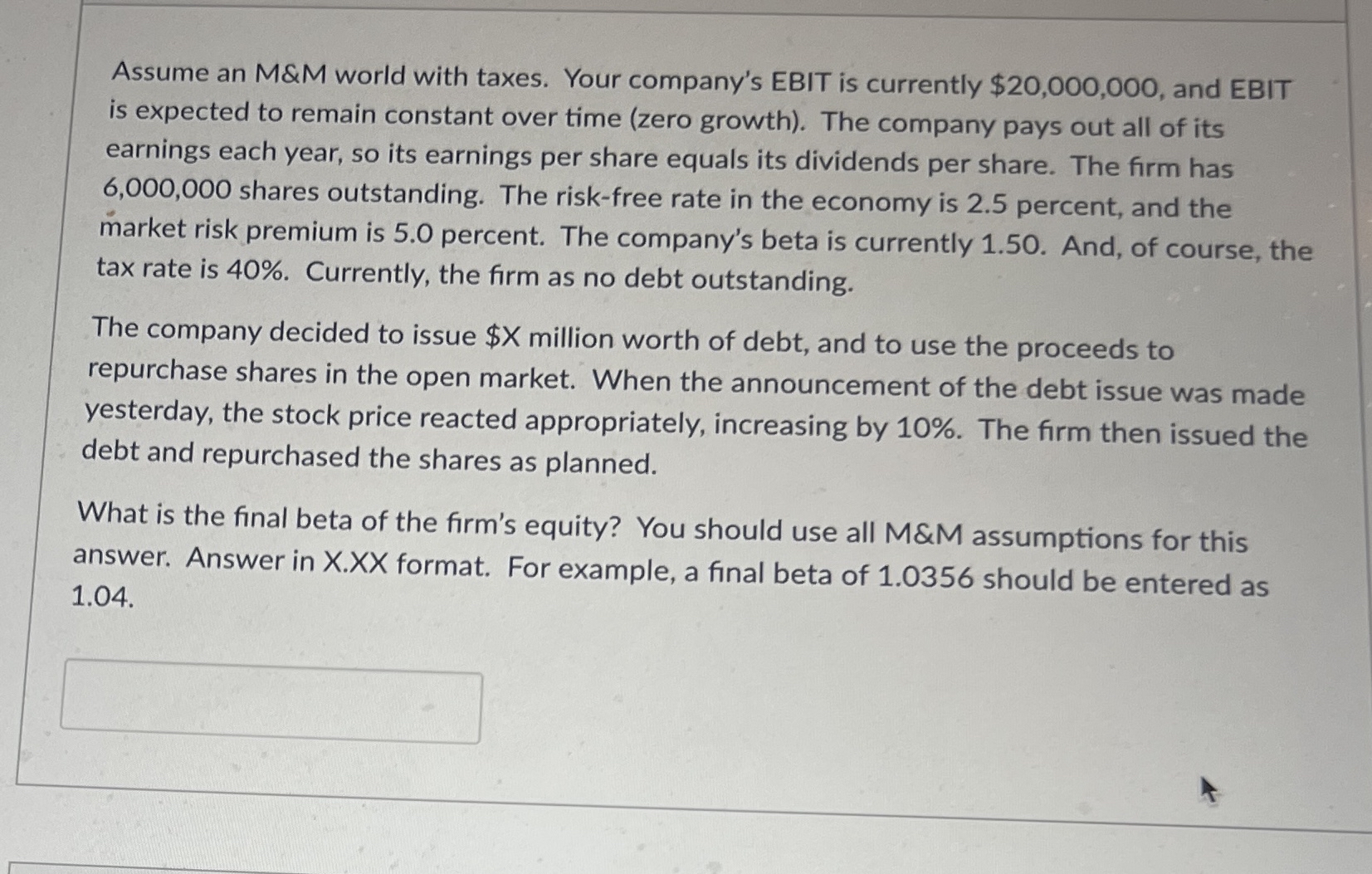

Assume an M&M world with taxes. Your company's EBIT is currently $ and EBIT is expected to remain constant over time zero growth The company pays out all of its earnings each year, so its earnings per share equals its dividends per share. The firm has shares outstanding. The riskfree rate in the economy is percent, and the market risk premium is percent. The company's beta is currently And, of course, the tax rate is Currently, the firm as no debt outstanding.

The company decided to issue $ million worth of debt, and to use the proceeds to repurchase shares in the open market. When the announcement of the debt issue was made yesterday, the stock price reacted appropriately, increasing by The firm then issued the debt and repurchased the shares as planned.

What is the final beta of the firm's equity? You should use all M&M assumptions for this answer. Answer in XXX format. For example, a final beta of should be entered as

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started