Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume (1) a company's plantwide predetermined overheed rate is $13.00 per direct labor-hout, and 2) to job cost sheet for Job X shows that

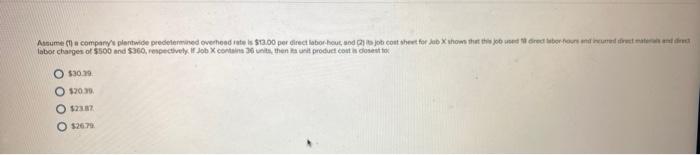

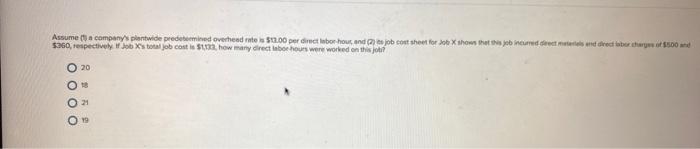

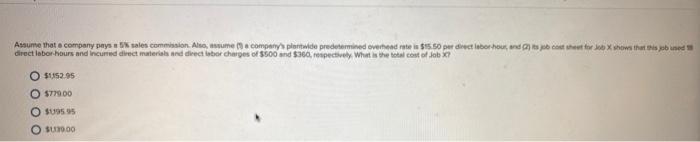

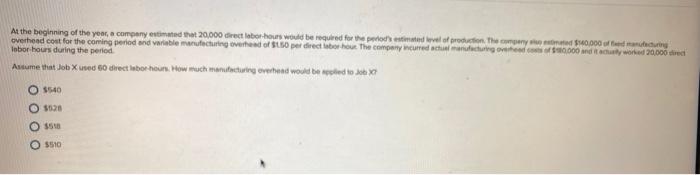

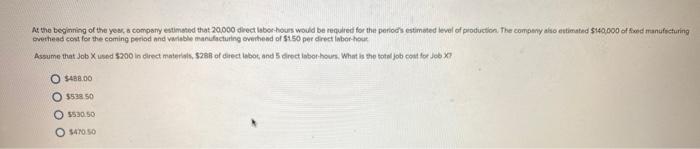

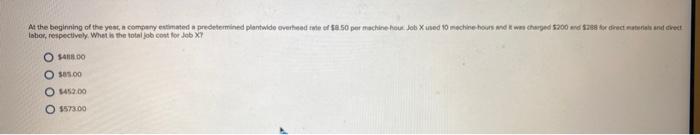

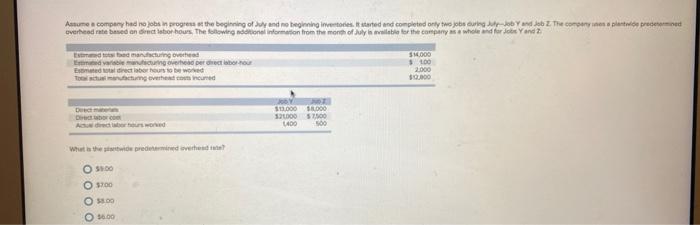

Assume (1) a company's plantwide predetermined overheed rate is $13.00 per direct labor-hout, and 2) to job cost sheet for Job X shows that this job used to direct labor-hours and incurred direct mater and direct labor charges of $500 and $360, respectively if Job X contains 36 units, then its unit product cost is closest to O$30.39 O $20.39 O$2387 O$2679 Assume (1) a company's plentwide predetermined overhead rate is $13.00 per direct labor-hour, and (2) es job cost sheet for Job X shows that this job incurred direct materials and direct labor charges of $500 and $360, respectively if Job X's total job cost is $1,133, how many direct labor hours were worked on this job? 0 000 0 20 21 Assume that a company pays a 5% sales commission. Also, assume a company's plantaldo predetermined overhead rate is $15.50 per direct labor hour, and 2) s job cost sheet for Job X shows that this job used direct labor-hours and incurred direct materials and direct labor charges of $500 and $360, respectively. What is the total cost of Job ? $1,152.95 O$779.00 $195.95 O $130.00 At the beginning of the year, a company estimated that 20,000 direct labor-hours would be required for the period's estimated level of production. The compeny sioextmated $140,000 of fed manufacturing overhead cost for the coming period and variable manufacturing overhead of $1.50 per direct labor hour. The company incurred actual manufacturing overhead costs of $80,000 and it actually worked 20,000 direct labor hours during the period. Assume that Job X used 60 direct labor hours. How much manufacturing overhead would be appl $540 $528 $518 $510 At the beginning of the year, a company estimated that 20.000 direct labor-hours would be required for the period's estimated level of production. The company also estimated $140,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $150 per direct labor-hour Assume that Job X used $200 in direct materials, $288 of direct labot, and 5 direct labor-hours. What is the total job cost for Job X7 O$488.00 O $538.50 O$530.50 $470.50 At the beginning of the year, a company estimated a predetermined plantwide overheed rate of $8.50 per machine hour Job X used 10 mechine-hours and it was charged $200 and $288 for direct materials and direct labor, respectively. Whet is the total job cost for Job X O $408.00 O $85.00 O $452.00 O $573.00 Assume a company had no jobs in progress at the beginning of July and no beginning inventories. It started and completed only two jobs during July-Job Y and Job Z. The company iness plantwide predetermined overhead rate based on direct Isbor hours. The following additional information from the month of July is available for the company as a whole and for Jobs Y and 2 Estand total food manufacturing overhead Estimated variable manufacturing overhead per direct labor-hour Estimated total direct labor hours to be worked To actual manufactumg overheat costs incurred Drect mater Director com What is the stwide predetermined overhead O $9:00 O $700 O $8.00 O $6.00 201 ROY $13,000 $8,000 121000 1400 $7,500 500 $14,000 $100 2,000 $12,000 Assume (1) a company's plantwide predetermined overheed rate is $13.00 per direct labor-hout, and 2) to job cost sheet for Job X shows that this job used to direct labor-hours and incurred direct mater and direct labor charges of $500 and $360, respectively if Job X contains 36 units, then its unit product cost is closest to O$30.39 O $20.39 O$2387 O$2679 Assume (1) a company's plentwide predetermined overhead rate is $13.00 per direct labor-hour, and (2) es job cost sheet for Job X shows that this job incurred direct materials and direct labor charges of $500 and $360, respectively if Job X's total job cost is $1,133, how many direct labor hours were worked on this job? 0 000 0 20 21 Assume that a company pays a 5% sales commission. Also, assume a company's plantaldo predetermined overhead rate is $15.50 per direct labor hour, and 2) s job cost sheet for Job X shows that this job used direct labor-hours and incurred direct materials and direct labor charges of $500 and $360, respectively. What is the total cost of Job ? $1,152.95 O$779.00 $195.95 O $130.00 At the beginning of the year, a company estimated that 20,000 direct labor-hours would be required for the period's estimated level of production. The compeny sioextmated $140,000 of fed manufacturing overhead cost for the coming period and variable manufacturing overhead of $1.50 per direct labor hour. The company incurred actual manufacturing overhead costs of $80,000 and it actually worked 20,000 direct labor hours during the period. Assume that Job X used 60 direct labor hours. How much manufacturing overhead would be appl $540 $528 $518 $510 At the beginning of the year, a company estimated that 20.000 direct labor-hours would be required for the period's estimated level of production. The company also estimated $140,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $150 per direct labor-hour Assume that Job X used $200 in direct materials, $288 of direct labot, and 5 direct labor-hours. What is the total job cost for Job X7 O$488.00 O $538.50 O$530.50 $470.50 At the beginning of the year, a company estimated a predetermined plantwide overheed rate of $8.50 per machine hour Job X used 10 mechine-hours and it was charged $200 and $288 for direct materials and direct labor, respectively. Whet is the total job cost for Job X O $408.00 O $85.00 O $452.00 O $573.00 Assume a company had no jobs in progress at the beginning of July and no beginning inventories. It started and completed only two jobs during July-Job Y and Job Z. The company iness plantwide predetermined overhead rate based on direct Isbor hours. The following additional information from the month of July is available for the company as a whole and for Jobs Y and 2 Estand total food manufacturing overhead Estimated variable manufacturing overhead per direct labor-hour Estimated total direct labor hours to be worked To actual manufactumg overheat costs incurred Drect mater Director com What is the stwide predetermined overhead O $9:00 O $700 O $8.00 O $6.00 201 ROY $13,000 $8,000 121000 1400 $7,500 500 $14,000 $100 2,000 $12,000 Assume (1) a company's plantwide predetermined overheed rate is $13.00 per direct labor-hout, and 2) to job cost sheet for Job X shows that this job used to direct labor-hours and incurred direct mater and direct labor charges of $500 and $360, respectively if Job X contains 36 units, then its unit product cost is closest to O$30.39 O $20.39 O$2387 O$2679 Assume (1) a company's plentwide predetermined overhead rate is $13.00 per direct labor-hour, and (2) es job cost sheet for Job X shows that this job incurred direct materials and direct labor charges of $500 and $360, respectively if Job X's total job cost is $1,133, how many direct labor hours were worked on this job? 0 000 0 20 21 Assume that a company pays a 5% sales commission. Also, assume a company's plantaldo predetermined overhead rate is $15.50 per direct labor hour, and 2) s job cost sheet for Job X shows that this job used direct labor-hours and incurred direct materials and direct labor charges of $500 and $360, respectively. What is the total cost of Job ? $1,152.95 O$779.00 $195.95 O $130.00 At the beginning of the year, a company estimated that 20,000 direct labor-hours would be required for the period's estimated level of production. The compeny sioextmated $140,000 of fed manufacturing overhead cost for the coming period and variable manufacturing overhead of $1.50 per direct labor hour. The company incurred actual manufacturing overhead costs of $80,000 and it actually worked 20,000 direct labor hours during the period. Assume that Job X used 60 direct labor hours. How much manufacturing overhead would be appl $540 $528 $518 $510 At the beginning of the year, a company estimated that 20.000 direct labor-hours would be required for the period's estimated level of production. The company also estimated $140,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $150 per direct labor-hour Assume that Job X used $200 in direct materials, $288 of direct labot, and 5 direct labor-hours. What is the total job cost for Job X7 O$488.00 O $538.50 O$530.50 $470.50 At the beginning of the year, a company estimated a predetermined plantwide overheed rate of $8.50 per machine hour Job X used 10 mechine-hours and it was charged $200 and $288 for direct materials and direct labor, respectively. Whet is the total job cost for Job X O $408.00 O $85.00 O $452.00 O $573.00 Assume a company had no jobs in progress at the beginning of July and no beginning inventories. It started and completed only two jobs during July-Job Y and Job Z. The company iness plantwide predetermined overhead rate based on direct Isbor hours. The following additional information from the month of July is available for the company as a whole and for Jobs Y and 2 Estand total food manufacturing overhead Estimated variable manufacturing overhead per direct labor-hour Estimated total direct labor hours to be worked To actual manufactumg overheat costs incurred Drect mater Director com What is the stwide predetermined overhead O $9:00 O $700 O $8.00 O $6.00 201 ROY $13,000 $8,000 121000 1400 $7,500 500 $14,000 $100 2,000 $12,000 Assume (1) a company's plantwide predetermined overheed rate is $13.00 per direct labor-hout, and 2) to job cost sheet for Job X shows that this job used to direct labor-hours and incurred direct mater and direct labor charges of $500 and $360, respectively if Job X contains 36 units, then its unit product cost is closest to O$30.39 O $20.39 O$2387 O$2679 Assume (1) a company's plentwide predetermined overhead rate is $13.00 per direct labor-hour, and (2) es job cost sheet for Job X shows that this job incurred direct materials and direct labor charges of $500 and $360, respectively if Job X's total job cost is $1,133, how many direct labor hours were worked on this job? 0 000 0 20 21 Assume that a company pays a 5% sales commission. Also, assume a company's plantaldo predetermined overhead rate is $15.50 per direct labor hour, and 2) s job cost sheet for Job X shows that this job used direct labor-hours and incurred direct materials and direct labor charges of $500 and $360, respectively. What is the total cost of Job ? $1,152.95 O$779.00 $195.95 O $130.00 At the beginning of the year, a company estimated that 20,000 direct labor-hours would be required for the period's estimated level of production. The compeny sioextmated $140,000 of fed manufacturing overhead cost for the coming period and variable manufacturing overhead of $1.50 per direct labor hour. The company incurred actual manufacturing overhead costs of $80,000 and it actually worked 20,000 direct labor hours during the period. Assume that Job X used 60 direct labor hours. How much manufacturing overhead would be appl $540 $528 $518 $510 At the beginning of the year, a company estimated that 20.000 direct labor-hours would be required for the period's estimated level of production. The company also estimated $140,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $150 per direct labor-hour Assume that Job X used $200 in direct materials, $288 of direct labot, and 5 direct labor-hours. What is the total job cost for Job X7 O$488.00 O $538.50 O$530.50 $470.50 At the beginning of the year, a company estimated a predetermined plantwide overheed rate of $8.50 per machine hour Job X used 10 mechine-hours and it was charged $200 and $288 for direct materials and direct labor, respectively. Whet is the total job cost for Job X O $408.00 O $85.00 O $452.00 O $573.00 Assume a company had no jobs in progress at the beginning of July and no beginning inventories. It started and completed only two jobs during July-Job Y and Job Z. The company iness plantwide predetermined overhead rate based on direct Isbor hours. The following additional information from the month of July is available for the company as a whole and for Jobs Y and 2 Estand total food manufacturing overhead Estimated variable manufacturing overhead per direct labor-hour Estimated total direct labor hours to be worked To actual manufactumg overheat costs incurred Drect mater Director com What is the stwide predetermined overhead O $9:00 O $700 O $8.00 O $6.00 201 ROY $13,000 $8,000 121000 1400 $7,500 500 $14,000 $100 2,000 $12,000 Assume (1) a company's plantwide predetermined overheed rate is $13.00 per direct labor-hout, and 2) to job cost sheet for Job X shows that this job used to direct labor-hours and incurred direct mater and direct labor charges of $500 and $360, respectively if Job X contains 36 units, then its unit product cost is closest to O$30.39 O $20.39 O$2387 O$2679 Assume (1) a company's plentwide predetermined overhead rate is $13.00 per direct labor-hour, and (2) es job cost sheet for Job X shows that this job incurred direct materials and direct labor charges of $500 and $360, respectively if Job X's total job cost is $1,133, how many direct labor hours were worked on this job? 0 000 0 20 21 Assume that a company pays a 5% sales commission. Also, assume a company's plantaldo predetermined overhead rate is $15.50 per direct labor hour, and 2) s job cost sheet for Job X shows that this job used direct labor-hours and incurred direct materials and direct labor charges of $500 and $360, respectively. What is the total cost of Job ? $1,152.95 O$779.00 $195.95 O $130.00 At the beginning of the year, a company estimated that 20,000 direct labor-hours would be required for the period's estimated level of production. The compeny sioextmated $140,000 of fed manufacturing overhead cost for the coming period and variable manufacturing overhead of $1.50 per direct labor hour. The company incurred actual manufacturing overhead costs of $80,000 and it actually worked 20,000 direct labor hours during the period. Assume that Job X used 60 direct labor hours. How much manufacturing overhead would be appl $540 $528 $518 $510 At the beginning of the year, a company estimated that 20.000 direct labor-hours would be required for the period's estimated level of production. The company also estimated $140,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $150 per direct labor-hour Assume that Job X used $200 in direct materials, $288 of direct labot, and 5 direct labor-hours. What is the total job cost for Job X7 O$488.00 O $538.50 O$530.50 $470.50 At the beginning of the year, a company estimated a predetermined plantwide overheed rate of $8.50 per machine hour Job X used 10 mechine-hours and it was charged $200 and $288 for direct materials and direct labor, respectively. Whet is the total job cost for Job X O $408.00 O $85.00 O $452.00 O $573.00 Assume a company had no jobs in progress at the beginning of July and no beginning inventories. It started and completed only two jobs during July-Job Y and Job Z. The company iness plantwide predetermined overhead rate based on direct Isbor hours. The following additional information from the month of July is available for the company as a whole and for Jobs Y and 2 Estand total food manufacturing overhead Estimated variable manufacturing overhead per direct labor-hour Estimated total direct labor hours to be worked To actual manufactumg overheat costs incurred Drect mater Director com What is the stwide predetermined overhead O $9:00 O $700 O $8.00 O $6.00 201 ROY $13,000 $8,000 121000 1400 $7,500 500 $14,000 $100 2,000 $12,000

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER 1 Soluation If Job X contains 36 units total producti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started