Answered step by step

Verified Expert Solution

Question

1 Approved Answer

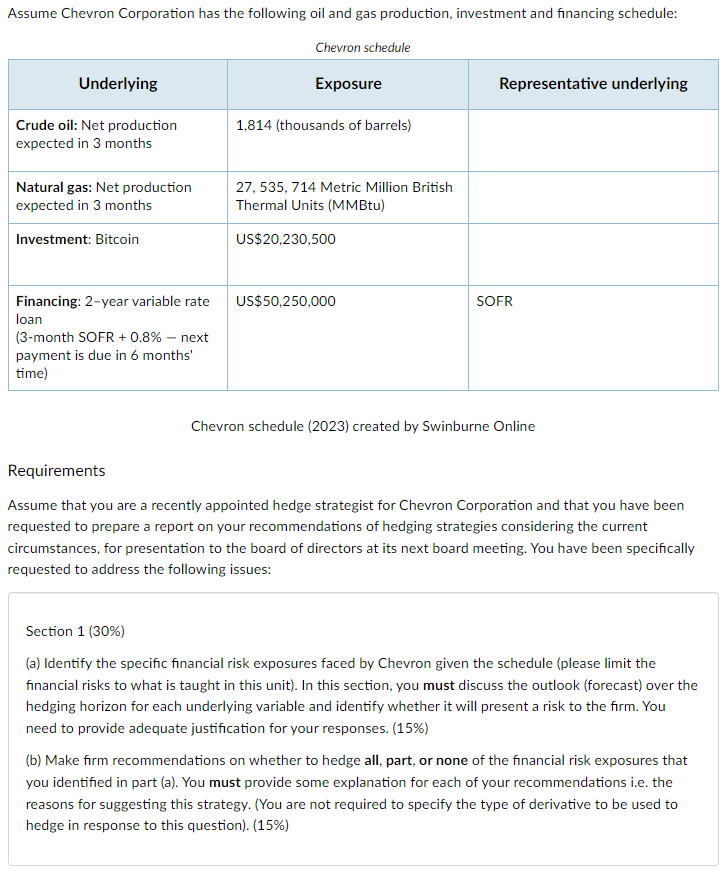

Assume Chevron Corporation has the following oil and gas production, investment and financing schedule: Chevron schedule Underlying Crude oil: Net production expected in 3

Assume Chevron Corporation has the following oil and gas production, investment and financing schedule: Chevron schedule Underlying Crude oil: Net production expected in 3 months Natural gas: Net production expected in 3 months Investment: Bitcoin Financing: 2-year variable rate loan (3-month SOFR + 0.8% - next payment is due in 6 months' time) Exposure 1,814 (thousands of barrels) 27, 535, 714 Metric Million British Thermal Units (MMBtu) US$20,230,500 US$50,250,000 Representative underlying SOFR Chevron schedule (2023) created by Swinburne Online Requirements Assume that you are a recently appointed hedge strategist for Chevron Corporation and that you have been requested to prepare a report on your recommendations of hedging strategies considering the current circumstances, for presentation to the board of directors at its next board meeting. You have been specifically requested to address the following issues: Section 1 (30%) (a) Identify the specific financial risk exposures faced by Chevron given the schedule (please limit the financial risks to what is taught in this unit). In this section, you must discuss the outlook (forecast) over the hedging horizon for each underlying variable and identify whether it will present a risk to the firm. You need to provide adequate justification for your responses. (15%) (b) Make firm recommendations on whether to hedge all, part, or none of the financial risk exposures that you identified in part (a). You must provide some explanation for each of your recommendations i.e. the reasons for suggesting this strategy. (You are not required to specify the type of derivative to be used to hedge in response to this question). (15%)

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Section 1 Financial Risk Exposures and Recommendations a Financial Risk Exposures 1 Crude Oil Production The forecasted net production of crude oil in 3 months is 1814 thousand barrels The financial r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started