Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume Company S1 sells land for $750,000 cash (with a carrying value of $ 150,000) to Company S2- neither are in real estate business

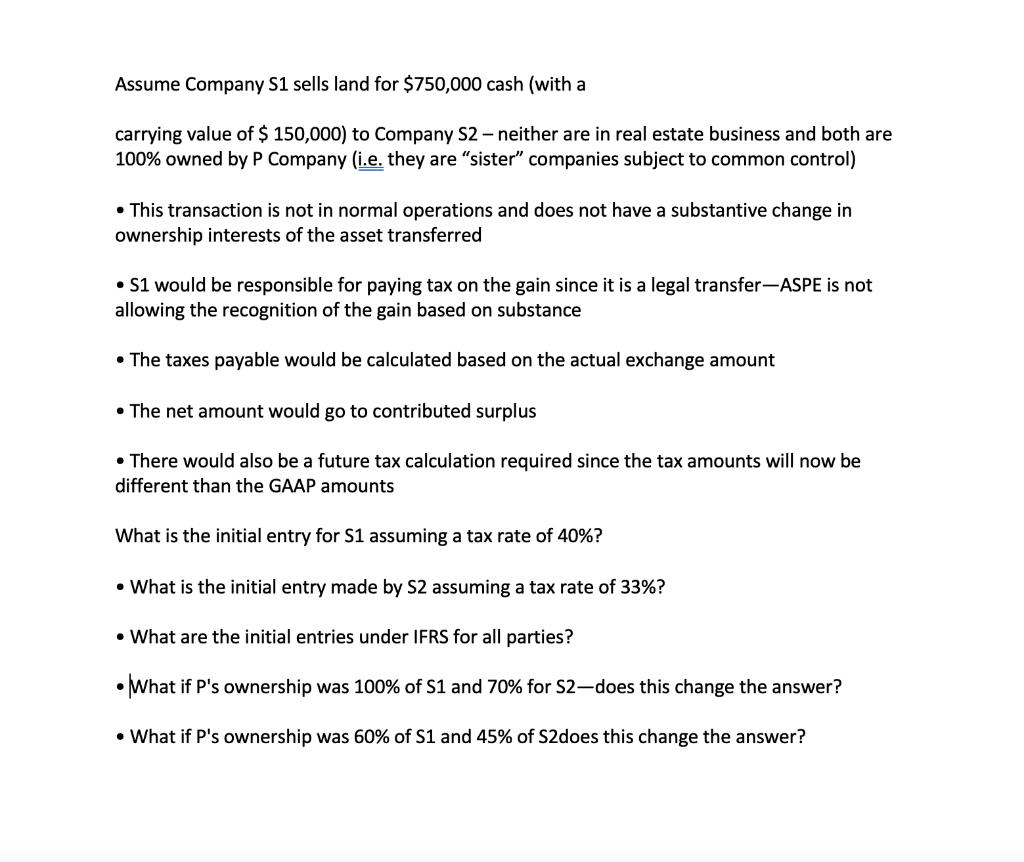

Assume Company S1 sells land for $750,000 cash (with a carrying value of $ 150,000) to Company S2- neither are in real estate business and both are 100% owned by P Company (i.e. they are "sister" companies subject to common control) This transaction is not in normal operations and does not have a substantive change in ownership interests of the asset transferred S1 would be responsible for paying tax on the gain since it is a legal transfer-ASPE is not allowing the recognition of the gain based on substance The taxes payable would be calculated based on the actual exchange amount The net amount would go to contributed surplus There would also be a future tax calculation required since the tax amounts will now be different than the GAAP amounts What is the initial entry for S1 assuming a tax rate of 40%? What is the initial entry made by S2 assuming a tax rate of 33%? What are the initial entries under IFRS for all parties? What if P's ownership was 100% of S1 and 70% for S2-does this change the answer? What if P's ownership was 60% of S1 and 45% of S2does this change the answer?

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started