Answered step by step

Verified Expert Solution

Question

1 Approved Answer

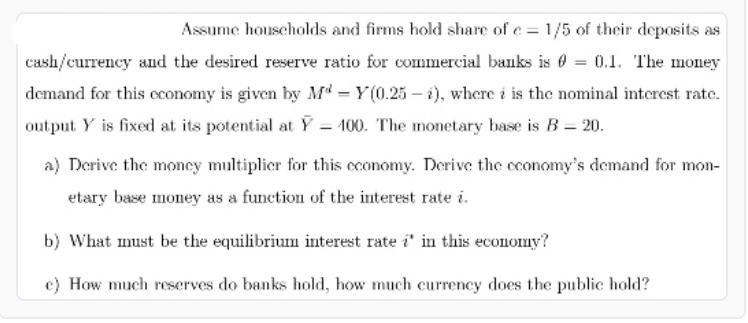

Assume households and firms hold share of e=1/5 of their deposits as cash/currency and the desired reserve ratio for commercial banks is = 0.1.

Assume households and firms hold share of e=1/5 of their deposits as cash/currency and the desired reserve ratio for commercial banks is = 0.1. The money demand for this economy is given by MY(0.25-i), where i is the nominal interest rate. output Y is fixed at its potential at Y = 100. The monetary base is B = 20. a) Derive the money multiplier for this economy. Derive the economy's demand for mon- etary base money as a function of the interest rate i. b) What must be the equilibrium interest rate i' in this economy? e) How much reserves do banks hold, how much currency does the public hold?

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a The money multiplier is determined by the desired reserve ratio and the currency holding ratio In ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started